How do I pay my check online?

Can you pay someone with a check online

How to send an eCheck – you will first need to sign up for an eCheck service, either through your bank or a payment processor, then provide payment details and finally authorise the payment. A digital form of the paper check, eChecks offer a fast, easy way to send and receive payments using online banking networks.

How do I pay a check online

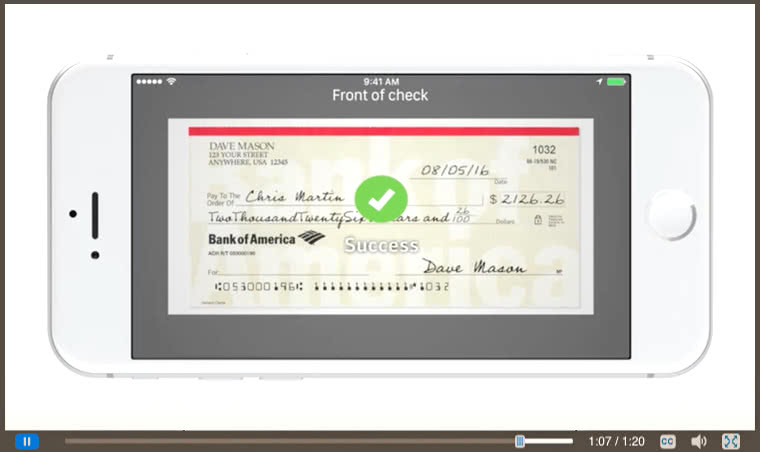

Some steps to deposit an online check may include:Sign into your selected banking mobile app.Tap "Deposit checks" and choose the account where you want your deposit to go.Enter the deposit amount.Tap "Front" and take a photo of the front of the check.Endorse your check, then tap "Next"

Cached

How do I pay online with routing and account number

To use your checking account as a payment option, select Add a personal checking account at the bottom of the Shipping & Payment page during the checkout process. Enter the bank routing number, also known as the ABA code. Enter the checking account number.

How do I pay online with my bank account

Paying online through your bankCreate an online account on your bank's website or app, if you don't already have one.Once you've logged in, look for a “bill pay” link and create profiles for each of the companies (known as “payees") you want to pay.Enter how much you want to pay the company and on what date.

Cached

Can I send a paper check online

Traditionally, businesses depended solely on printed checks for conducting their business. However, that is no longer the case, today, as businesses have a broader choice of options when sending checks. Today Companies can send paper checks online or use eChecks.

Can you write a check and send it online

Can you create a check online Yes, you can write a check online using OnlineCheckWriter.com. Write a check online by completing the date, payee or business name, amount written in and the numerical amount filled in and sign at the bottom right hand corner of the check.

Can I pay a check in without going to the bank

Visit your nearest Post Office, where you can pay in cheques and cash into your account. You'll need a paying in slip, which you'll find either in your paying in book, or at the back of your cheque book.

Is it better to pay with check or online

You can often view your payment history online, which can be helpful if you need to dispute a charge or track your spending. It can be more secure than paying bills with a check, as your information is typically encrypted when you enter it online.

Can I send money with my checking and routing number

Can you send money with a routing and account number Yes. Routing and account numbers are important in the process of sending payments in the US. A routing number is used so the sending bank knows which financial institution the recipient's account is held by, and the account number is unique to that account.

Is it safe to pay online with routing and account number

The short answer: Real damage! The combination of a bank account and a routing number is a dangerous combo that scammers want. There's a difference between these numbers, but put them together in the wrong hands and a mastermind of mischief can cause financial mayhem.

Can you pay directly from your bank account

ACH Direct Payments

Direct payments can be used by individuals, businesses, and other organizations to send money. For example, if you're paying a bill online with your bank account, that's an ACH direct payment. Social payment apps such as Venmo and Zelle also use the network when you send money to friends and family.

Can someone use my routing number and account number

If fraudsters can combine your bank details and other easy-to-find information — such as your Social Security number (SSN), ABA or routing number, checking account number, address, or name — they can easily begin to steal money from your account.

Is it safe to mail a check or pay online

Mailing a check in the United States via regular mail is quite safe. Numerous checks move through the mail every day, including many of the payments made through online bill payment services. Banks sometimes send those payments electronically, but they often print a check and drop it in the mail.

What is the best way to send a check

Instead of leaving the letter, with the enclosed check, in your flagged mailbox for outgoing mail, it is best to drop off the letter in an official postal collection box, hand it directly to a uniformed mail carrier, or take it to the Post Office. Certified Mail® is the best way to send a check.

What do you need to send an online check

To initiate an e-check, you will need the recipient's bank information, including their routing and account numbers of a checking account, for example. You will also need your own bank account information. Once you have this information, you can log into your bank's website or app and initiate the e-check payment.

Can you mobile deposit someone else’s check in your account

Yes, it is possible to deposit your friend's check in your account. To do so, they must endorse it with their name, include "Pay to the order of" and write your name.

What do I need to deposit a check

How to Deposit or Cash a Check at the BankStep 1: Bring a valid ID. Be sure to have a valid form of ID with you when you go to your bank to deposit a check.Step 2: Endorse the check. Once you arrive at the branch, flip the check over to the back and look for two grey lines.Step 3: Present the check to the banker.

What is the safest way to pay by check

There are many ways to reduce your risk of fraud and safeguard your information. Always fill out the payee line and full, current date on every check you write using ink. Be sure to keep your checks in a safe place—not in your purse or wallet, which could be lost or stolen.

What is the safest form of check payment

Cashier’s checks

Cashier's checks are typically deemed a safe way to make a large payment on a purchase. The difference from a regular check is that the bank guarantees its payment, not the purchaser.

Can I send money to someone using my checking account

Using money transfer apps, you can send money to someone else's bank account using the funds from your bank account, debit card, or credit card. You don't need to know the recipient's personal or bank account details to make a transaction. Google Pay, for example, only requires an email address.