How do I get my payoff from Navy Federal Credit Union?

What is the fax number for Navy Federal payoff request

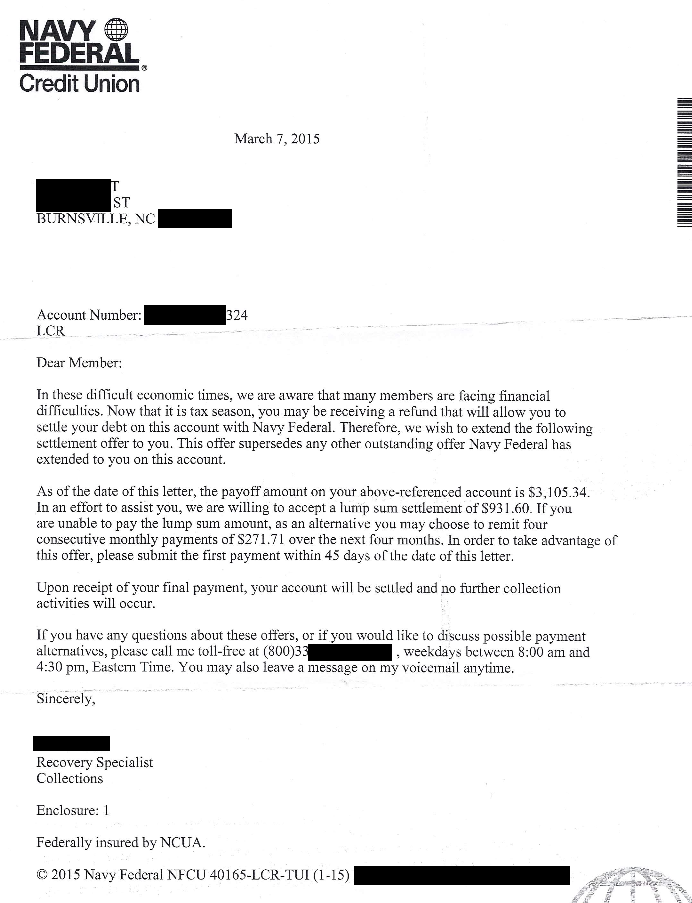

Deposit Trust Section

| Hours (Shown are Eastern Time) | Phone Numbers |

|---|---|

| 8 AM to 6 PM, Monday through Saturday 8 AM to 3 PM, Saturday | Phone: 1-888-842-6328 Fax: 703-206-3724 |

How long does it take to get title after payoff Navy Federal

within 10 business days

In most situations, your title will be released within 10 business days of Navy Federal receiving your payoff, and it can take up to 7 to 10 business days for delivery of the title or lien release.

What is the phone number for Navy Federal auto payoff

call us at 1-888-842-6328. visit a branch.

What is the payoff address for Navy Federal Credit Union

All payments must be made in U.S. dollars. Payments you mail must be addressed to Navy Federal, P.O. Box 3500, Merrifield, VA 22119-3500.

Cached

How do I get a pay off statement

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

What is a payoff request form

A payoff letter is a document that provides detailed instructions on how to pay off a loan. If you have the funds to pay off an installment loan early, request a payoff letter from your lender. It tells you the amount due, where to send the money, how to pay, and any additional charges due.

How long does it take to get a payoff amount

You need an official payoff statement from the servicer to ensure you pay the correct amount. Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

How long does it take to get a loan payoff letter

within seven business days

How long does it take to get a mortgage payoff statement Generally speaking, you should receive your mortgage payoff statement within seven business days of your request.

How do I find out my payoff

You can calculate a mortgage payoff amount using a formula. Work out the daily interest rate by multiplying the loan balance by the interest rate, then dividing that by 365. This figure, multiplied by the days until payoff, plus the loan balance, gives you your mortgage payoff amount.

How do I get my payoff

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

How do I get a payoff letter from my bank

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

Where do I get a payoff statement

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

What is proof of payoff letter

An auto loan payoff letter is just a way to prove that you have paid in full for a car. If you are selling your vehicle, often the buyer will ask to see the letter as proof that the car is owned free and clear, and does not have any liens against it.

How long does it take to get a payoff statement

within seven business days

You need an official payoff statement from the servicer to ensure you pay the correct amount. Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions.

Can I get a payoff letter online

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

How do I get my payoff amount

Your loan holder/servicer can provide your payoff amount, which will include principal and interest, as well as other fees and costs on your account (if applicable). Contact your servicer for your payoff amount.

How do I request a payoff letter

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

How do I get a loan payoff document

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

How do I request a payoff

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

How long does it take to get a payoff request

within seven business days

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)