How do I notify a credit card company of death?

How do I tell my credit card company someone died

How to Notify Credit Bureaus of DeathObtain the death certificate.Call the credit agencies and request a credit freeze.Send the death certificate.Request a copy of the credit report.Work with the estate executor to close out credit accounts or pay off any remaining balance.

Cached

Are credit cards automatically Cancelled when someone dies

It's important to remember that credit card debt does not automatically go away when someone dies. It must be paid by the estate or the co-signers on the account. You'll also want to notify the appropriate entities such as credit card companies, credit bureaus and any services that are set up with automatic payments.

Cached

Do I need to notify the credit bureaus of a death

Notifying any one of the three credit bureaus — Equifax, Experian, and TransUnion — allows the individual's credit report to be updated with a deceased notice, which may help prevent theft of their identity.

Cached

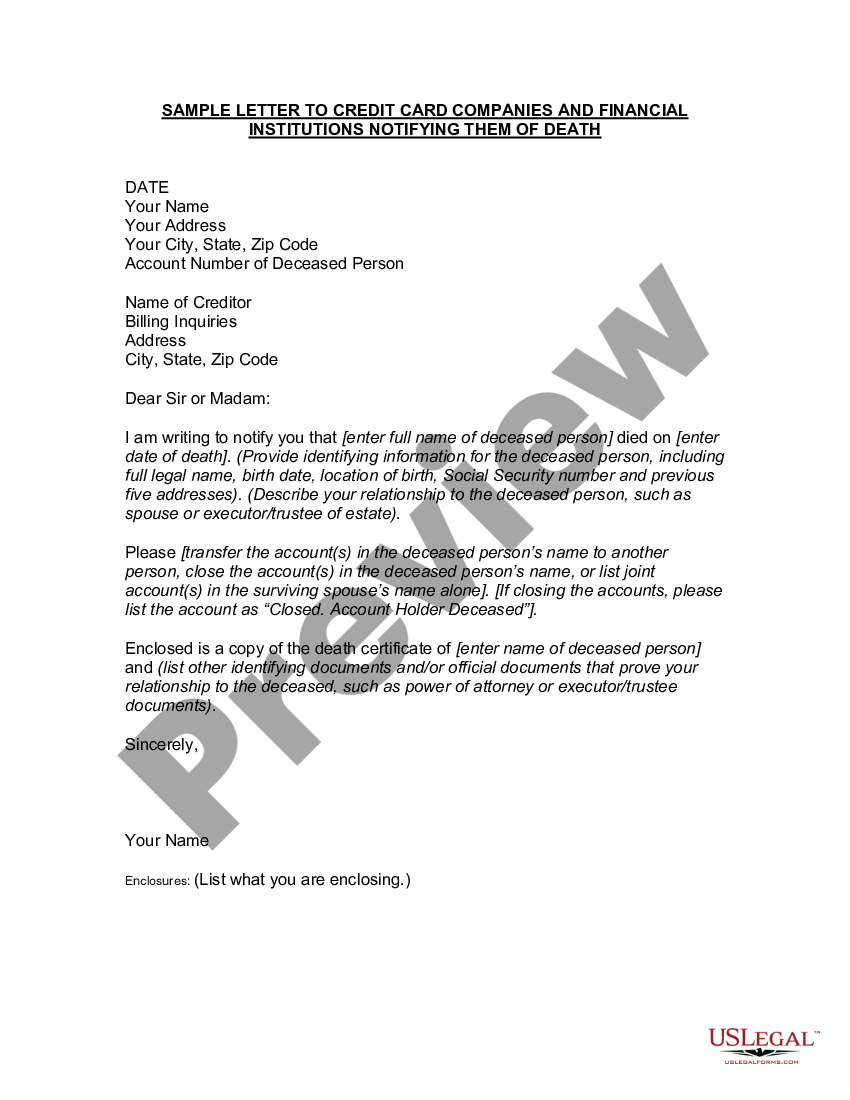

How do you write a letter to a credit card company after death

Unfortunately, (Detail Deceased's name) passed away on (Detail Date). I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.

