How do I pay my Wells Fargo credit card automatically?

How do I pay my credit card bill automatically

Auto Debit FacilityLog in to your net banking account to register for the auto-debit facility.Visit the 'Credit Card' section.Look out for 'Auto-Debit' feature.Click on 'Enable' once you locate it.Select whether you want to pay only the minimum amount due or the total bill amount in full.

Does Wells Fargo do automatic payments

In addition you can: Set up automatic payments for recurring bills — like mortgage or cable TV. Make one-time payments for bills that differ each month — like the phone or utility bill. Pay your Wells Fargo credit card and loan accounts online quickly and easily.

How do I set up automatic payments on Wells Fargo app

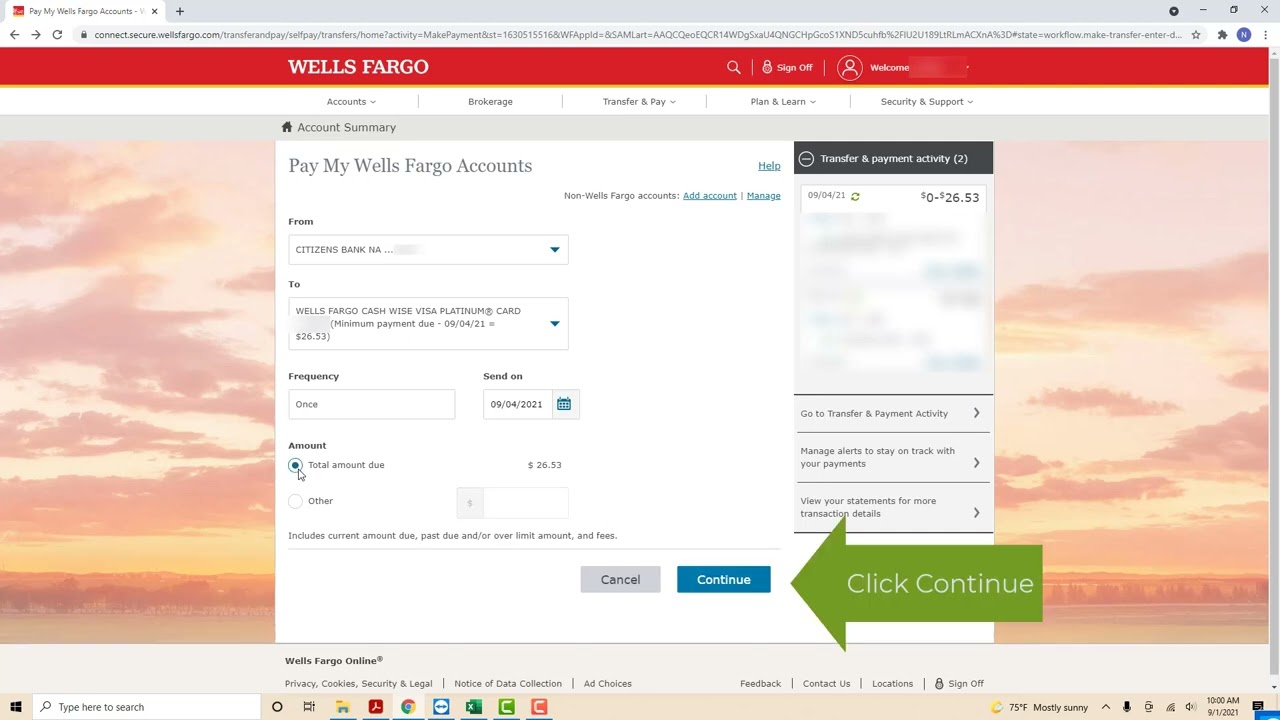

Log in to your account on the Wells Fargo website or mobile app. Find the “Bill Pay” option on the account home page and select “Set Up Recurring Payment”. Enter your bank account routing number and account number. This is the account from which Wells Fargo will deduct your payment each month.

Cached

Can you pay credit card balance automatically

What is autopay Automatic payments or “autopay” is a feature offered by most credit card issuers that allows you to have your balance or minimum payment automatically paid from a bank account when your statement is posted. You can set up autopay with your credit card issuer over the phone or online.

