How do I pay bills directly from my bank account?

How do I pay bills directly from my checking account

It's usually a simple process that you can complete through your online banking account or mobile banking app. Typically, you sign into your account, select the bill pay page and follow the steps as prompted. For each bill, you'll likely need to enter some of the merchant or service provider's information.

Cached

Can you pay directly from your bank account

ACH Direct Payments

Direct payments can be used by individuals, businesses, and other organizations to send money. For example, if you're paying a bill online with your bank account, that's an ACH direct payment. Social payment apps such as Venmo and Zelle also use the network when you send money to friends and family.

How do I pay online directly from my bank account

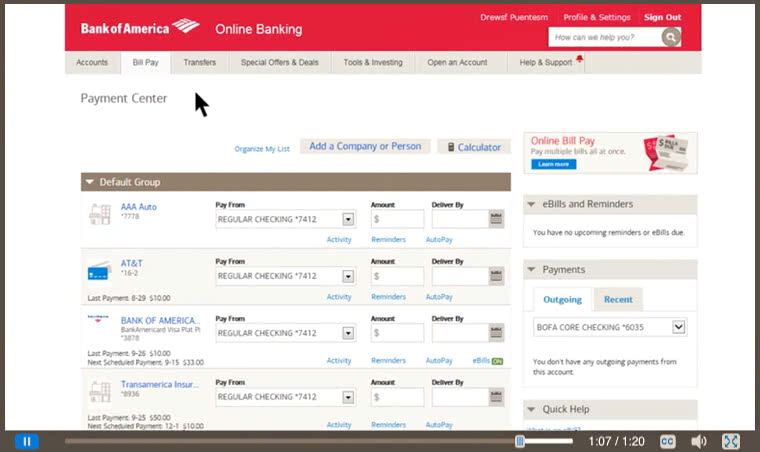

Paying online through your bankCreate an online account on your bank's website or app, if you don't already have one.Once you've logged in, look for a “bill pay” link and create profiles for each of the companies (known as “payees") you want to pay.Enter how much you want to pay the company and on what date.

Cached

How do I do automatic payments from my bank account

You tell the bank or credit union how much to pay and when to pay it each month. The bank then authorizes that amount to be deducted from your selected account each month and transferred to the company you need to pay. The second way to set up automated payments is by using your credit card.

Cached

Can I use my routing and account number to pay bills

First: online bill pay at my bank. In this case, the bank uses the credit card company's routing and account numbers to pay my bill on my behalf. Second, I can enter my check account routing and account numbers on my credit card company's website to pay with an ACH transfer. Either way, it is quick, free, and easy!

What is it called when you pay directly from bank account

ACH stands for Automated Clearing House, a U.S. financial network used for electronic payments and money transfers. Also known as “direct payments,” ACH payments are a way to transfer money from one bank account to another without using paper checks, credit card networks, wire transfers, or cash.

What are the methods to pay from bank account

Wire transfers and ACH transfers allow you to move money between your account and someone else's account, either at the same bank or at different banks. You can also transfer money to mobile payment apps or friends and family via those apps.

Can I pay online with my account and routing number

Depending on the retailer you are shopping at making the actual payment can be as simple as entering your routing number and your account number. Most retailers will also need the name of the account holder and the address.

Can you set up automatic bill payment using a checking account

Individuals can set up an automatic bill payment through their online checking account, brokerage, or mutual fund to pay their monthly bills. Advantages of automatic bill payments include the ease of automated payment, the ability to avoid late payments, and the potential to maintain or improve your credit score.

What is the difference between autopay and bill pay

The main difference between auto pay vs bill pay is that, with bill pay, you are the one initiating the payment, while with auto pay, the vendor initiates the charge to your credit or debit card. Another difference is that, with auto pay, you are authorizing the vendor to charge your card on a recurring basis.

What app can I send money with routing and account number

Western Union®⁴ is one of the best known money transfer services in the world, and offers options to send payments to a bank account using an account and routing number. You'll be able to set up your payment online, in the Western Union app, or by visiting an agent location.

How do I pay someone with a bank account and routing number

Log in to your online banking account or mobile banking app. Choose Wire Transfer. Enter the routing number and account number for your new bank. Enter the amount you want to transfer.

What is the difference between ACH and bill pay

Paying bills with a debit card means initiating a transaction that's processed by your card's merchant and is directly linked to your business checking account. ACH is an abbreviation for Automated Clearing House, which is a network that moves funds electronically from bank to bank.

What is a bank account used to pay bills

A standard checking account is a basic checking account you can use to pay bills, write checks and make purchases using a debit card.

Can someone use my bank account number and routing number

If fraudsters can combine your bank details and other easy-to-find information — such as your Social Security number (SSN), ABA or routing number, checking account number, address, or name — they can easily begin to steal money from your account.

How to transfer money from one account to another using account and routing number

Steps for Transferring Money Between BanksLog into your bank's website or connect via the bank's app.Click on the transfer feature and choose transfer to another bank.Enter the routing and account numbers for the account at the other bank.Make the transfer.

What is the difference between autopay and Billpay

The main difference between auto pay vs bill pay is that, with bill pay, you are the one initiating the payment, while with auto pay, the vendor initiates the charge to your credit or debit card. Another difference is that, with auto pay, you are authorizing the vendor to charge your card on a recurring basis.

What are 3 ways you can make payments with a checking account

NoteCheck: You can write a check, which the recipient will then deposit at their own bank to transfer the money from your account to theirs.Debit card: You can typically make purchases with your debit card.Online pay: Most banks and credit unions allow online bill payment with every checking account.

What bills should you never put on autopay

Don't use automatic payments for bills where the total fluctuates each time: think utility bills and cable bills that could end up being a different total each month. You should also avoid paying certain bills with cash—including utility bills.

What is the downside of autopay

Overdraft Risk: Automatic payments do have some drawbacks. If you're not carefully tracking how much you spend each month and making sure you have enough money in your account to cover your automatic payments, you could forget about a large upcoming payment and end up overdrawing your account.