What happens when credit card holder dies

In the unfortunate event of the user's demise, the credit card issuer cannot issue notices in the deceased's name to ensure repayment. Hence, they hold the next of kin or legal heirs responsible for repaying the outstanding amount.

What happens when the main credit card holder dies

Generally, the deceased person's estate is responsible for paying any unpaid debts. When a person dies, their assets pass to their estate. If there is no money or property left, then the debt generally will not be paid. Generally, no one else is required to pay the debts of someone who died.

Do you need to send a death certificate to credit card company

Step 1: Notify the three major credit bureaus

You will need to provide a certified copy of the death certificate, a copy of your identification, and proof of your authority over the estate (e.g., a marriage certificate for a spouse or a Letter of Testamentary or court order naming you as the executor).

How do I cancel a credit card for a deceased person

Call the number of the credit card company on the back of the card to cancel the card. While you may be able to cancel the card without giving any reason, you should be prepared to provide the deceased's name, Social Security Number, and the reason you are canceling the card.

Does funeral home notify credit bureaus of death

The SSA routinely notifies the three credit bureaus about deaths. To do that, of course, the SSA itself needs to have been notified about the death. This is often done by the funeral home.

What debts are not forgiven at death

Bottom line. Federal student loans are the only debt that truly vanishes when you pass away. All other debt may be required to be repaid by a co-owner, cosigner, spouse, or your estate.

What happens if I use my dad’s credit card after he dies

Be aware that if you use a credit card after the primary cardholder passes away, this is considered fraud. It does not matter if you are an authorized user. You have no legal right to use the card any longer because the primary count holder has passed away leaving no one left to pay the balance.

How do I notify Capital One of a death

The first step is to call 1-877-383-4802 between the hours of 9:00am-11:00pm EST to obtain a case number. Within a few days, you will receive a cover sheet and packet of information via email. Once you have your cover sheet and case number, documents can be submitted through email or fax.

What happens when a credit card holder dies

In the unfortunate event of the user's demise, the credit card issuer cannot issue notices in the deceased's name to ensure repayment. Hence, they hold the next of kin or legal heirs responsible for repaying the outstanding amount.

What happens to a credit card when the primary cardholder dies

Be aware that if you use a credit card after the primary cardholder passes away, this is considered fraud. It does not matter if you are an authorized user. You have no legal right to use the card any longer because the primary count holder has passed away leaving no one left to pay the balance.

When a person dies what happens to their credit card bills

No, when someone dies owing a debt, the debt does not go away. Generally, the deceased person's estate is responsible for paying any unpaid debts. When a person dies, their assets pass to their estate. If there is no money or property left, then the debt generally will not be paid.

How to negotiate credit card debt after death

It's possible to negotiate the credit card debt of a deceased person if you're legally responsible for paying the debt. That means you must be the executor or the administrator of the estate, a cosigner or joint account holder on the credit card, or a surviving spouse in a community property state.

Do I have to pay my deceased mother’s credit card debt

Generally, the deceased person's estate is responsible for paying any unpaid debts. When a person dies, their assets pass to their estate. If there is no money or property left, then the debt generally will not be paid. Generally, no one else is required to pay the debts of someone who died.

Do you need a death certificate to cancel credit cards

The credit card company may request a copy of the death certificate or any paperwork relating to the estate. This is a great opportunity for you to reiterate your request to close the account in writing. If the account is a joint account, the issuer will simply remove your loved one's name from the account.

What happens if primary owner of credit card dies

After someone has passed, their estate is responsible for paying off any debts owed, including those from credit cards. Relatives typically aren't responsible for using their own money to pay off credit card debt after death.

What will happen if a credit card holder dies

In the unfortunate event of the user's demise, the credit card issuer cannot issue notices in the deceased's name to ensure repayment. Hence, they hold the next of kin or legal heirs responsible for repaying the outstanding amount.