How do I pay my Capital One credit card with a credit card?

How do I pay my credit card bill with another credit card

Banks don't allow you to pay your credit card balance directly using another credit card. Typically payments via check, electronic bank transfer or money order are the only acceptable methods of payment. There is one loophole: A balance transfer credit card.

How do I pay my credit card bill with one card

You can pay the outstanding dues from the App itself, through the following modes: a)Debit Card b) Netbanking c) UPI d) IMPS/NEFT to unique OneCard account number provided in app.

Can I pay my Capital One credit card with another debit card

Yes, you can pay your Capital One credit card with a debit card, just not directly. You may use a checking or savings account to pay online or over the phone.

Can you pay a bill with a credit card

Using a credit card has become a convenient way to make purchases both online and in-stores. Credit cards can also be used to pay bills, which could be helpful for both you and your credit score when used responsibly.

Can you pay for one bill with two credit cards

Most will not allow this transaction when using multiple cards, debit or credit. When customers use multiple debit or credit cards for one transaction, it can make it difficult for the merchant to properly process the transaction. Additionally, prohibiting using multiple cards helps cut down on fraudulent payments.

How can I pay two credit cards at once

Snowball method — You make your minimum payments on all of your credit cards. Then, you focus all of your extra money on paying off the card with the smallest balance. Once you pay that card off, you take the money you were paying for that card and put it toward the card with the next smallest balance.

Can you use two credit cards for one payment

Retailers accept a growing number of payment forms in-person at their brick-and-mortar stores—even allowing more than one credit card for a single transaction.

What payment methods does Capital One accept

You can pay your Capital One credit card with cash at a Capital One branch location or at an ATM. You may also make a payment at Money Services, Western Union, MoneyGram or through the PayNearMe platform.

Does transferring balances hurt your credit score

Balance transfers won't hurt your credit score directly, but applying for a new card could affect your credit in both good and bad ways. As the cornerstone of a debt-reduction plan, a balance transfer can be a very smart move in the long-term.

What bills Cannot be paid with a credit card

The short answer is, entertainment and nonessentials can usually be paid with a credit card with no fees. Services, utilities, and taxes, can often be paid with a credit card but with a processing fee. Loan payments, are usually check or bank withdrawal payments only.

What happens if you pay with a credit card

Once you purchase goods or services with a credit card, the purchase amount is deducted from your available balance. Conversely, when you make a payment on your credit card account, you will have more available credit to use for future purchases.

What happens if you double pay your credit card

Overpaying your credit card will result in a negative balance, but it won't hurt your credit score—and the overpayment will be returned to you.

Is it okay to put two credit cards together

Having more than one credit card may help you keep your credit line utilization ratio per card lower than the recommended 30% by spreading charges. There are potential benefits to having multiple cards, such as pairing various types of rewards cards to optimize earnings on all categories of spending.

What is the 15 3 payment trick

With the 15/3 credit card payment method, you make two payments each statement period. You pay half of your credit card statement balance 15 days before the due date, and then make another payment three days before the due date on your statement.

Does making 2 payments boost your credit score

Since your credit utilization ratio is a factor in your credit score, making multiple payments each month can contribute to an increase in your credit score. The impact is usually more prominent in cases where your overall credit limit is very low relative to your monthly purchases.

How can I use two payment methods online

Though most online retailers do not allow payments between two different credit cards, some allow split payments between a credit card and a gift card. If you have a gift card for your favorite retailer that does not cover your entire balance, you can use your credit card or debit card to pay the remainder.

Does making multiple credit card payments hurt your credit

While making multiple payments each month won't affect your credit score (it will only show up as one payment per month), you will be able to better manage your credit utilization ratio.

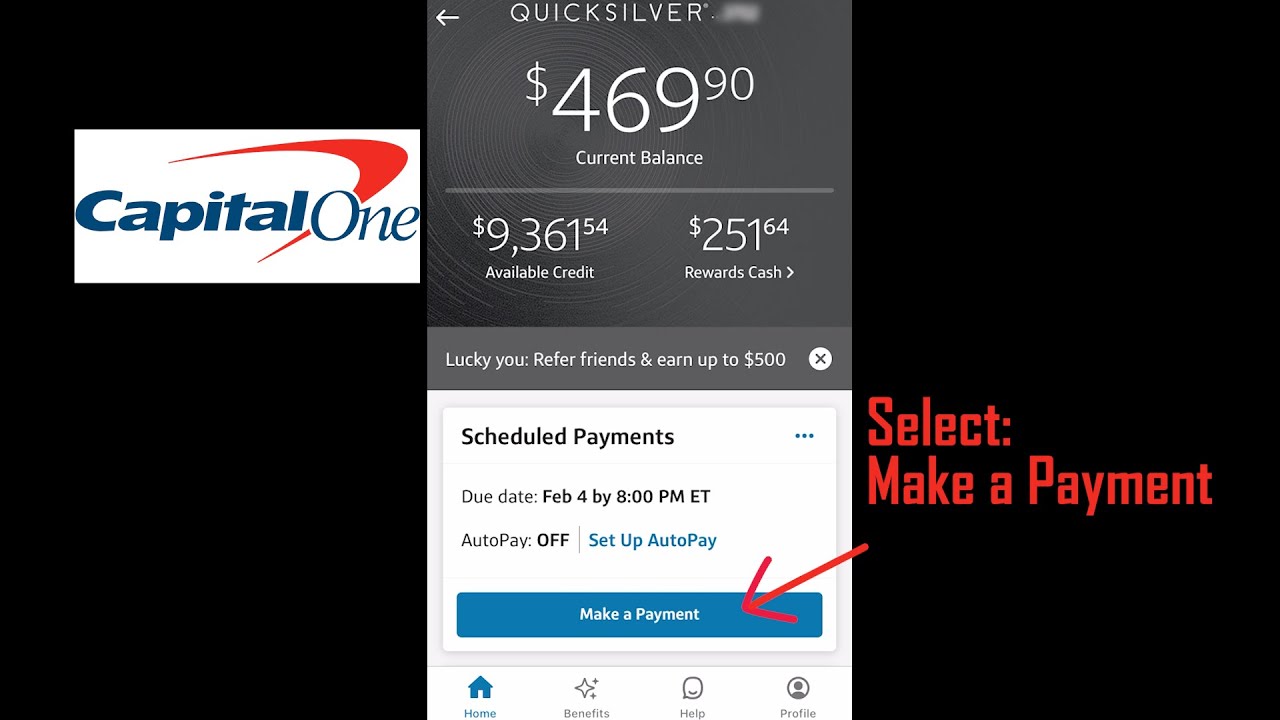

Does Capital One accept credit card payments online

Online payment methods in a nutshell

Connecting your Capital One credit card to a digital wallet can help you pay easily from your phone or any device. So while reducing your risk of fraud, you'll still get the benefits of a credit card when shopping online.

How to pay with Capital One credit card without card

Add your Capital One credit card to Google Pay to shop online without sharing your physical card number. Chrome can automatically enter a virtual card into the payment field. No need for your physical card. You can lock, unlock or delete your virtual cards at any time for added control over your shopping experience.

What is the downside of a balance transfer credit card

Possible drop in credit score: A balance transfer might hurt your credit score in two ways. If the new card comes with a lower credit limit than your existing card, and if you close your existing card's account after the transfer, you may expect your credit utilization ratio to rise.