How do I know if the IRS reduced my refund?

What if the IRS changed my refund amount

Under the law, the IRS must send you a letter telling you about the change and giving you 60 days to ask the IRS to undo (“abate”) the change. You have the right to ask the IRS to abate the change. You then can give the IRS information or documents that fix any error or prove your tax return was correct as filed.

Cached

Why would the IRS reduce my refund

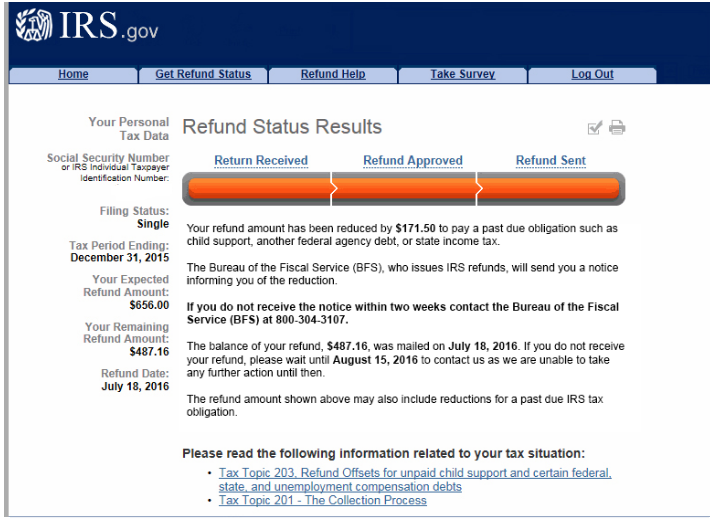

All or part of your refund may be offset to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans.

CachedSimilar

What does it mean if your refund has been reduced

If you owe money to a federal or state agency, the federal government may use part or all of your federal tax refund to repay the debt. This is called a tax refund offset. If your tax refund is lower than you calculated, it may be due to a tax refund offset for an unpaid debt such as child support.

Cached

Will the IRS automatically adjust my refund

File an amended tax return if there is a change in your filing status, income, deductions or credits. IRS will automatically make those changes for you.

How long does it take the IRS to adjust your refund

When to check… Your amended return will take up to 3 weeks after you mailed it to show up on our system. Processing it can take up to 16 weeks.

Can I track my offset refund

Call the IRS toll-free number 800-829-1040.

Does the IRS make mistakes on refunds

The IRS sometimes makes changes because of a miscalculation. The IRS might also believe, based on other information on the return, that you're eligible for a credit you didn't claim.

How do I find out why my refund was less than expected

If your refund is less than expected, you can check IRS Where's My Refund, which will give you the most up to date information about your refund. The IRS will also send you a notice CP12 outlining why your refund was adjusted.

How often does the IRS make mistakes on refunds

Data on IRS Mistakes

IRS mistakes are actually quite rare. In fact, a 2023 study by the Treasury Inspector General for Tax Administration found that the IRS makes errors in less than 1% of the returns it processes.

Will the IRS automatically correct my return

Normally you do not need to file an amended return to correct math errors. The IRS will automatically make those changes for you. Also, don't file an amended return because you forgot to attach tax forms, such as Forms W-2 or schedules. If necessary, the IRS normally will send a request asking for those documents.

Can you check IRS offset online

You can access your federal tax account through a secure login at IRS.gov/account. Once in your account, you can view the amount you owe along with details of your balance, view 18 months of payment history, access Get Transcript, and view key information from your current year tax return.

How long does it take for the IRS to offset your refund

Non-joint refund: Federal law requires a state to disburse a non-joint refund offset no later than 30 calendar days after receipt unless there is a special circumstance (for example, a pending appeal).

How do I know if my tax return has been flagged

If the IRS decides that your return merits a second glance, you'll be issued a CP05 Notice. This notice lets you know that your return is being reviewed to verify any or all of the following: Your income. Your tax withholding.

How do I stop my tax refund from being offset

If you have an objection to the debt, you have the right to request a review of your objection. If you're successful, your tax refund and other federal payments will not be offset, or the amount being offset may be reduced. If you're unsuccessful, your tax refund and other federal payments will be offset.

How long does IRS offset take

Non-joint refund: Federal law requires a state to disburse a non-joint refund offset no later than 30 calendar days after receipt unless there is a special circumstance (for example, a pending appeal).

What triggers a red flag to IRS

Some red flags for an audit are round numbers, missing income, excessive deductions or credits, unreported income and refundable tax credits. The best defense is proper documentation and receipts, tax experts say.

How long does it take IRS to flag a return

If you provide the information the IRS requested, the IRS should correct your account and resolve the refund issue (generally within 60 days). If you file a missing or late return, the IRS will process your returns and issue your refunds (generally within 90 days).

How long does offset delay refund

Non-joint refund: Federal law requires a state to disburse a non-joint refund offset no later than 30 calendar days after receipt unless there is a special circumstance (for example, a pending appeal).

Can my refund be offset after approved

If you have a past due, legally enforceable California income tax debt and are entitled to a federal income tax refund, we are authorized to have your refund withheld (offset) to pay your balance due. We may charge a fee for federal offsets.

What check amount gets flagged by IRS

$10,000

Although many cash transactions are legitimate, the government can often trace illegal activities through payments reported on complete, accurate Forms 8300, Report of Cash Payments Over $10,000 Received in a Trade or BusinessPDF.