How do I remove something from my credit report?

How do I get something deleted off my credit report

Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms.

Cached

How do I clear my credit history clean

How to clean up your credit reportRequest your credit reports.Review your credit reports.Dispute credit report errors.Pay off any debts.

How do I get a goodwill deletion

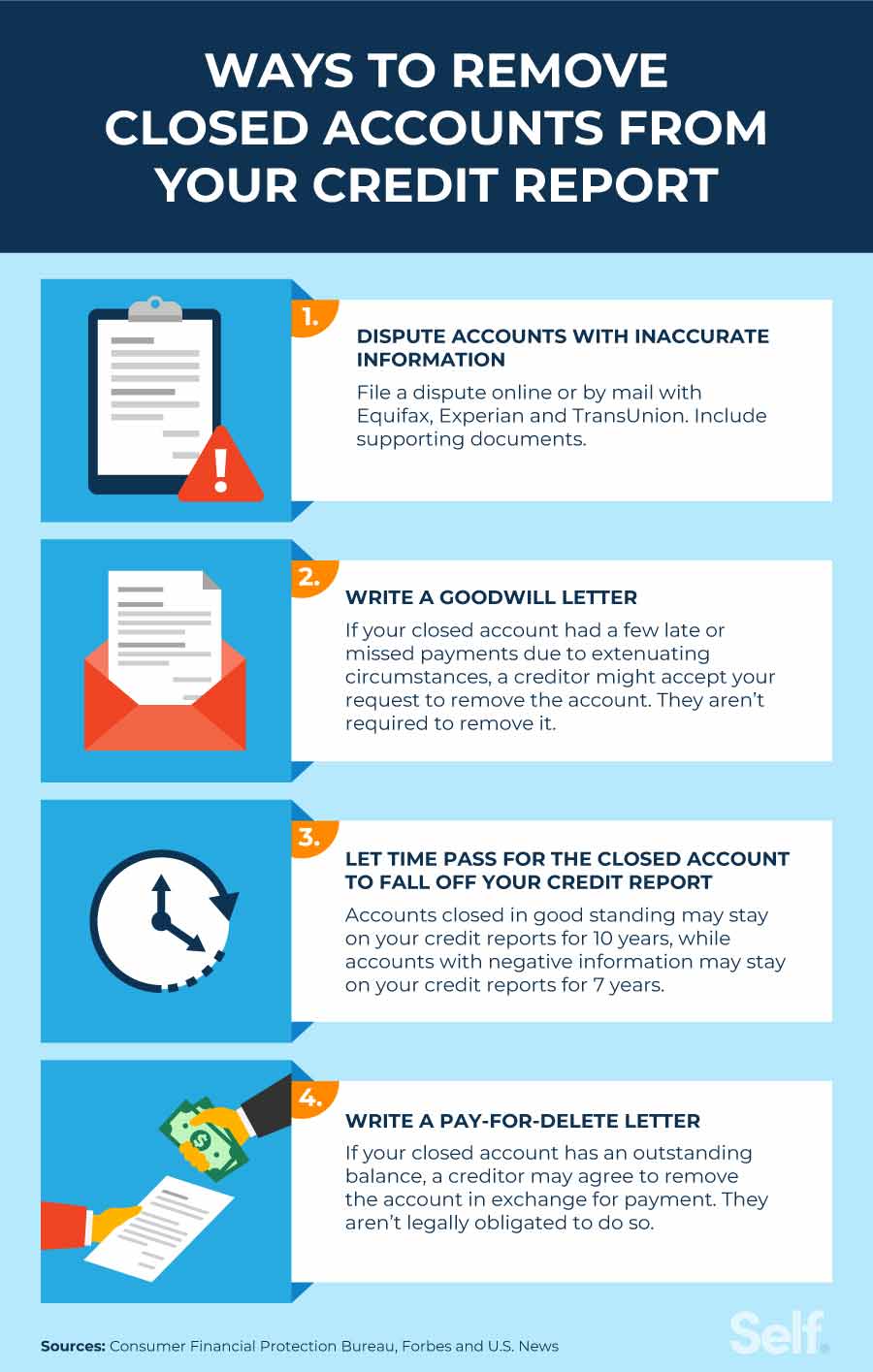

If your misstep happened because of unfortunate circumstances like a personal emergency or a technical error, try writing a goodwill letter to ask the creditor to consider removing it. The creditor or collection agency may ask the credit bureaus to remove the negative mark.

