How do I get pre-approval from TD Bank?

What credit score is needed for TD Bank

A credit score of 660 or better is required for a personal loan if you have a TD Bank checking or savings account. If not, a score of 750 is required.

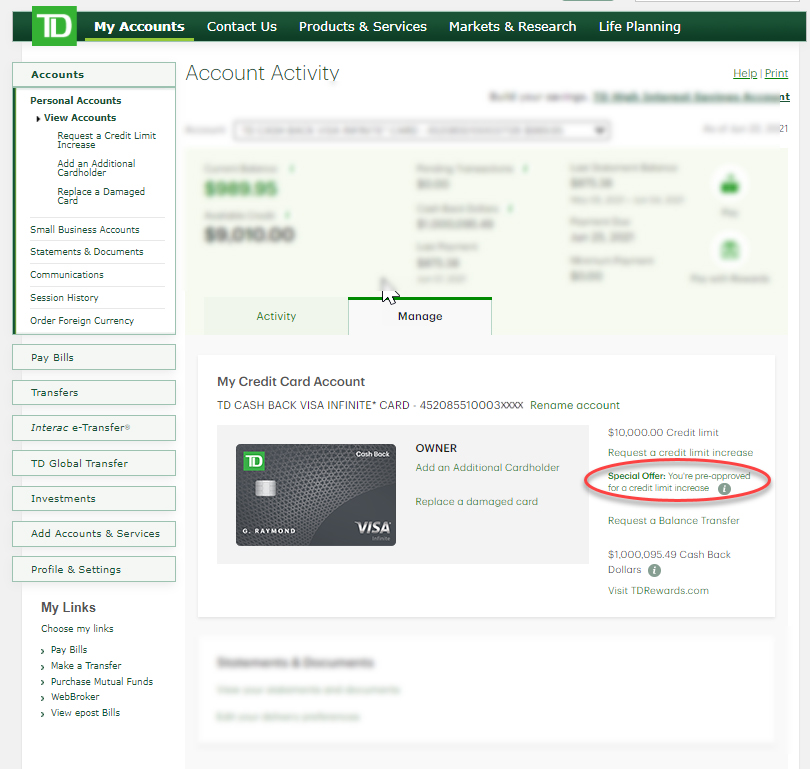

How do I check my TD pre-approved offer

From your credit card account activity page, click on the Manage tab. Your pre-approved credit limit offer is located just below your current credit limit.

Is TD Bank hard to get approved for

TD Bank credit card approval odds are best for people with a good or excellent credit score of 700+, an annual income of $50,000+, and relatively little debt. Applicants will also need to be 18+ years old with a U.S. mailing address and an SSN to get a TD Bank credit card.

Does TD Bank give instant approval

In most cases, you'll receive an instant decision if you apply for a TD credit card online, by phone, or in person at a TD Bank branch. In some cases, however, TD Bank will need more time to review your application.

Which TD credit card is easiest to get approved

The easiest credit card to get from TD Bank is the TD Cash Secured Credit Card, which is available to applicants with bad credit. Depending on your credit score, you may be able to qualify for other TD Bank credit cards, too.

How long does TD take to approve line of credit

Typically, an application will take 2 business days to process, plus an additional 7-10 business days to have the card directly mailed to your residence.

How fast to get pre-approval

On average, it takes 7-10 days to get a pre-approval, although in some cases it may take less time. To speed up the home loan pre-approval time, you should gather your financial documents that the lender will require (e.g., W2s, proof of income, tax returns, etc.).

How do I get pre-approved offers from bank

The eligibility criteria for pre-approved loans Consistently good credit score. Good financial discipline and savings. Good repayment history. Should already be an existing customer with the lender. Stable income source.

What is the easiest TD Bank credit card to get

TD Cash Secured Credit Card

The easiest credit card to get from TD Bank is the TD Cash Secured Credit Card, which is available to applicants with bad credit. Depending on your credit score, you may be able to qualify for other TD Bank credit cards, too.

Who does TD Bank pull credit from

Experian

TD Bank. TD will usually pull your Experian credit report. See real-time data in our Credit Card Database.

How long does it take to get pre approval from a bank

A straightforward application could be pre-approved within a day. On average, it's more likely to take 3-5 business days. And if your situation is more complex, it could take up to 2 weeks.

Which bank will give credit card easily

1. HDFC Bank instant approval credit card. HDFC Bank credit cards are not only 100% secure, but they also provide instant activation and ownership.

Which bank credit card is hard to get

Centurion® Card from American Express

Why it's one of the hardest credit cards to get: The hardest credit card to get is the American Express Centurion Card. Known simply as the “Black Card,” you need an invitation to get Amex Centurion.

What is pre approved credit limit

When you get pre-approval for a line of credit, it means that the bank has assessed the risk and deemed that you can afford a line of credit. Often, they put these offers out to entice you to take out a personal line of credit, which can then result in unexpected debt.

How to be pre approved for a credit card

Request a pre-qualification on the credit card issuer's website. Most major credit card issuers that offer pre-approval have online links to a simple form where you can apply that can be found on the issuer's site. These forms will often ask you to provide basic personal and financial information.

Does a pre-approval hurt my credit score

A mortgage preapproval can have a hard inquiry on your credit score if you end up applying for the credit. Although a preapproval may affect your credit score, it plays an important step in the home buying process and is recommended to have. The good news is that this ding on your credit score is only temporary.

How much does a pre-approval hit your credit

five points

A mortgage pre-approval affects a home buyer's credit score. The pre-approval typically requires a hard credit inquiry, which decreases a buyer's credit score by five points or less. A pre-approval is the first big step towards purchasing your first home.

Which bank is best for pre-approved loan

Some of the top banks that provide pre approved personal loans are HDFC, SBI, ICICI, Bajaj Finserv, and IDFC FIRST Bank. They offer pre-approved loans up to Rs. 25 Lakhs – Rs. 50 Lakhs at interest rates starting from 9.60% – 13% p.a. And processing fee up to 4%.

How do you qualify for a pre-approved loan

Lenders check your credit score, credit history, bank balance, and income details. If you have a high credit score, a good credit history, excellent repayment record, stable income, and sound savings in your bank account, then you are eligible for a pre-approved loan.

Which credit card usually gives the highest credit limit

Highest “Overall” Credit Limit: $500,000

The winners of the nosebleed award for the highest credit limit among cards for mere mortals are these twins: Chase Sapphire Preferred® Card and Chase Sapphire Reserve®, with annual fees in the mid-triple digits and high-double digits, respectively.