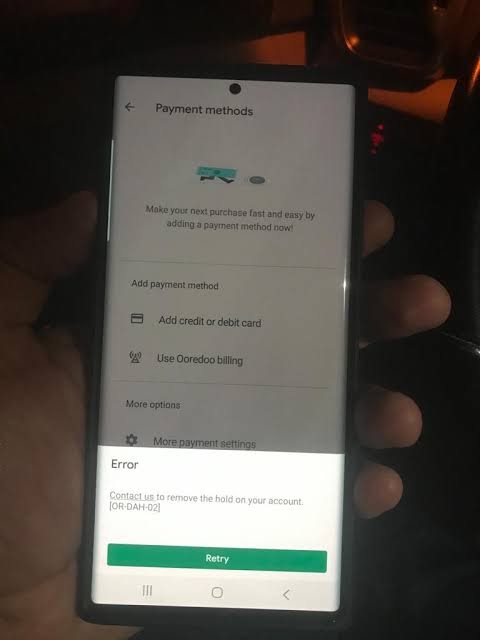

How do I remove my hold account?

What to do when your account is on hold

In many cases, you won't be able to do anything about a hold. However, your bank needs to follow federal regulations and justify any holds in your account, so they can't keep you from your money forever. If things go on for too long, contact the U.S. Consumer Financial Protection Bureau (CFPB) and file a complaint.

Cached

How long can your account be on hold

For instance, a bank may put a hold on an account if they detect unusual activity that may be due to suspected fraud or identity theft. An account hold may last only a day or two, but it could also be much longer in duration depending on the reason for the hold.

Cached

Why is my account on hold

The most common reason banks put a hold on funds in your account is to ensure that a check clears. Putting it simply, they want to make sure they receive the appropriate funds before these funds are made available to you.

Why does my bank account say hold

A hold means there's money in your account that isn't available yet. We might place a hold on money for a number of reasons that delay its availability. For example, you might have deposited a Western Union money order for something you sold online. That's essentially a check deposit, subject to standard hold times.

How long do banks put you on hold

Deposit holds typically range from 2-7 business days, depending on the reason for the hold.

How do I withdraw money from a frozen account

Frozen accounts do not permit any debit transactions. So when an account is frozen, account holders cannot make any withdrawals, purchases, or transfers. However, they may be able to continue to make deposits and transfer money into it. There is no set amount of time that an account may be frozen.

How long does it take for a bank hold to clear

How long it takes for a check to clear. Usually, it takes about two business days for a check to clear. That can vary from check to check, though. It's important to review your financial institution's deposit agreement, which will specify how long they typically hold checks for.

How long does it take for a bank to release a hold

As mentioned above, banks can only hold checks for a “reasonable period of time,” as defined by Regulation CC. In terms of how long it takes a check you deposit to clear, it generally ranges from two to five business days.

How long does it take for a bank to clear a hold

Usually, it takes about two business days for a check to clear. That can vary from check to check, though. It's important to review your financial institution's deposit agreement, which will specify how long they typically hold checks for.

Can I ask my bank to release a hold

You can ask your bank to remove a check hold, but that doesn't guarantee the bank will comply. If the bank has reason to believe that the check may be fraudulent or that the check writer lacks sufficient funds to cover it, the hold may remain in place for the full window that's allowed by law.

How long can a bank keep your money frozen

How Long Can a Bank Freeze an Account For There is no set timeline that banks have before they have to unfreeze an account. Generally, for simpler situations or misunderstandings the freeze can last for 7-10 days.

How do I unfreeze my bank account instantly

If your account is frozen due to suspicious activities, you can simply call up your bank and resolve it. If it is frozen due to any other reason that involves debts and bankruptcy, the best step to take is to go to the court and vacate the judgment at the earliest to unfreeze your account quickly.

Can you ask the bank to remove a hold

You can ask your bank to remove a check hold, but that doesn't guarantee the bank will comply. If the bank has reason to believe that the check may be fraudulent or that the check writer lacks sufficient funds to cover it, the hold may remain in place for the full window that's allowed by law.

What’s the longest a bank can hold your money

The Federal Reserve requires that a bank hold most checks before crediting the customer's account for no longer than a “reasonable period of time,” which is regarded as two business days for a same-bank check and up to six business days for one drawn on a different bank.

Can a bank hold be released early

Request Early Release: If there is a reason a check is unlikely to bounce, you can request an early release of your money. An example would be a payroll or reimbursement check from your employer.

Can I withdraw money from a frozen account

Frozen accounts do not permit any debit transactions. So when an account is frozen, account holders cannot make any withdrawals, purchases, or transfers. However, they may be able to continue to make deposits and transfer money into it. There is no set amount of time that an account may be frozen.

How do I get my money back from a frozen bank account

If your account is frozen because of activity you know is legitimate, go to the bank with proof. If you prove there's no reason for the freeze, the bank can grant you full access to the account again. But do so promptly, as you may have limited time to make a claim.

How long does it take for the bank to unfreeze your account

Generally, for simpler situations or misunderstandings the freeze can last for 7-10 days. For more complicated situations, the bank may request detailed information and take 30 days or more to review and decide whether to unfreeze or close the account entirely.

How do I get money from a frozen bank account

If your account is frozen because of activity you know is legitimate, go to the bank with proof. If you prove there's no reason for the freeze, the bank can grant you full access to the account again. But do so promptly, as you may have limited time to make a claim.

Can bank release hold funds

Federal regulations allow banks to hold deposited funds for a set period, meaning you can't tap into that money until after the hold is lifted. But the bank can't keep your money on hold indefinitely. Federal law outlines rules for funds availability and how long a bank can hold deposited funds.