How do I know if a transaction is safe?

How do you know if a transaction is secure

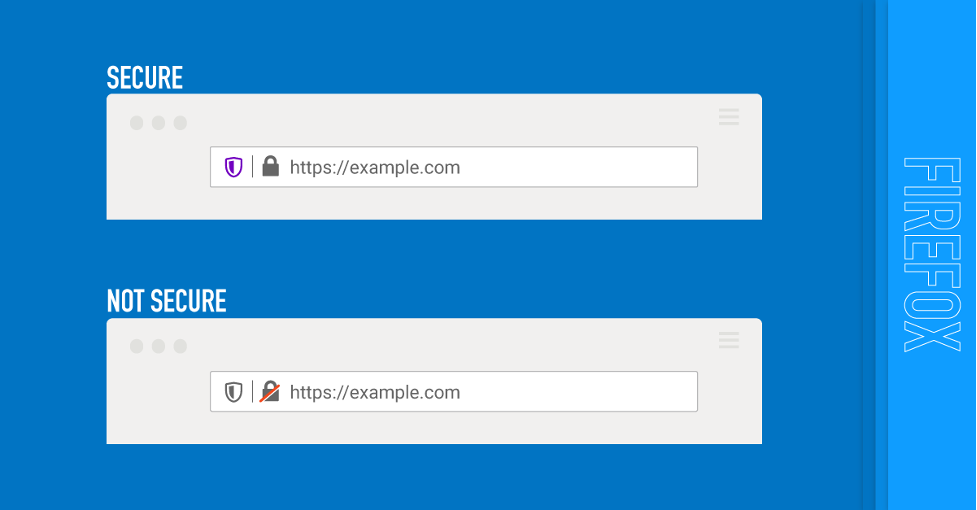

Before entering payment card details on a website, ensure that the link is secure, in two ways: There should be a padlock symbol in the browser window frame, which appears when you attempt to log in or register. Be sure that the padlock is not on the page itself … this will probably indicate a fraudulent site.

What is the safest mode of transaction

By and large, credit cards are easily the most secure and safe payment method to use when you shop online. Credit cards use online security features like encryption and fraud monitoring to keep your accounts and personal information safe.

Cached

How do I make sure my online payment is secure

Online shopping safety tipsResearch retailers online to make sure they're legitimate.Make sure the website is secure.Know your rights and the company's returns policy.Keep software and virus protection up-to-date and use strong passwords for online accounts.Don't use public wi-fi.Pay using a credit card.Be smart.

What do you think online transaction is safe mode of transaction

Online transaction is a payment method in which the transfer of fund or money happens online over electronic fund transfer. Online transaction process (OLTP) is secure and password protected. Three steps involved in the online transaction are Registration, Placing an order, and, Payment.

What makes a transaction suspicious

What Are Suspicious Transactions in Banking Suspicious transactions are any event within a financial institution that could be possibly related to fraud, money laundering, terrorist financing, or other illegal activities.

How can I identify transactions I don’t recognize

Check your transactions. Check your transactions. Check the date, time and location of the transaction to see if any of the details are familiar to you.Check with others. Check with others.Check for regular payments. Check for regular payments.Check any payment codes. Check any payment codes.

How can I make my bank transaction safe

Change your identification number (PIN) and password every few months.Check Your Bank Statements Often.Protect Your PIN Number.Consider Using a Credit Card Online.Only Use ATMs at a Bank.Avoid Public Wireless Access for Financial Transactions.Report Problems Immediately.Consider Filing a Police Report.

Is it safer to pay by debit card or bank transfer

When paying by debit card, the money comes directly out of your bank account. It's like taking out cash and handing it over – but safer, because the card is easy to cancel if it's lost or stolen. You'll also get a little bit of fraud protection – although not as much as you get with a credit card.

What is the safest payment method for a seller

What is the safest way to accept payment Besides cash, a certified check is the safest way you can receive a payment to your business.

What are the risks involved in online transactions

Its vulnerability is costly both to merchants and customers who are often easy prey when conducting online transactions if there's a lack of secure third-party platforms or gateways. Businesses and their clients are more vulnerable to credit and debit card fraud, data breaches and identity theft.

Which of the following is an example of a suspicious transaction

A client who authorizes fund transfer from his account to another client's account. A client whose account indicates large or frequent wire transfer and sums are immediately withdrawn. A client whose account shows active movement of funds with low level of trading transactions.

Which of the following is an example of red flag for suspicious transaction

Unusual transactions

Firms should look out for activity that is inconsistent with their expected behavior, such as large cash payments, unexplained payments from a third party, or use of multiple or foreign accounts. These are all AML red flags.

How do I verify bank transactions

How to verify the transaction on your bank statementLocate the transaction date of the transaction in question.Match the UPI transaction ID found in the Google Pay app to the UPI transaction ID on your bank statement.

How do you identify a suspicious transaction with an example

Refusing to provide information necessary to update account information. Reporting various bank accounts or modifying them constantly. Soliciting, coercing, or bribing an officer to alter the history or record of a transaction.

What bank details should I never give out

Don't share your Debit / Credit cards with any one. Don't share your personal information like Debit card details/PIN/CVV/OTP/Card Expiry Date/UPI PIN, over phone mails/e mail/SMS to anyone even though some one pretending to be bank officials. Your bank never asks for such details to customers.

How do you avoid being scammed in the bank

How to Protect Yourself (and Your Accounts) From Bank ScamsDon't cash checks for other people.Do your homework.Don't share personal information.Avoid high-pressure sales tactics.Avoid paying fees.File a complaint.Use your best judgment.

Do I have any protection if I pay by bank transfer

If you paid by bank transfer or Direct Debit

Contact your bank immediately to let them know what's happened and ask if you can get a refund. Most banks should reimburse you if you've transferred money to someone because of a scam. This type of scam is known as an 'authorised push payment'.

What is the safest way to pay with a debit card

Debit Card Safety TipsSign Immediately.Memorize Your Pin.Protect your cards as if they were cash.Take your receipt and save it.Report lost or stolen card immediately.Keep an eye on your card when doing a transaction.Check your bank statement to assure the amounts charged are what your authorized.

What is the safest way to receive money from a buyer

What is the safest way to accept payment Besides cash, a certified check is the safest way you can receive a payment to your business.

Will PayPal refund money if scammed

Yes, PayPal refunds money if you've been scammed while using the platform. So, if you buy something using PayPal and the transaction turns out to be fraudulent, PayPal will often return your money.