How do I get free processing fees for Square?

How do I avoid Square processing fees

Square sellers using Afterpay get paid the full amount at the time of purchase, minus a processing fee on the total order. Enabling Afterpay with Square is free — there are no monthly fees or startup costs.

CachedSimilar

Does Square offer free processing

From the Get Free Processingpage of your online Square Dashboard, you can view your active rewards, the amount processed, and past rewards. Note: For free processing rewards, you'll see fee reimbursements grouped with each transfer. Free processing credits are only valid for 180 days.

How do I get around processing fees

Implementing a surcharge program is an effective way to eliminate processing fees. Surcharge programs pass the cost of these fees onto the consumer. They can avoid these fees by paying with cash or debit instead. The best way to implement a surcharge program is through Nadapayments.

Can you charge the customer the Square processing fee

No. Service charges and credit card surcharges are two separate types of fees. Learn more about applying a surcharge with Square. Note: Under no circumstances are you permitted to apply a special charge to a customer solely because they are electing to pay with a debit card or prepaid card.

Can I negotiate my Square fees

Does Square negotiate rates Typically, Square won't negotiate rates. But they do offer custom pricing, which equates to negotiating. If you process more than $250,000 per year in card sales and your average ticket price is lower than $15, Square may provide lower rates.

Why does Square charge so much

Square does not charge a monthly or annual fee. Instead, the company makes money through a percentage of every credit card transaction it processes. Square charges 2.6% plus 10 cents for most in-person transactions. However, if the card must be entered manually, it charges 3.5% plus 15 cents per transaction.

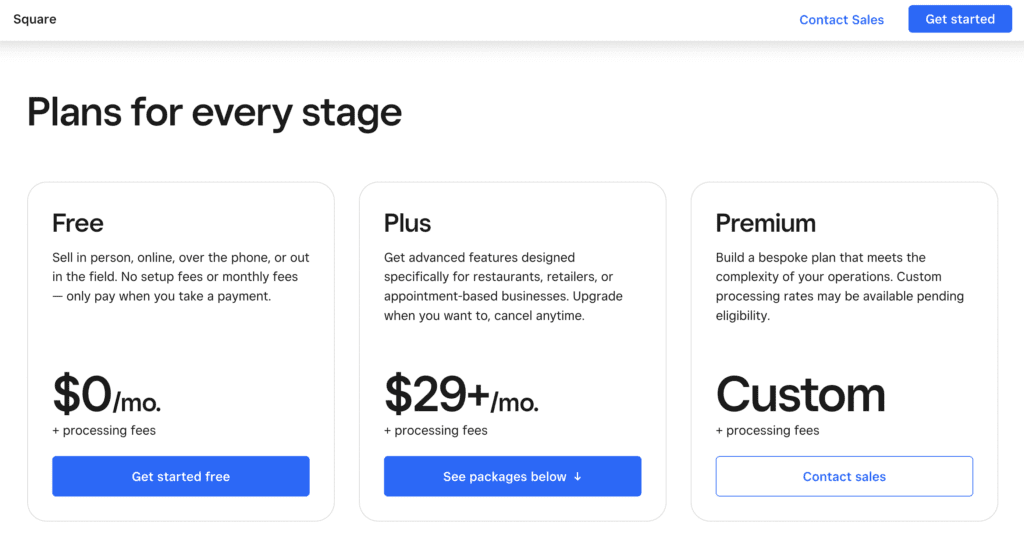

What is the monthly fee to use Square

How much does Square cost per month Square does not charge a monthly or annual fee. Instead, the company makes money through a percentage of every credit card transaction it processes. Square charges 2.6% plus 10 cents for most in-person transactions.

What amount does Square report to IRS

In most states, accounts meeting both of the following criteria qualify for a Form 1099-K and must be reported to the IRS by Square: More than $20,000 in gross sales from goods or services in the calendar year. AND more than 200 transactions in the calendar year.

How do you pass processing fees to customers

4 Methods to Pass Credit Card Merchant Fees to CustomersConvenience Fees. A convenience fee allows businesses to add fees to some transactions but not others.Cash Discounts.Minimum Purchase Requirements.Follow Laws and Requirements.Be Transparent.Provide Multiple Payment Options.

Can you negotiate processing fees

Credit card processing fees are inevitable; however, you can often negotiate fees to ensure you get the best deal possible. You can save money by accepting card payments in person and ensuring your account and terminal are correctly set up.

Who pays Square transaction fee

When a customer taps or inserts their card in person, you pay 1.9% per transaction with the Square Reader. Sellers using Square Terminal or Square Register pay 1.6% per transaction. There is a lower risk of fraudulent activity when the cardholder is present.

How do I offset credit card processing fees

A quick strategy for how to offset credit card processing feesLower operating expenses.Increase sticker prices.Set a minimum for using a credit card.Avoid manual entering of credit card info (this leads to higher fees)Negotiate with your credit card processor.Find a cheaper payment processor.

What is the average Square fee

What are your fees The Square standard processing fee is 2.6% + 10¢ for contactless payments, swiped or inserted chip cards, and swiped magstripe cards. Payments that are manually keyed-in, processed using Card on File, or manually entered using Virtual Terminal have a 3.5% + 15¢ fee.

How much does Square take from every transaction

What are your fees The Square standard processing fee is 2.6% + 10¢ for contactless payments, swiped or inserted chip cards, and swiped magstripe cards. Payments that are manually keyed-in, processed using Card on File, or manually entered using Virtual Terminal have a 3.5% + 15¢ fee. Invoices cost from 2.9% + 30¢.

Is Square worth it for small business

Square is a standout point-of-sale system and often a good option for small businesses. Its wide range of features and hardware can be tailored to fit a variety of business types. The pricing is transparent, and the free plan is one of the most powerful no-cost POS systems we've seen.

How much does Square charge to transfer to bank

Funds are sent to either your linked bank account or debit card for a 1.75% fee per transfer. Your funds will routinely be sent to your linked debit card 15 minutes after your close of day, every day. To use same-day transfer, you must have a minimum balance of $1 after Square's fees.

How much do you have to make on Square to get a 1099

$600 or more

Square is required to issue a Form 1099-K and report to the state when $600 or more is processed in card payments. These reporting thresholds are based on the aggregate gross sales volume processed on all accounts using the same Tax Identification Number (TIN).

Does Square automatically report to the IRS

The IRS requires Square to report every account that meets the Form 1099-K requirements—including non-profits.

Is it legal to charge customers a processing fee

In most states, companies can legally add a surcharge to your bill if you pay with a credit card. The fee might be a certain percentage on top of the purchase amount, which the companies can use to cover their credit card processing costs.

Can I pass on credit card fees to customers

With surcharging, merchants are able to automatically pass credit card fees to their customers when a credit card is used at checkout. Credit card surcharging allows businesses to pass on the financial burden of credit card processing fees by attaching an extra fee to each customer's credit card transaction.