How do I know if a letter is real from the IRS?

How do I verify my IRS letter

If you cannot verify your identity online, you can contact the IRS at 1-800-830-5084 from 7:00am – 7:00pm. You have a better chance of reaching the IRS if you call early in the morning. If the IRS did not provide you with a specific phone number, you can call IRS taxpayer assistance at 1-800-829-1040.

What letters are being sent from IRS

Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes any steps the taxpayer needs to take. A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return.

Are all IRS letters sent certified

Some IRS notices are sent via certified mail, such as the Notice of Intent to Levy, while others are mailed via regular post, like changes made to your tax return. Read all IRS letters and notices you receive, both certified and via regular mail. Do not ignore any of them.

Does the IRS contact you by mail

The IRS initiates most contacts through regular mail and will never initiate contact with taxpayers by email, text or social media regarding a bill or tax refund. Never click on any unsolicited communication claiming to be the IRS as it may surreptitiously load malware.

Do IRS audit letters come certified mail

An IRS audit letter will come to you by certified mail. When you open it up, it will identify your name, taxpayer ID, form number, employee ID number, and contact information.

Why would IRS send me a letter 2023

Typically, it's about a specific issue with a taxpayer's federal tax return or tax account. A notice may tell them about changes to their account or ask for more information. It could also tell them they need to make a payment.

What two letters are we waiting for from the IRS

24. As you prepare to file your 2023 taxes, you'll want to watch for two letters from the IRS to make sure you get the money you deserve. This year, the IRS is mailing two letters – Letter 6419 and Letter 6475 – to qualifying Americans.

Can you view letters from the IRS online

Get a letter or notice from IRS Here's what you should know: http://go.usa.gov/kWUj #IRS_notice.

How do you tell if a letter is sent certified mail

Certified Mail service provides date and time of delivery or attempted delivery when you access www.usps.com (under “Quick Tools,” click on Tracking) or call toll-free 800-222-1811. Upon request, it also provides a postmarked mailing receipt.

What documents does the IRS send certified mail

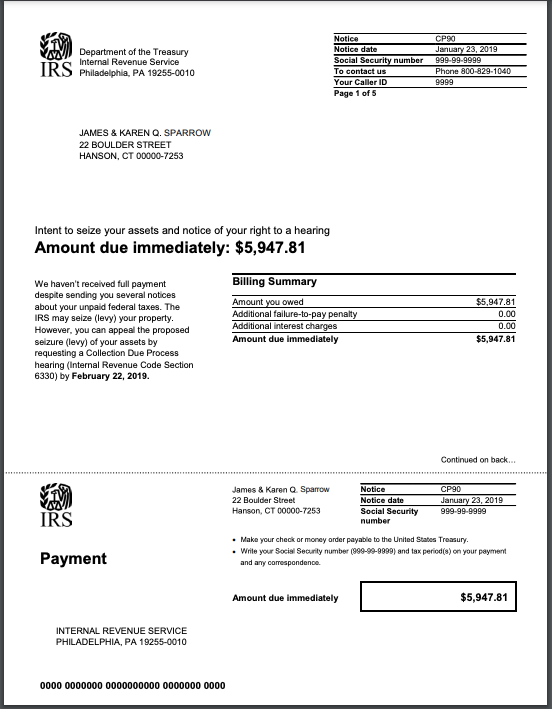

7 Valid Types of IRS Certified Mail and NoticesOutstanding Balance. An unpaid tax balance is one frequent reason the IRS sends certified mail.Refund Discrepancy. Not all news from the IRS is bad news.Return Questions.Identity Verification.Information Needed.Return Amendments.Processing Delays.

What is the most common way the IRS will contact you

IRS employees may make official, unannounced visits

Taxpayers generally will first receive a letter or notice from the IRS in the mail. If a taxpayer has an outstanding federal tax debt, IRS will request full payment but will provide a range of payment options.

What does IRS audit mail look like

The IRS audit letter will arrive via certified mail and list your full name, taxpayer ID or social security number, the form number, and the Information they are reviewing. It will also provide the IRS agent's contact information for more information or questions on the process or specific case.

How do you know if the IRS is auditing you

If the IRS decides to audit, or “examine” a taxpayer's return, that taxpayer will receive written notification from the IRS. The IRS sends written notification to the taxpayer's or business's last known address of record. Alternatively, IRS correspondence may be sent to the taxpayer's tax preparer.

Should I worry about a certified letter

Many people get anxious if they receive a certified mail notice. Most of the time it is from a bill collector, but it's not always the case. Remember that certified mail can be sent by anyone. Jury duty isn't the best news to most people, but sometimes you will found out through certified mail.

Why am I getting a letter from the Department of Treasury

Your payment may be less because you owed an overdue debt to a federal or state agency. If that is the case, you should have received a letter telling you this would happen. The law says that Treasury may withhold money to satisfy an overdue (delinquent) debt.

What does IRS audit letter look like in mail

The IRS audit letter will arrive via certified mail and list your full name, taxpayer ID or social security number, the form number, and the Information they are reviewing. It will also provide the IRS agent's contact information for more information or questions on the process or specific case.

Does the post office forward letters from the IRS

Changes of address through the U.S. Postal Service (USPS) may update your address of record on file with us based on what they retain in their National Change of Address (NCOA) database. However, even when you notify the USPS, not all post offices forward government checks, so you should still notify us.

How do you know if a letter is certified

Certified mail is trackable by default though the barcode supplied with the mailing form you purchase at the post office. So once you know the number of the mail piece (e.g., 9407 3000 0000 0000 0000 00), you can enter it on the USPS website (www.usps.com) to check certified mail.

How do I find out who is sending me a certified letter

Identifying the Sender

Visit USPS.com and submit the tracking number. The tracking system may only provide you with the city, state and zip code of the sender, but this may be all the information you need to determine the sender's identity.

Who sent me a certified letter

People commonly receive certified mail from attorneys, the IRS, debtors, jury duty, etc. Due to the security of this type of mail, it is a great way to send legal documents. The court can use these certified tracking receipts as evidence in court proceedings.