How do I get pre approved uplift?

Why can’t i get approved for Uplift

Guest booking details must match the personal information on credit report (source: Equifax). If the names and personal data do not match, a guest's application regrettably cannot be approved.

Cached

How much does Uplift approve

Is There a Maximum Purchase Size When Using Uplift Yes. The maximum you can borrow is $25,000.

Cached

Is Uplift better than affirm

Uplift typically charges an APR of 7 percent to 36 percent, with an average of 15 percent. Affirm charges interest rates between 10 percent and 30 percent, averaging 17 percent. By way of comparison, the average rate of interest on credit cards is 17.30 percent, according to CreditCards.com.

Cached

Does Uplift improve credit score

Indeed, Uplift does report to the credit bureaus. This can be both positive and negative for you, as you can use Uplift to build your credit history based on good transactions. But at the same time, this could also affect you negatively if you default on fees and rates.

Does everyone qualify for Uplift

An Uplift loan may be an option for someone who has strong enough credit to qualify for one of Uplift's lowest APRs, and is confident they can make the monthly loan payments. If you have weaker credit, you could end up with a higher APR, which means you'll pay more in interest.

How does Uplift determine eligibility

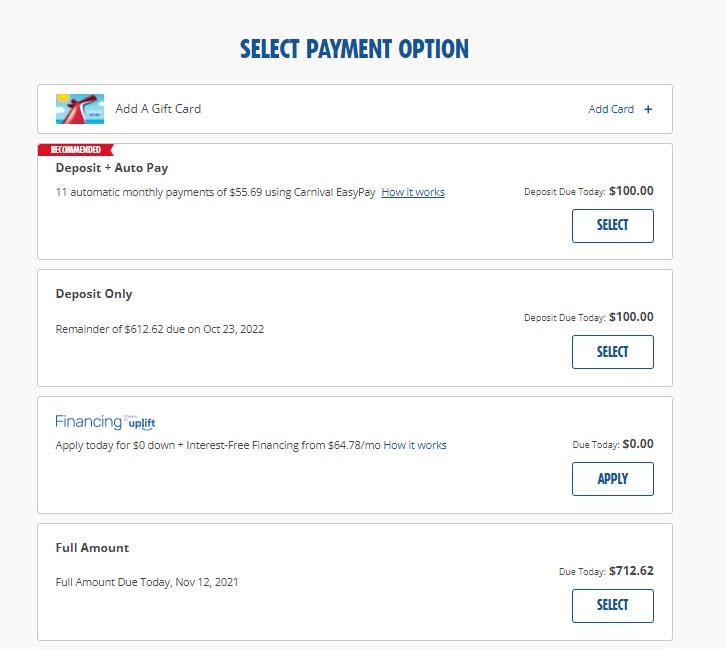

Carnival guests can be approved for monthly payment plans through Uplift for Carnival vacations ranging in total cost between $100 – $15,000USD (including add-ons such as CVP, gratuities, air, etc. *). Eligibility is based on a number of factors, including the guest's credit information, purchase details, and more.

Does Uplift require down payment

With Uplift, there's no need to have a large down payment available ahead of time. Instead, you can budget your trip into your ongoing monthly expenses. Time doesn't wait and neither should your travel plans! Take that trip now, make memories to last a lifetime, and pay monthly after returning home.

What is the highest Affirm loan

$17,500

Loan amounts — Affirm offers loans of up to $17,500. Purchases of less than $50 require repayment within 30 days. Credit history — Even if you're still building your credit, Affirm may approve you, since it considers factors besides your credit scores when it reviews your application.

What is the biggest Affirm loan

Our review covers everything you need to know about Affirm and how to decide if it's right for you. Affirm offers APRs between 0% to 36% depending on your credit history. You may borrow anywhere from $0 to $17,500, but the amount may vary by store.

Does uplift do a hard pull

Some don't pull a hard inquiry from your credit report, which means that signing up won't affect your credit score. Uplift doesn't charge any fees to customers, including late fees or prepayment penalties.

What brings your credit score up the most

One of the best things you can do to improve your credit score is to pay your debts on time and in full whenever possible. Payment history makes up a significant chunk of your credit score, so it's important to avoid late payments.

What credit is needed for affirm

The Credit Score Needed for Affirm

While each applicant's experience will vary, if your credit score is 640 or higher, you will likely be approved by Affirm. A prequalification process is required to get lending with Affirm. While a score as low as 540 may get you approved for some lending, there is a limit.

Does Uplift do a hard pull

Some don't pull a hard inquiry from your credit report, which means that signing up won't affect your credit score. Uplift doesn't charge any fees to customers, including late fees or prepayment penalties.

Is uplift easy to get approved for

While Uplift accepts borrowers with bad credit, you're unlikely to qualify for a competitive rate. If you have good to excellent credit, you may be able to score an APR close to its minimum of 0%, making it much less expensive than most credit cards.

Does everyone qualify for uplift

An Uplift loan may be an option for someone who has strong enough credit to qualify for one of Uplift's lowest APRs, and is confident they can make the monthly loan payments. If you have weaker credit, you could end up with a higher APR, which means you'll pay more in interest.

What credit score do I need to get Affirm

Loan limits vary by merchant and will depend on your credit record and payment history with Affirm. The lender has no minimum credit score to qualify for a loan, and checking whether you prequalify will not damage your credit score.

Can I get a cash loan from Affirm

You may borrow anywhere from $0 to $17,500, but the amount may vary by store. 1 Affirm offers personal loan terms for three, six, or 12 months, but depending on the retailer and the size of the purchase, terms could be as short as two weeks to three months, or as long as 48 months.

How do I get a high Affirm limit

Things like paying bills on time, reducing debt balances, and limiting how often you apply for new credit could work in your favor for getting a higher credit limit with Affirm or any other lender.

Does affirm do a hard credit check

Affirm generally just conducts a soft pull of applicants' credit histories, which doesn't affect their scores. Depending on your credit and eligibility, your annual percentage rate (APR) on an Affirm loan can end up being 0%, or 10% to 30%.

How to get your credit score up 100 points in 30 days

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.