How do I pay my cc?

How do I pay my CC bill

Credit card bills can be paid online or offline. Offline methods include paying a cheque, over-the-counter, using an ATM, or contacting customer support. Online methods include using a mobile wallet, NEFT, IMPS, internet banking, mobile wallet, auto debit facility, or BillDesk.

How do I pay my CC online

5 Steps To Pay Online With a Credit CardEnter Your Shipping Address.Choose 'Credit Card' as Your Payment Method.Enter Your Info as It Appears on Your Credit Card.Enter the Billing Address for Your Credit Card.Verify Your Information.

Cached

How do I pay my CC with a debit card

To use your debit card to pay a credit card bill, you must do so via bank transfer payment. In other words, you have to use either a credit card provider's payment portal or a third-party payment portal that includes not only your debit card information, but also your banking information.

Can I pay my CC at the bank

At a branch: Visit the card issuer's branch to pay at the counter in person. Let the teller know you want to pay your credit card bill and provide your cash payment.

Cached

Can I pay my CC with a credit card

No, you cannot use a credit card to pay other credit card bills. However, credit cards often have options like cash advance or balance transfer that give you access to "cash" funds. If you are short on money to pay your bills, you can use these funds to pay off your balance.

How often should you pay your CC bill

When possible, it's best to pay your credit card balance in full each month. Not only does that help ensure that you're spending within your means, but it also saves you on interest.

Why can’t you pay a credit card with a debit card

Most of the banks allow you to visit their bank ATMs to make credit card payment of their own credit cards. However, you cannot use a debit of one bank to pay credit card bill of another bank. And unlike ATM cash withdrawals, credit card payments must be done at the respective bank ATMs not at any other bank ATMs.

Why can’t I pay my credit card with a credit card

Typically, you can't simply pay your credit card bill with another card as if you were paying your utility or phone bill. Credit card companies don't usually accept credit cards as a regular form of payment, in part because it opens the door for debt to revolve through your accounts in an infinite loop.

What happens if I can’t pay my CC bill

Consequences for missed credit card payments can vary depending on the card issuer. But generally, if you don't pay your credit card bill, you can expect that your credit scores will suffer, you'll incur charges such as late fees and a higher penalty interest rate, and your account may be closed.

Is it smart to pay off one credit card with another

When transferring a balance: Yes. You can save money on interest by moving debt from a high-interest credit card to one with an introductory 0% APR offer or low-interest promotion on balance transfers, then paying it off at a lower rate.

Can you pay your credit card early

Paying your credit card early reduces the interest you're charged. If you don't pay a credit card in full, the next month you're charged interest each day, based on your daily balance. That means if you pay part (or all) of your bill early, you'll have a smaller average daily balance and lower interest payments.

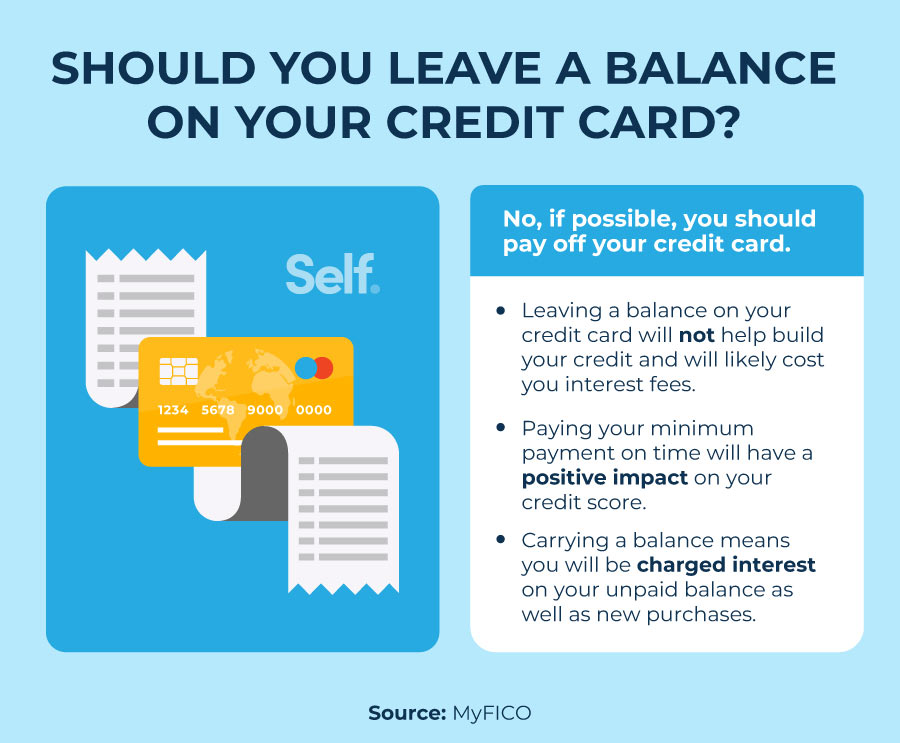

Should I pay off my credit card in full or leave a small balance

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

How often should I use my $200 credit card

To keep your scores healthy, a rule of thumb is to use no more than 30% of your credit card's limit at all times. On a card with a $200 limit, for example, that would mean keeping your balance below $60. The less of your limit you use, the better.

Is it bad to pay for a credit card with a credit card

The short answer is no. Credit card companies don't allow you to make minimum monthly payments, or to pay off an outstanding balance, with another credit card from a different company. Often, the fees for these types of transactions are too high for credit card companies to allow it.

Can credit card balance be paid with debit card

No, you cannot pay a credit card with a debit card. But you can a pay a credit card with the bank account that a debit card is linked to, by doing an electronic transfer.

Is it safe to pay a credit card bill with a debit card

Bottom Line: The simple answer is that you cannot use a physical debit card to pay your credit card bill. You will have to set up payments using the nine-digit routing number from the checking account your debit card is linked to. At the end of the day, the money is coming from the same place.

How bad is it to not pay credit card in full

The bottom line. Reporting a balance on your cards of more than about 30 percent of its maximum credit line will hurt your score and carries additional risks. The lower your balances, the better your score — and a very low balance will keep your financial risks low.

How long can you go without paying a credit card bill

30 days late: The creditor will report your late payment to the credit bureaus, causing your credit scores to drop. Your creditor may also contact you to try and work out a solution. 60-180 days late: The credit card company will continue charging interest and may increase the APR on your overdue balance.

Does a late CC payment affect credit score

A late payment can drop your credit score by as much as 180 points and may stay on your credit reports for up to seven years. However, lenders typically report late payments to the credit bureaus once you're 30 days past due, meaning your credit score won't be damaged if you pay within those 30 days.

Does making multiple credit card payments hurt your credit

While making multiple payments each month won't affect your credit score (it will only show up as one payment per month), you will be able to better manage your credit utilization ratio.