How do I pay a derogatory mark?

Can you pay off a derogatory mark

The charge-off will appear on your credit reports for seven years. What to do: Try to pay off the debt or negotiate a settlement. While this won't get the charge-off removed from your credit reports, it'll remove the risk that you'll be sued over the debt.

Cached

How do you fix derogatory marks

Once seven years has passed from the date of delinquency, check your credit report to be sure the derogatory mark has been removed. If it hasn't, you can file a dispute with the relevant credit bureau to have the error removed.

Cached

How do I pay off derogatory

Following are the strategies on how to remove derogatory items from your credit reportCheck For Inaccuracies.Submit A Dispute To The Credit Bureau.Send A Pay For Delete Offer To Your Creditor.Make A Goodwill Request For Deletion.Wait Out The Credit Reporting Time Limit.

Should I pay a closed derogatory account

It can be beneficial to pay off derogatory credit items that remain on your credit report. Your credit score may not go up right away after paying off a negative item. However, most lenders won't approve a mortgage application if you have unpaid derogatory items on your credit report.

Cached

Will paying off derogatory accounts raise credit score

Contrary to what many consumers think, paying off an account that's gone to collections will not improve your credit score. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law's editorial disclosure for more information.

How long does it take for a derogatory mark to fall off once paid

seven years

What happens to your credit score when derogatory marks fall off your report Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising.

Can you buy a house with derogatory marks

Homebuyers can buy a house and qualify for a mortgage with derogatory credit. Borrowers do not need perfect credit to qualify for a home mortgage. You can have derogatory credit tradelines and qualify for FHA, VA, USDA, Conventional, Jumbo, and non-QM loans.

Will my credit score improve if I pay off a derogatory account

Contrary to what many consumers think, paying off an account that's gone to collections will not improve your credit score. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law's editorial disclosure for more information.

Will paying off derogatory accounts help my credit score

In the newest versions of the FICO and VantageScore credit scores, however, paying or settling your delinquent debts, specifically those that have been sent to collections, can result in a higher credit score.

How many points is a derogatory mark

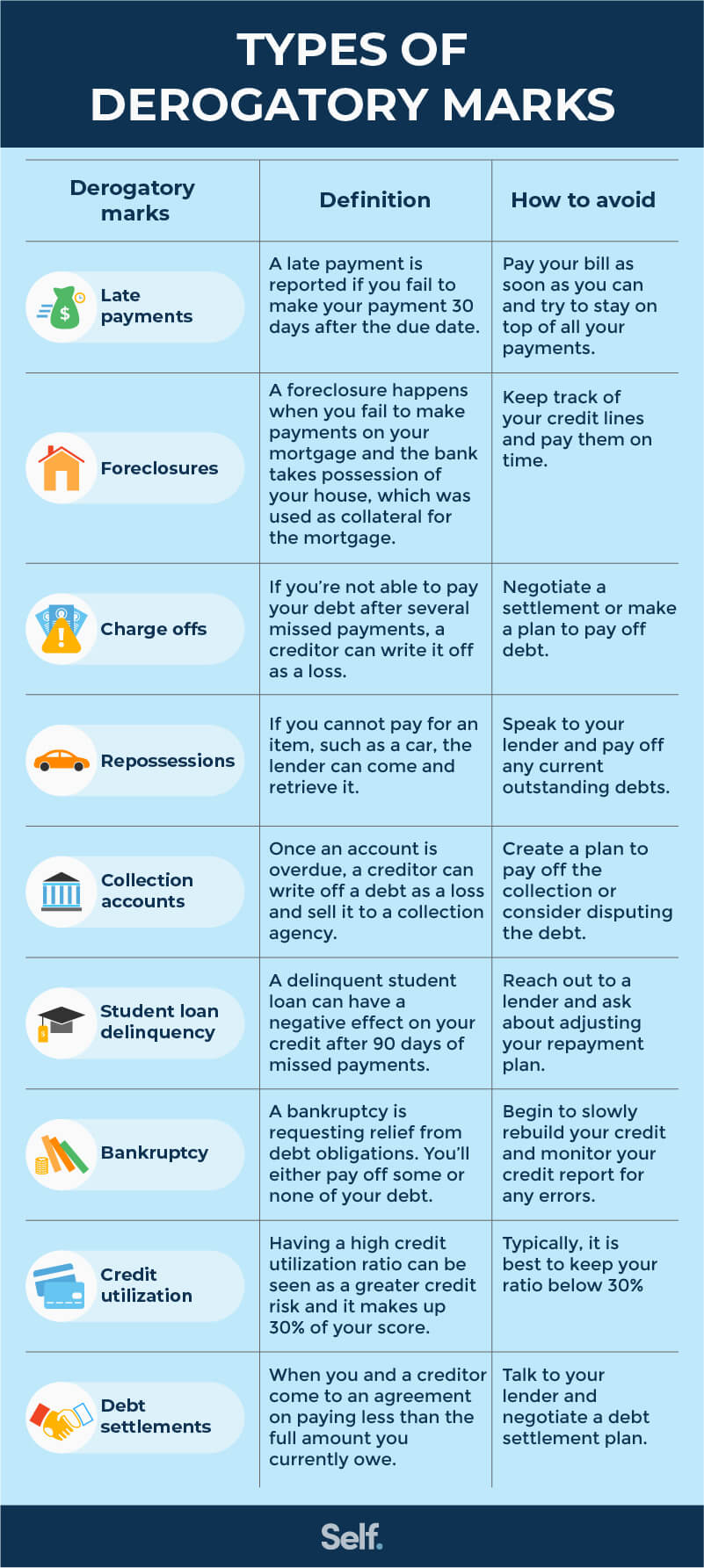

Late payments

It can appear on your report as a derogatory remark and has the potential to lower your credit score by 100 points or more.

Should I pay off a 2 year old collection

Any action on your credit report can negatively impact your credit score, even paying back loans. If you have an outstanding loan that's a year or two old, it's better for your credit report to avoid paying it.

What happens if I pay off my derogatory accounts

Making a payment doesn't automatically remove the negative mark from your report, but it does prevent you from being sued over the debt. Pay the full settled amount to prevent your account from going to collections or being charged off. Ask your lender if they will remove the item if you pay your debt in full.

How long does it take for a derogatory mark to fall off

seven years

What happens to your credit score when derogatory marks fall off your report Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising.

Can I still pay off a closed account

You can still make payments on a closed credit card account, you just cannot make purchases with it. To pay off a balance, continue making payments the same way you did before it was closed. You can usually do this online or, if you get a paper bill, via check.

How fast will credit score go up after delinquent accounts are paid

It takes up to 30 days for a credit score to update after paying off debt, in most cases. The updated balance must first be reported to the credit bureaus, and most major lenders report on a monthly basis – usually when the account statement is generated.

How long does it take for derogatory marks to fall off

What happens to your credit score when derogatory marks fall off your report Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising.

What happens if you never pay collections

If you ignore a debt in collections, you can be sued and have your bank account or wages garnished or may even lose property like your home. You'll also hurt your credit score. If you aren't paying because you don't have the money, remember that you still have options!

Does paying off delinquent accounts help credit score

While paying off your debts often helps improve your credit scores, this isn't always the case. It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. However, that doesn't mean you should ignore what you owe.

Do I still owe if the account is closed

Once your credit card is closed, you can no longer use that credit card, but you are still responsible for paying any balance you still owe to the creditor. In most situations, creditors will not reopen closed accounts.

Will paying a closed account hurt my credit

If the account defaulted, it could be transferred to a collection agency. Paying off closed accounts like these should improve your credit score, but you might not see an increase right away.