How do I qualify for a card for Apple Pay?

How do I qualify for Apple Pay card

To be eligible to apply for Apple Card, you must be 18 years old or older, depending on where you live. You must be a U.S. citizen or a lawful resident with a valid, physical U.S. address that's not a P.O. Box. You can also use a military address. Your device must be compatible with Apple Pay.

Cached

Why isn t my card eligible for Apple Pay

Check that you're able to use Apple Pay: Contact your card issuer to see if they support Apple Pay. Update to the latest version of iOS , watchOS or macOS. Confirm that you have Face ID, Touch ID or a passcode set on your device.

What credit score do you need for Apple Pay

Apple Financing uses Experian and other credit bureaus to evaluate your Apple Pay Later application. If your credit score is low — for example, if your FICO9 score is less than 6206 or Lift Premium score is lower than 5807 — Apple Financing might not approve your application.

What is the minimum income for Apple Card

There is no minimum income limit you need to have.

Do I pre qualify for an Apple Card

The Apple Card's online preapproval tool can give you a solid idea of whether you'll qualify in just a couple of minutes. You won't have to go through a hard credit check, so there's no impact on your credit score. However, be aware a preapproval is not a guarantee of actual approval.

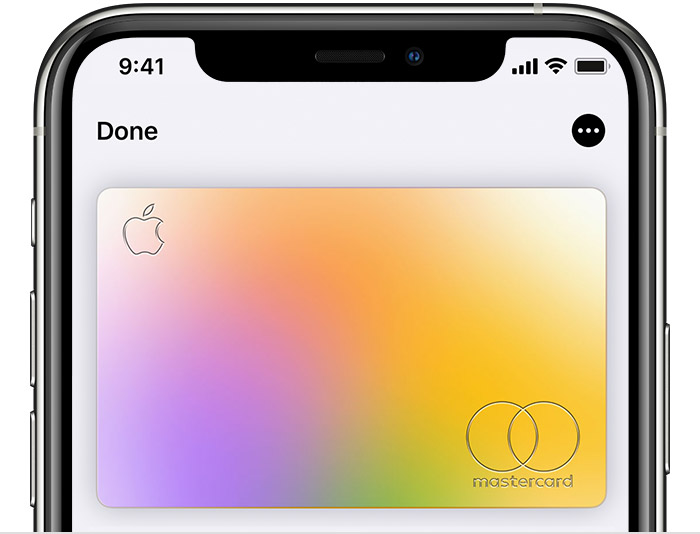

Does Apple Pay give you a card

Apple Card lives on your iPhone, in the Wallet app. You can sign up in as little as a minute and start using it right away with Apple Pay. Your transactions, payments, and account details are all in one place, where only you can see them.

Why is Apple Pay denied

If your payment has been declined using Apple Pay at the checkout in a store, it could be that there was a poor connection between your Apple device and the contactless terminal. To ensure a smooth payment, you should hold the top of your device on the terminal and wait for it to show that payment has been accepted.

How old do you have to be to add a debit card to Apple Pay

If you're less than 13 years old, you can't add a card to Wallet to use with Apple Cash. Apple Cash services are provided by Green Dot Bank, Member FDIC. Learn more about the Terms and Conditions.

Can I get an Apple Card with a 580 credit score

Apple Card uses FICO Score 9. FICO Score 9 ranges from 300 to 850, with scores above 660 considered favorable for credit approval.

Does getting denied for Apple Card hurt your credit

Your credit score won't be impacted if you're declined, or don't accept your offer. Your credit score might be impacted if your application is approved and you accept your offer. You can apply for Apple Card again, but you might receive the same decision.

Is Apple Card based on income

Learn about the key criteria used to determine whether your Apple Card application is approved or declined. Goldman Sachs1 uses your credit score, your credit report (including your current debt obligations), and the income you report on your application when reviewing your Apple Card application.

What is the total annual income

Annual income is the total amount of money you earn during one year. It includes your salary and other payment sources such as Social Security checks and welfare assistance. In some cases, your annual income might be for a calendar year, which is from January 1 to December 31 of the same year.

How long does Apple Card approval take

between 7-10 business days

It can take somewhere between 7-10 business days to get approved for the Apple Credit Card. In some cases, you could get immediately approved. If you do, you'll get an offer with your initial credit limit and APR after applying.

What credit score do you start with

zero

Some people wonder whether the starting credit score is zero, for example, or whether we all start with a credit score of 300 (the lowest possible FICO score). The truth is that there's no such thing as a “starting credit score.” We each build our own unique credit score based on the way we use credit.

Do I need my card if I have Apple Pay

To use Apple Pay, you need: A compatible device1 with the latest version of iOS or iPadOS, watchOS, or macOS. A supported card from a participating card issuer. An Apple ID signed in to your Apple device.

Do you need a bank card for Apple Pay

Apple Pay works with major credit and debit cards from banks around the world, with more added all the time. You can see all the banks that support Apple Pay here. If your card does not yet support Apple Pay, contact your bank for more information.

Can Apple Pay get rejected

If you see the message "This card cannot be used", check whether your bank or card issuer currently supports Apple Pay: Apple Pay-participating banks in Canada, Latin America and the United States. Apple Payparticipating banks in Africa, Europe and the Middle East.

Why is my card declining when I have money

Your card may be declined for a number of reasons: the card has expired; you're over your credit limit; the card issuer sees suspicious activity that could be a sign of fraud; or a hotel, rental car company, or other business placed a block (or hold) on your card for its estimated total of your bill.

Can my child add my credit card to Apple Pay

If you're less than 13 years old, you can't add a card to Wallet to use with Apple Cash. Apple Cash services are provided by Green Dot Bank, Member FDIC.

Can under 16 have Apple Pay

If you're under the age of 13, Apple Pay isn't available and you can't add a card in the Wallet app.