How do I not get flagged by the IRS?

What triggers a red flag to IRS

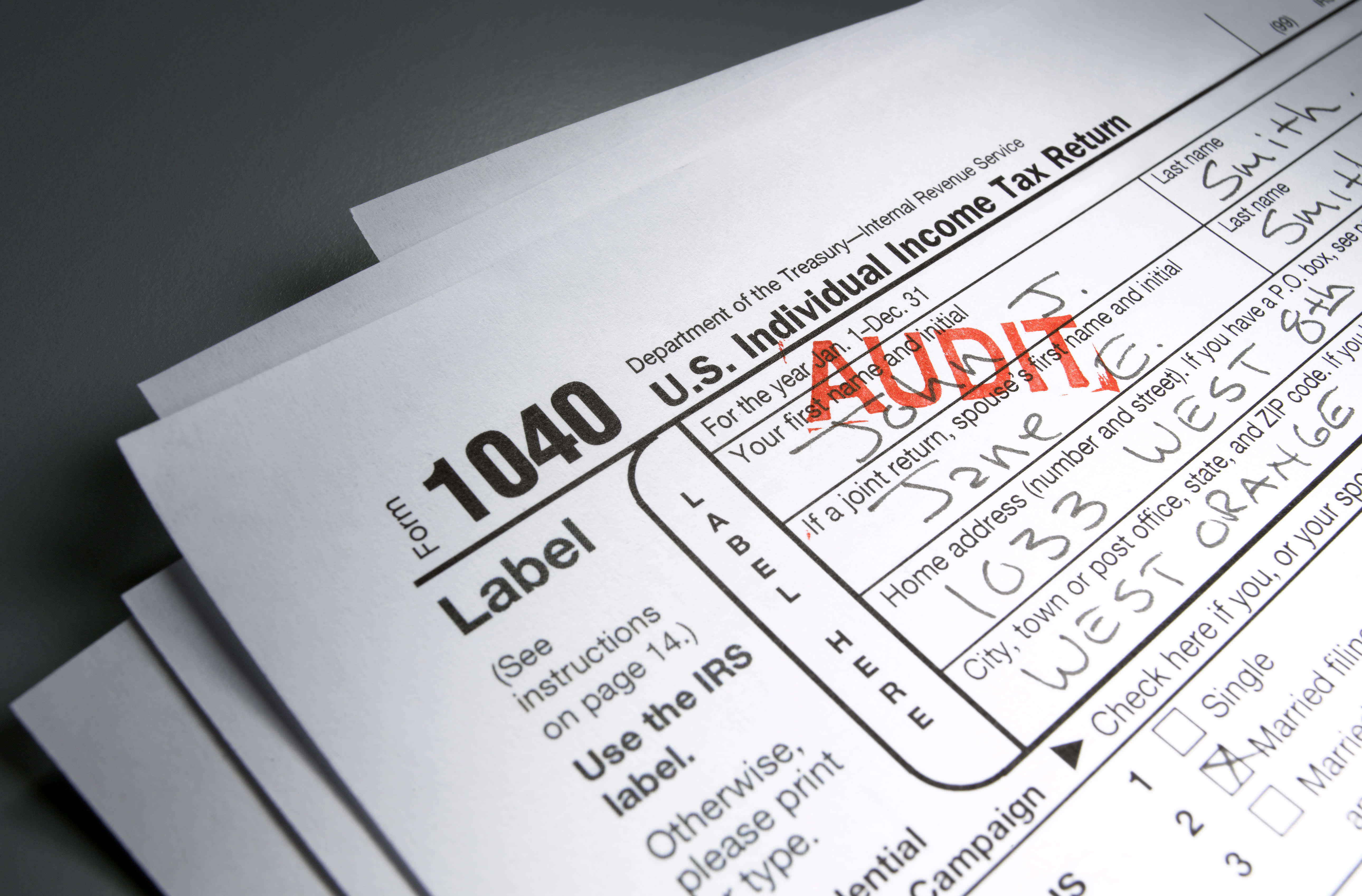

Some red flags for an audit are round numbers, missing income, excessive deductions or credits, unreported income and refundable tax credits. The best defense is proper documentation and receipts, tax experts say.

