How do I record sales tax collected in Quickbooks?

How do you account for sales tax collected

To record received sales tax from customers, debit your Cash account, and credit your Sales Revenue and Sales Tax Payable accounts. When you remit the sales tax to the government, you can reverse your initial journal entry. To do this, debit your Sales Tax Payable account and credit your Cash account.

Cached

What is the journal entry for sales tax collected

What Is the Journal Entry for Sales Tax The journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or cash received, a credit to the sales account and a credit to the sales tax payable account for the amount of sales taxes billed.

Cached

What type of account is sales tax collected

So, sales tax payable is the account in your general ledger where you record all the sales tax you collect from customers. Since the sales tax payable account holds money that's owed, it's considered a liability account.

Cached

What account is collected sales tax held in QuickBooks

When you charge your customers sales tax, it posts to the Sales Tax Liability account (as a credit) in your chart of accounts. When you pay the collected tax to your state revenue department, you would post that payment to the same Sales Tax Liability account (as a debit) to reduce your liability.

Cached

How do I categorize sales tax collected in Quickbooks online

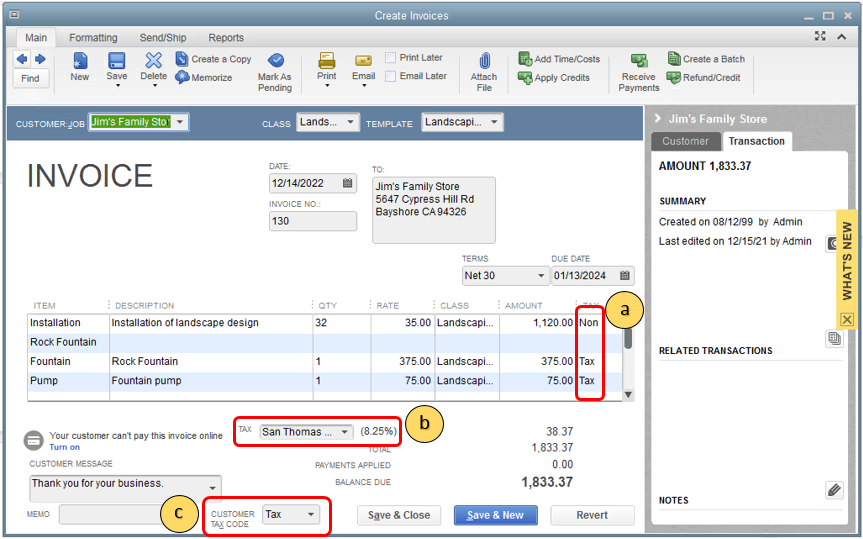

Assign a special sales tax category to a product or serviceGo to Get paid & pay or Sales, then select Products & services (Take me there).Look for the item you want to assign a tax category to, then select Edit.Select Edit sales tax.Look for the sales tax category you want to use.

Is sales tax capitalized or expensed

Other expenses associated with constructing a fixed asset can also be capitalized. These include materials, sales taxes, labor, transportation, and interest incurred to finance the construction of the asset.

Why is sales tax collected considered a liability

Why is sales tax collected considered a liability It is considered a liability because it is an amount that is collected until it is paid by the government, so the account would be a liability account with a normal credit balance.

Is sales tax a business expense

You can deduct sales tax on items you purchased as a deductible business expense. If you have any doubts about the validity of a tax-based deduction, speak with a tax professional.

How do I categorize sales tax in QuickBooks

Assign a special sales tax category to a product or serviceGo to Get paid & pay or Sales, then select Products & services (Take me there).Look for the item you want to assign a tax category to, then select Edit.Select Edit sales tax.Look for the sales tax category you want to use.

What is the difference between sales tax collected and sales tax payable in QuickBooks

Tax collected is equal to the total taxable sales multiplied by tax rate. This is the total amount you have collected from your sales transactions. Sales tax payable, on the other hand, is equal to the total tax collected minus the payment you've made within the date range selected for the report.

How do I categorize sales tax collected in QuickBooks online

Assign a special sales tax category to a product or serviceGo to Get paid & pay or Sales, then select Products & services (Take me there).Look for the item you want to assign a tax category to, then select Edit.Select Edit sales tax.Look for the sales tax category you want to use.

What is the difference between sales tax collected and sales tax payable

Sales tax collected means the same as sales tax payable because all sales tax collected is payable to your state's department of revenue. Businesses collect sales tax on sales through a specific period and file a sales tax return on or before the due date.

What expense category is sales tax

However, sales taxes could be classified as either a cost of goods sold (COGS) or an operating expense. If you sell products that are subject to sales tax, you would likely include the sales tax in the product's price and would therefore classify it as a COGS.

Is sales tax paid an expense in QuickBooks

Sales tax can be tracked as an expense in QuickBooks by creating an expense account and then selecting that account to track your tax payments. The expense account can be created within the Chart of Accounts.

Should sales tax be expense or liability

Sales tax and use tax are usually listed on the balance sheet as current liabilities. They are both paid directly to the government and depend on the amount of product or services sold because the tax is a percentage of total sales.

Should the sales tax collected by a retailer be recorded as an expense or liability

Answer and Explanation: Sales taxes collected by a retailer are recorded as credit to sales taxes payable under the current liabilities section on the balance sheet. This transaction remains on the balance sheet until the business is required to remit the funds to the government.

Is sales tax payable asset or liability

Sales taxes payable is a liability account in which is stored the aggregate amount of sales taxes that a business has collected from customers on behalf of a governing tax authority. The business is the custodian of these funds, and is liable for remitting them to the government on a timely basis.

Should sales tax collected be included in gross sales

The gross sales formula is calculated by totaling all sale invoices or related revenue transactions. However, gross sales do not include the operating expenses, tax expenses, or other charges—all of these are deducted to calculate net sales.

Should sales tax collected be included in gross receipts

The Census Bureau includes revenue from gross receipts taxes in its revenue totals for either general sales taxes or "other selective sales taxes." A gross receipts tax is also a tax on sales, but the tax is paid by the seller (not the consumer) and is levied on each business's total sales over a given time period …

Is sales tax considered a business expense

You can deduct sales tax on items you purchased as a deductible business expense. If you have any doubts about the validity of a tax-based deduction, speak with a tax professional.