How do I put all my bills in one?

How do I combine all my bills into one

You can combine all of your debts into one payment by applying for a debt consolidation loan or a balance transfer credit card from a bank or credit union, then using it to pay off your debts.

What bills can you consolidate

This basically means credit cards, store cards, gas cards and unsecured personal loans can all be consolidated. Additionally, unpaid medical debts and even some payday loans can be included, too.

Does consolidation hurt your credit

Does debt consolidation hurt your credit Debt consolidation loans can hurt your credit, but it's only temporary. The lender will perform a credit check when you apply for a debt consolidation loan. This will result in a hard inquiry, which could lower your credit score by 10 points.

How to put all my loans in one

A debt consolidation loan is a type of loan that's used to combine all your existing debts into one pot. All you'll need to do is apply for a loan for the amount you owe in existing debt and if approved, you can use the funds to pay off your other borrowing.

What is debt relief program

A debt relief program is a method for managing and paying off debt. It typically involves hiring a debt relief company to employ one or more strategies that help you get debt under control, such as by reducing the amount you owe, lowering your interest rate, or securing better terms.

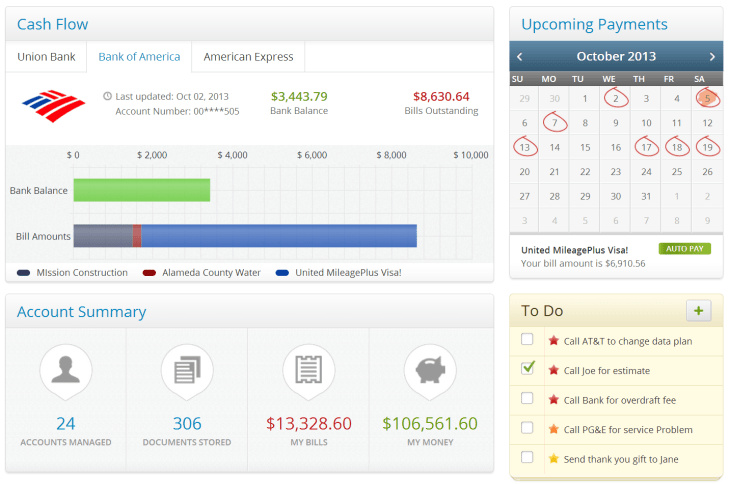

Is there an app to pay all bills at once

The complete bill payment app

The 1bill app helps you get organized, so you'll pay your bills on time and avoid late fees: pays bills automatically.

Is it a good idea to consolidate all your bills

Combining multiple outstanding debts into a single loan reduces the number of payments and interest rates you have to worry about. Consolidation can also improve your credit by reducing the chances of making a late payment—or missing a payment entirely.

Does anyone qualify for debt consolidation

You'll typically need a credit score of at least 700 to qualify for a debt consolidation loan with a competitive interest rate. Although a lower credit score doesn't automatically equal a loan denial, the borrowing costs will likely be higher.

How long does debt consolidation stay on your record

seven years

If you take out a debt consolidation loan, it will stay on your credit report for as long as the loan is open. If you make payments on your loan and keep it in good standing, this can be a good thing. However, if you miss a payment, later payments can stay on your credit report for up to seven years.

What is a disadvantage of debt consolidation

Your debt consolidation loan could come at a higher rate than what you currently pay on your debts. This can happen for a variety of reasons, including your current credit score. If it's on the lower end, the risk of default is higher and you'll likely pay more for credit.

Can you combine all my debt into one monthly bill

Debt consolidation loan

Banks, credit unions, and installment loan lenders may offer debt consolidation loans. These loans convert many of your debts into one loan payment, simplifying how many payments you have to make. These offers also might be for lower interest rates than what you're currently paying.

How to clear 20K debt

How to Pay Off 20,000 in Credit Card DebtMake a Plan to Tackle $20K in Credit Card Debt.Reduce Your Interest Rates.Reduce Your Bills and Cut Down on Spending.Utilize Debt Repayment Strategies.How to Get Additional Help With Your Debt.Make a Habit of Responsible Credit Use.Monitor Your Credit Going Forward.

How do I qualify for debt relief

Debt relief qualifications

To qualify for National Debt Relief's settlement program, there are a few factors at play. You must owe more than $7,500 in debt and be at least several months behind on payments. You must also be able to make monthly payments to National Debt Relief at an agreed-upon rate.

Do I qualify for the debt relief program

What does it take to qualify for debt relief Requirements differ from one debt relief company to another. At National Debt Relief, you must have at least $7,500 and be able to make monthly payments into your settlement fund to qualify for our debt relief program. Debt relief companies also might have other criteria.

Is there an app to link all bank accounts

YNAB allows you to link your checking and savings accounts, as well as credit cards and loans.

How do you pay all your bills and still have money

How to pay your bills and still save moneyPut a cap on non-essentials.Consolidate, or at least snowball, your debt.Don't use your balance as permission to spend.Don't base your spending on other people.Follow a budget that works.Downgrade.

What are the disadvantages of consolidation

4 drawbacks of debt consolidationIt won't solve financial problems on its own. Consolidating debt does not guarantee that you won't go into debt again.There may be up-front costs. Some debt consolidation loans come with fees.You may pay a higher rate.Missing payments will set you back even further.

What are the 3 biggest strategies for paying down debt

Tips for paying off debtStick to a budget. Whatever strategy you choose for paying off debt, you'll need a budget.Start an emergency savings account. There's nothing like an unexpected car repair coming to ruin all your plans to get out of debt.Reduce monthly bills.Earn extra cash.Explore debt relief options.

Why would I get denied for a debt consolidation loan

As already discussed, there are three major reasons why people are denied debt consolidation loans. They don't make enough money to keep up with the payments; they have too much debt to get the loan, or their credit score was too low to qualify.

Does debt consolidation go against you

Do debt consolidation loans hurt your credit You might see a small dip in your credit score after you take out the loan because your lender will run a hard credit check. Luckily, this usually only lowers your credit score by five points or less, and after a year it won't affect your credit score at all.