How can I avoid getting audited by the IRS

How to avoid a tax auditBe careful about reporting all of your expenses. Reporting a net annual loss—especially a small loss—can put you on the IRS's radar.Itemize tax deductions.Provide appropriate detail.File on time.Avoid amending returns.Check your math.Don't use round numbers.Don't make excessive deductions.

CachedSimilar

How do you know if your taxes are being flagged

If the IRS decides that your return merits a second glance, you'll be issued a CP05 Notice. This notice lets you know that your return is being reviewed to verify any or all of the following: Your income. Your tax withholding.

CachedSimilar

What amount is flagged by the IRS

Federal law requires a person to report cash transactions of more than $10,000 by filing IRS Form 8300PDF, Report of Cash Payments Over $10,000 Received in a Trade or Business.

Who gets audited by IRS the most

Who gets audited by the IRS the most In terms of income levels, the IRS in recent years has audited taxpayers with incomes below $25,000 and above $500,000 at higher-than-average rates, according to government data.

How much money triggers an IRS audit

Under the Bank Secrecy Act, various types of businesses are required to notify the IRS and other federal agencies whenever anyone engages in large cash transactions that involve more than $10,000.

Is the IRS going to audit everyone

Does the IRS audit everyone It may be a relief to know that the IRS does not have the resources to audit everyone's return. It sets priorities based on certain factors reported in the return and the person who filed it. This is how they try to find potential tax revenue not reported.

What triggers IRS investigation

What triggers an IRS audit A lot of audit notices the IRS sends are automatically triggered if, for instance, your W-2 income tax form indicates you earned more than what you reported on your return, said Erin Collins, National Taxpayer Advocate at the Taxpayer Advocate Service division of the IRS.

How long does it take IRS to flag a return

If you provide the information the IRS requested, the IRS should correct your account and resolve the refund issue (generally within 60 days). If you file a missing or late return, the IRS will process your returns and issue your refunds (generally within 90 days).

Does the IRS monitor your bank account

The Short Answer: Yes. Share: The IRS probably already knows about many of your financial accounts, and the IRS can get information on how much is there.

How much money goes unreported to the IRS

The gross tax gap nonfiling, underreporting, and underpayment component projections for Tax Years 2023-2023 timeframe are $41 billion, $433 billion, and $66 billion respectively.

What happens if you get audited and don’t have receipts

You may have to reconstruct your records or just simply provide a valid explanation of a deduction instead of the original receipts to support the expense. If the IRS disagrees, you can appeal the decision.

Do normal people get audited by IRS

Although the IRS audits only a small percentage of filed returns, there is a chance the agency will audit your own. The myths about who or who does not get audited—and why—run the gamut.

What income is most likely to be audited

Who gets audited by the IRS the most In terms of income levels, the IRS in recent years has audited taxpayers with incomes below $25,000 and above $500,000 at higher-than-average rates, according to government data.

How much money can you transfer between accounts without being reported

$10,000

In summary, wire transfers over $10,000 are subject to reporting requirements under the Bank Secrecy Act. Financial institutions must file a Currency Transaction Report for any transaction over $10,000, and failure to comply with these requirements can result in significant penalties.

What happens if I don’t report all my income

It is never wise to underreport your income, even if you think you should be paying less tax. Underreporting and the subsequent underpayment can lead to interest charges, penalties, and even criminal charges in some cases.

Can you go to jail for not reporting income to IRS

Tax evasion in California is punishable by up to one year in county jail or state prison, as well as fines of up to $20,000. The state can also require you to pay your back taxes, and it will place a lien on your property as a security until you pay taxes.

How much money until you get audited

As you'd expect, the higher your income, the more likely you will get attention from the IRS as the IRS typically targets people making $500,000 or more at higher-than-average rates.

What happens if I get audited and don’t have receipts

You may have to reconstruct your records or just simply provide a valid explanation of a deduction instead of the original receipts to support the expense. If the IRS disagrees, you can appeal the decision.

What is the $3000 rule

Rule. The requirement that financial institutions verify and record the identity of each cash purchaser of money orders and bank, cashier's, and traveler's checks in excess of $3,000. 40 Recommendations A set of guidelines issued by the FATF to assist countries in the fight against money. laundering.