How do I get my FICO auto score of 9?

Who uses FICO auto score 9

Not All Lenders Embraced FICO 9

The mortgage industry relies primarily on FICO scores 2, 4, and 5. Auto lenders use FICO Scores 2, 4, 5, 8, and 9. Credit card issuers use FICO Scores 2, 4, 5, 8, and 9.

Do auto lenders use FICO 9

Most auto lenders use FICO Auto Score 8, as the most widespread, or FICO Auto Score 9. It's the most recent and used by all three bureaus. FICO Auto Score ranges from 250 to 900, meaning your FICO score will differ from your FICO Auto Score.

Cached

What is a good FICO 9 score

670 to 739

What Is a Good Credit Score

| FICO Score Ratings | |

|---|---|

| Very Good | 740 to 799 |

| Good | 670 to 739 |

| Fair | 580 to 669 |

| Very Poor | 300 to 579 |

Cached

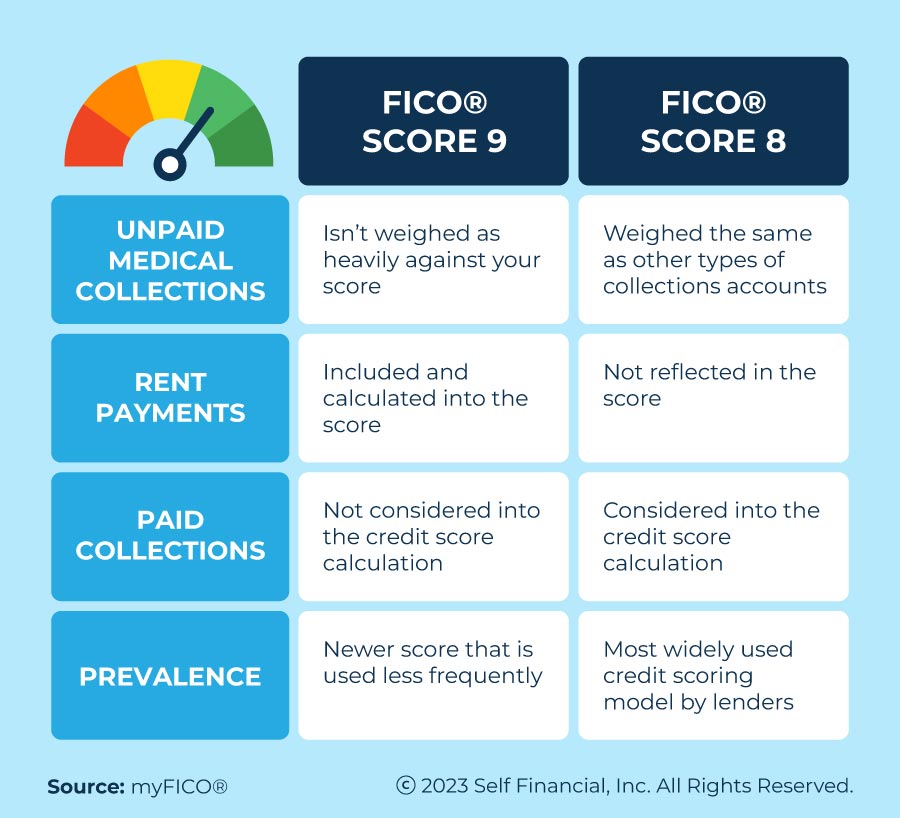

What’s the difference between FICO 8 and FICO 9

FICO 9 is similar to FICO 8 but differs when it comes to collections and rent payments. FICO 9 counts medical collections less harshly than other accounts in collections, so a surgery bill in collections will have less of an impact on your credit score than a credit card bill in collections.

What is the best FICO auto score

The FICO® Score ranges from 300 to 850 and is broken down into five tiers, or bands:Exceptional: 800-850.Very good: 740-799.Good: 670-739.Fair: 580-669.Poor: 300-579.

What’s the highest FICO auto score

FICO® credit scores are the auto industry standard for determining a potential buyer's creditworthiness. Using a variety of factors, the company will give you a three digit score ranging from 300 (lowest possible) to 850 (highest possible).

What version of FICO do car dealerships use

What credit score do auto lenders look at The three major credit bureaus are Experian, TransUnion and Equifax. The two big credit scoring models used by auto lenders are FICO® Auto Score and Vantage.

Is FICO score 9 better than 8

Though the FICO® Score 9 is an updated version of FICO® Score 8, the FICO® Score 8 is still the most widely used base score by lenders, meaning that, while you may have a better credit score from the FICO® Score 9 model, lenders are more likely to still use the previous version.

What is a good FICO auto score

What's a Good FICO Score In general, a good credit score is a score of 670 or above. If you have good credit, you have the best chance of getting favorable loan terms. To get the lowest interest rates and the best loan terms possible, you'll want to aim for a credit score in the excellent category (720 to 850).

How do I find out myFICO auto score

Checking your FICO auto score is easy, and you can do so directly from FICO. A one-time report from a single credit bureau, whether it's Experian, TransUnion, or Equifax, costs about $20, though you can get a report from all three for $60.

Do banks use FICO 8 or 9

While most lenders use the FICO Score 8, mortgage lenders use the following scores: Experian: FICO Score 2, or Fair Isaac Risk Model v2. Equifax: FICO Score 5, or Equifax Beacon 5. TransUnion: FICO Score 4, or TransUnion FICO Risk Score 04.

What is the difference between FICO score and FICO auto score

A basic FICO score measures how reliable you are at paying back debts. An auto loan FICO score specifically measures your ability to pay back auto loans. The basic FICO and auto loan FICO scores use different credit scoring models. The base FICO score ranges from 300 to 850, but FICO auto scores range from 250 to 900.

Where can I get my FICO auto score

You can monitor your TransUnion auto insurance score for free on Credit Karma, along with your free credit reports and VantageScore 3.0 scores from TransUnion and Equifax.

Does anyone have a 900 FICO score

Depending on the type of scoring model, a 900 credit score is possible. While the most common FICO and VantageScore models only go up to 850, the FICO Auto Score and FICO Bankcard Score models range from 250 to 900.

How do I get my FICO score 8 auto

How Do I Check My Auto Score You can check your FICO® Auto Score by purchasing your credit reports and scores by enrolling in a credit monitoring product. However, there are also many ways to check your other credit scores for free.

How do I find my auto FICO score

You can monitor your TransUnion auto insurance score for free on Credit Karma, along with your free credit reports and VantageScore 3.0 scores from TransUnion and Equifax. Just remember that your auto insurance scores are not the same as your credit scores, and a lender may not use your auto insurance scores.

What is the best FICO score to buy a car

Here's a quick look at how a good credit score can benefit you when you're buying a car. Lower interest rates. A good credit score — typically a score of 680 or higher — can help you secure a low interest rate from the dealer. In fact, taking your score from 600 to 780 could halve your rate.

What FICO score do car dealers use

What credit score do auto lenders look at The three major credit bureaus are Experian, TransUnion and Equifax. The two big credit scoring models used by auto lenders are FICO® Auto Score and Vantage.

What is the difference between a FICO score and a FICO auto score

The FICO® Auto Scores are based on a generic FICO® Score, and then the score is altered to better predict a person's likelihood of repaying an auto loan on time. Your history with auto loans could be especially important in determining your FICO® Auto Scores.

How do I find out my FICO auto score

Checking your FICO auto score is easy, and you can do so directly from FICO. A one-time report from a single credit bureau, whether it's Experian, TransUnion, or Equifax, costs about $20, though you can get a report from all three for $60.