How do I get approved for Fidelity?

Is it hard to get approved for options Fidelity

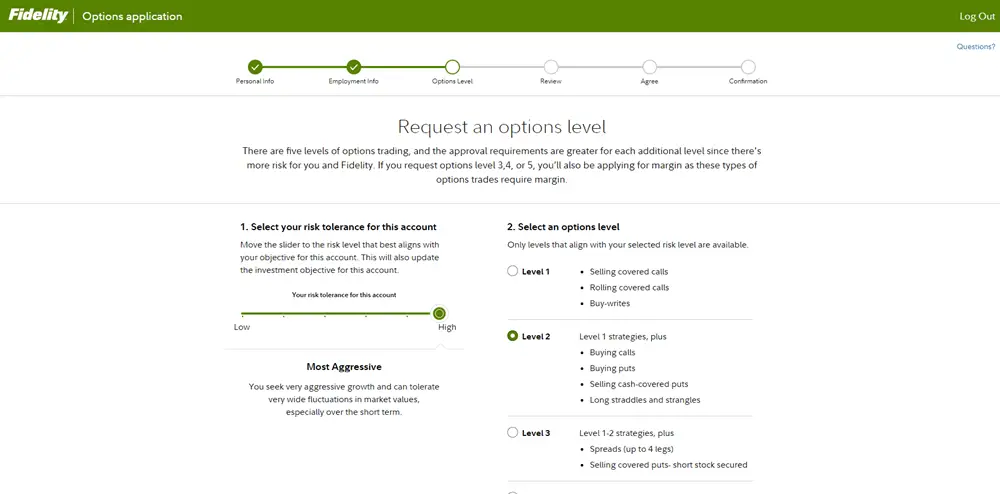

There are 3 tiers of options trading at Fidelity, and approval requirements are more rigorous at subsequent tiers, given the additional risks associated with more complex strategies. Your financial situation, trading experience, and investment objectives are taken into consideration for approval.

Cached

How long does it take for Fidelity to approve account

In most cases, it takes only a few minutes to complete the EFT setup process. However, if we are unable to verify your bank account ownership, you may be asked to upload additional documentation, like a check. If we cannot instantly verify your information, the process could take up to 7-10 days.

Is it hard to open a Fidelity account

It's easy—opening your new account takes just minutes. Need help choosing an account We'll guide you through some basic questions to help you find accounts that may fit your goals.

Is Fidelity good for beginners

Fidelity is a great option for beginners, especially since it provides a wealth of educational tools to help new investors get started. It also offers low costs which are especially beneficial to new investors.

What credit score do you need for Fidelity

750 or better

The Fidelity® Credit Card credit score requirement is 750 or better. That means people with excellent credit have a shot at getting approved for the Fidelity® Credit Card.

What is the minimum requirement for Fidelity

There is no minimum amount required to open a Fidelity Go account.

What documents need to open a Fidelity account

Certain accounts may require additional information.Name.Tax identification number.Valid government photo identification issued at least 30 days ago.Date of birth.Mailing and physical address (if different)Contact phone number.Mother's maiden name (for additional security)Citizenship/Residency status.

What is proof of identity for Fidelity

Driver's license with photo issued by a State or Territory of the U.S. Identification card with photo issued by a State or Territory of the U.S. NOTE: State temporary driver's license or ID card only valid if issued within the last 30 days and accompanied by expired driver's license or ID card.

How much money do you need to open an account with Fidelity

(Fidelity charges $0 account fees and has no minimums for opening or maintaining a brokerage account.)

Does Fidelity check your credit

The Fidelity® Credit Card mainly uses the TransUnion credit bureau for approval. When applying for the card, a hard inquiry will be conducted. After approval, the Fidelity® Credit Card will report to the three major credit bureaus: Experian, TransUnion and Equifax.

What is the minimum opening deposit for Fidelity

Zero

Zero account minimums and zero account fees apply to retail brokerage accounts only. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs) and commissions, interest charges, or other expenses for transactions may still apply. See Fidelity.com/commissions for further details.

How much do I need to open an account at Fidelity Bank

GHS 50

Minimum account opening amount – GHS 50. Minimum account balance – GHS 50. No withdrawal in the first 6 months of account opening.

How much do you need to invest in a Fidelity account

$0

Fidelity's account minimum is $0*, which has become the industry standard for brokers we review, as many no longer have a required minimum to open or maintain your account. Some investment choices, such as mutual funds, may require a minimum initial investment.

How much money do you need to start a Fidelity account

$0

Fidelity's account minimum is $0*, which has become the industry standard for brokers we review, as many no longer have a required minimum to open or maintain your account. Some investment choices, such as mutual funds, may require a minimum initial investment.

Why won’t Fidelity confirm my identity

Unsuccessful verification attempts may be due to many reasons: You may have recently moved. You may have answered security questions incorrectly. Your credit report may be locked or frozen.

Why is Fidelity asking for my Social Security card

The IRS requires you to certify your SSN or TIN to verify your U.S. tax status. If our information doesn't match what the IRS has on file, the IRS requires Fidelity to withhold 24% of the proceeds when you sell a security or receive dividends, interest, or other income. You may also be subject to penalties.

Which is better Vanguard or Fidelity

In fact, Fidelity is our overall pick for the best online broker in 2023, so it is very hard to beat. All that said, Vanguard still offers some of the lowest-cost funds in the industry and will appeal to buy-and-hold investors, retirement savers, and investors who want access to professional advice.

What bank does Fidelity use

PNC Bank, N.A.

The Fidelity® Debit Card is issued by PNC Bank, N.A., and the debit card program is administered by BNY Mellon Investment Servicing Trust Company.

What credit score does Fidelity use

The FICO score it assigns you based on its credit analysis offers a quick insight into your creditworthiness, with 300 being the worst credit score and 850 the best. FICO's analytics model is the one most commonly used by lenders to determine creditworthiness.

How much is the average Fidelity account

Fidelity Investment's latest analysis of its retirement accounts reveals Americans have, on average, six-figure balances in their IRA and 401(k) retirement accounts. As of the fourth quarter of 2023, the average balances in an IRA, 401(k) and 403(b) were (respectively) $104,000, $103,900 and $92,683.