Cached

How do I set up auto pay on my credit one credit card

To set up AutoPay:Sign in to your account. Click "Pay Bill."Next to AutoPay, click "Set Up."Follow the prompts to set up automatic payments.

Does AutoPay hurt credit score

When it comes to payments that are reported to credit bureaus, as long as your payment arrives on time, automatic payments don't affect your credit scores any more than if you'd dropped your payment in the nearest mailbox. That being said, auto payments can help you consistently pay your bills on time.

How do I do automatic payments from my bank account

You tell the bank or credit union how much to pay and when to pay it each month. The bank then authorizes that amount to be deducted from your selected account each month and transferred to the company you need to pay. The second way to set up automated payments is by using your credit card.

Can you set up automatic payments from your bank account

In recurring bill-pay, you give permission to your bank or credit union to send the payments to the company. With automatic debits, you give your permission to the company to take the payments from your bank account.

How do I activate automatic payments

Authorize a mandate request from a merchantOpen the Google Pay app .At the top right, click your profile picture.Select Autopay.In the “Pending” tab, select the mandate you want to take action on: Set up autopay. Cancel autopay.Enter your UPI PIN.

How do I set up an automatic payment system

You tell the bank or credit union how much to pay and when to pay it each month. The bank then authorizes that amount to be deducted from your selected account each month and transferred to the company you need to pay. The second way to set up automated payments is by using your credit card.

Does autopay hurt credit score

When it comes to payments that are reported to credit bureaus, as long as your payment arrives on time, automatic payments don't affect your credit scores any more than if you'd dropped your payment in the nearest mailbox. That being said, auto payments can help you consistently pay your bills on time.

Is it better to auto pay with credit card or bank account

Paying bills with a credit card might help your credit score if: It helps you pay on time. If you struggle to remember payment due dates, setting up automatic payments with a credit card can help prevent missed payments without worrying about insufficient funds in your checking account.

How to pay Credit One credit card with debit card

To pay your Credit One credit card with a debit card, log in to the Credit One mobile app or website and enter your debit card information in the payment section, or call 1 (888) 729-6274 to pay with a rep by phone.

Why does my credit card say no payment due but I have a balance

If your credit card statement reflects a zero minimum payment due – even if you have a balance on your card – it is because of recent, positive credit history. A review of your recent credit history and determination to waive your minimum monthly payment allows you to skip your monthly payment for a statement cycle.

What bills should you never put on autopay

Don't use automatic payments for bills where the total fluctuates each time: think utility bills and cable bills that could end up being a different total each month. You should also avoid paying certain bills with cash—including utility bills.

What is the downside of autopay

Overdraft Risk: Automatic payments do have some drawbacks. If you're not carefully tracking how much you spend each month and making sure you have enough money in your account to cover your automatic payments, you could forget about a large upcoming payment and end up overdrawing your account.

What is the difference between autopay and recurring payment

Automatic debit payments work differently than the recurring bill-pay feature offered by your bank. In recurring bill-pay, you give permission to your bank or credit union to send the payments to the company. With automatic debits, you give your permission to the company to take the payments from your bank account.

What happens if I pay credit card bill before autopay

This means if you make a partial payment before the payment due date, the autopay instruction for payment of the Minimum Amount due (MAD) or Total Amount due (TAD), as opted, may be returned unpaid. As a result, autopay return charges will be levied on the net payable amount.

How do I check my automatic payments on my card

The easiest and best way to find recurring charges on your credit card is to laser focus on your credit card statements. "Check your credit card statement every single month, but don't just look at the balance," says Erik Skjodt, co-founder and CEO of personal finance app Medean.

Can I pay my credit card bill with a debit card from another bank

Most of the banks allow you to visit their bank ATMs to make credit card payment of their own credit cards. However, you cannot use a debit of one bank to pay credit card bill of another bank. And unlike ATM cash withdrawals, credit card payments must be done at the respective bank ATMs not at any other bank ATMs.