How do I get collections removed

Successfully disputing inaccurate information is the only surefire way to get collections removed from your credit report. If you've repaid a debt and the collection account remains on your credit report, you can request a goodwill deletion from your creditor, though there's no guarantee they'll grant your request.

Cached

How quickly can something be removed from credit report

A credit reporting company generally can report most negative information for seven years. Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can stay on your report for up to ten years.

Is it illegal to pay for delete

"As to the debt collector, you can ask them to pay for delete," says McClelland. "This is completely legal under the FCRA. If going this route, you will need to get that in writing, so you can enforce it after the fact."

Can you pay someone to wipe your credit clean

"As to the debt collector, you can ask them to pay for delete," says McClelland. "This is completely legal under the FCRA. If going this route, you will need to get that in writing, so you can enforce it after the fact."

What is the fastest way to clean up your credit

Paying bills on time and paying down balances on your credit cards are the most powerful steps you can take to raise your credit. Issuers report your payment behavior to the credit bureaus every 30 days, so positive steps can help your credit quickly.

Do goodwill letters to creditors work

One possible solution: You may be able to remove late payments on your credit reports and start to improve your credit with a “goodwill letter.” A goodwill letter won't always work, but some consumers have reported success. It's worth trying because these derogatory marks on your credit can last seven years.

Can you pay for a deletion

Pay for delete refers to the process of getting a debt collector to remove collection account removed from your credit report. It's a point you can use during a debt settlement negotiation, as you settle a debt for less than you owe. You agree to pay a certain amount of money in your settlement.

Will my credit score go up if a collection is removed

Will deleting collections improve credit score In most cases, deleting a collections account from your credit report can improve your credit score. In other cases, it may have little-to-no effect on your credit score.

Do collections go away without paying

A debt doesn't generally expire or disappear until its paid, but in many states, there may be a time limit on how long creditors or debt collectors can use legal action to collect a debt.

Should I remove closed accounts from credit report

Should you remove closed accounts from your credit report You should attempt to remove closed accounts that contain inaccurate information or negative items that are eligible for removal. Otherwise, there is generally no need to remove closed accounts from your credit report.

How can I get a collection removed without paying

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

Does a pay for delete hurt your credit

Does 'pay for delete' hurt your credit There's no guarantee that negotiating the deletion of a collection account from your credit report will improve your credit score. However, getting a collection account off your credit reports through a pay for delete agreement should not hurt your credit either.

How many points will credit go up if I pay off collections

With most of the current standard credit scoring models, paying a collection account off likely won't increase your credit score since the item will remain on your credit report. It will show up as “paid” instead of “unpaid,” which might positively influence a lender's opinion.

Is pay for delete worth it

Do 'pay for delete' letters actually work While you may not be successful in convincing a debt collection agency to comply with a pay for delete request, it can't hurt to try. However, it's important to wait for written confirmation that a collection agency has accepted your offer before you proceed with payment.

How much does it cost to have someone clean up your credit

Credit repair doesn't cost anything if you handle the process yourself. If you hire a credit repair company to assist you, you'll typically pay fees of $19 to $149 per month. The services a credit repair company provides are ones you can generally do for yourself.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How to get a 700 credit score in 30 days

Best Credit Cards for Bad Credit.Check Your Credit Reports and Credit Scores. The first step is to know what is being reported about you.Correct Mistakes in Your Credit Reports. Once you have your credit reports, read them carefully.Avoid Late Payments.Pay Down Debt.Add Positive Credit History.Keep Great Credit Habits.