How do I request a loan payoff?

How do I request a loan payoff amount

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

Cached

Should I request a payoff quote

If the loan is not paid off by the good through date, a new payoff quote must be requested because the payoff amount will likely change. This could either be because additional interest will build up and need to be added, other charges may apply, or the benefits of early repayment might change the total amount.

Cached

What happens when you request a payoff quote

A payoff quote shows the remaining balance on your mortgage loan, which includes your outstanding principal balance, accrued interest, late charges/fees and any other amounts. You'll need to request your free payoff quote as you think about paying off your mortgage.

CachedSimilar

How do I request a 10 day payoff

How to get your 10-day payoff letter. You'll need to request a 10-day payoff letter from your current loan servicer, which you may be able to do online. Not all lenders offer an online request option, however, so you may need to call or email your loan servicer directly to get this information.

Cached

How long does it take to get a payoff request

within seven business days

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

How do you negotiate payoff amount

How to negotiate a car payoff settlementKeep making your payments. Even if your car is totaled or has already been sold, you're still contractually responsible for making your loan payments as agreed.Find out what you owe.Look at the big picture.Talk to your lender.Get everything in writing.

Is a lender required to provide a payoff statement

You need an official payoff statement from the servicer to ensure you pay the correct amount. Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R.

What is a pay off request

A payoff request is a statement prepared by your lender which details the payoff amount for prepayment of your mortgage loan. The payoff statement will typically be the remaining balance on your mortgage loan, but it might also include any accrued interest or late charges/fees that could be owed.

Can you negotiate a payoff amount

If you want to pay off your car loan early or you're looking to pay less than the full balance, negotiating with your lender could be an option. Some lenders may even be willing to accept one lump sum payment for less than the full balance you owe.

How long does a lender have to provide a payoff

7 business days

h.). Federal Law. Under 15 U.S.C. § 1639g, “A creditor or servicer of a home loan shall send an accurate payoff balance within a reasonable time, but in no case more than 7 business days, after the receipt of a written request for such balance from or on behalf of the borrower.” The aggrieved borrower under 15 U.S.C.

Does using payoff hurt your credit

Paying off your only line of installment credit reduces your credit mix and may ultimately decrease your credit scores. Similarly, if you pay off a credit card debt and close the account entirely, your scores could drop.

Can I negotiate a loan payoff

Contrary to conventional wisdom, lenders are often willing to negotiate with customers who want to lower their interest rates, develop payment plans or pursue other arrangements to better manage their debt.

Why do you have to request a payoff amount

Your payoff amount is how much you will actually have to pay to satisfy the terms of your mortgage loan and completely pay off your debt. Your payoff amount is different from your current balance. Your current balance might not reflect how much you actually have to pay to completely satisfy the loan.

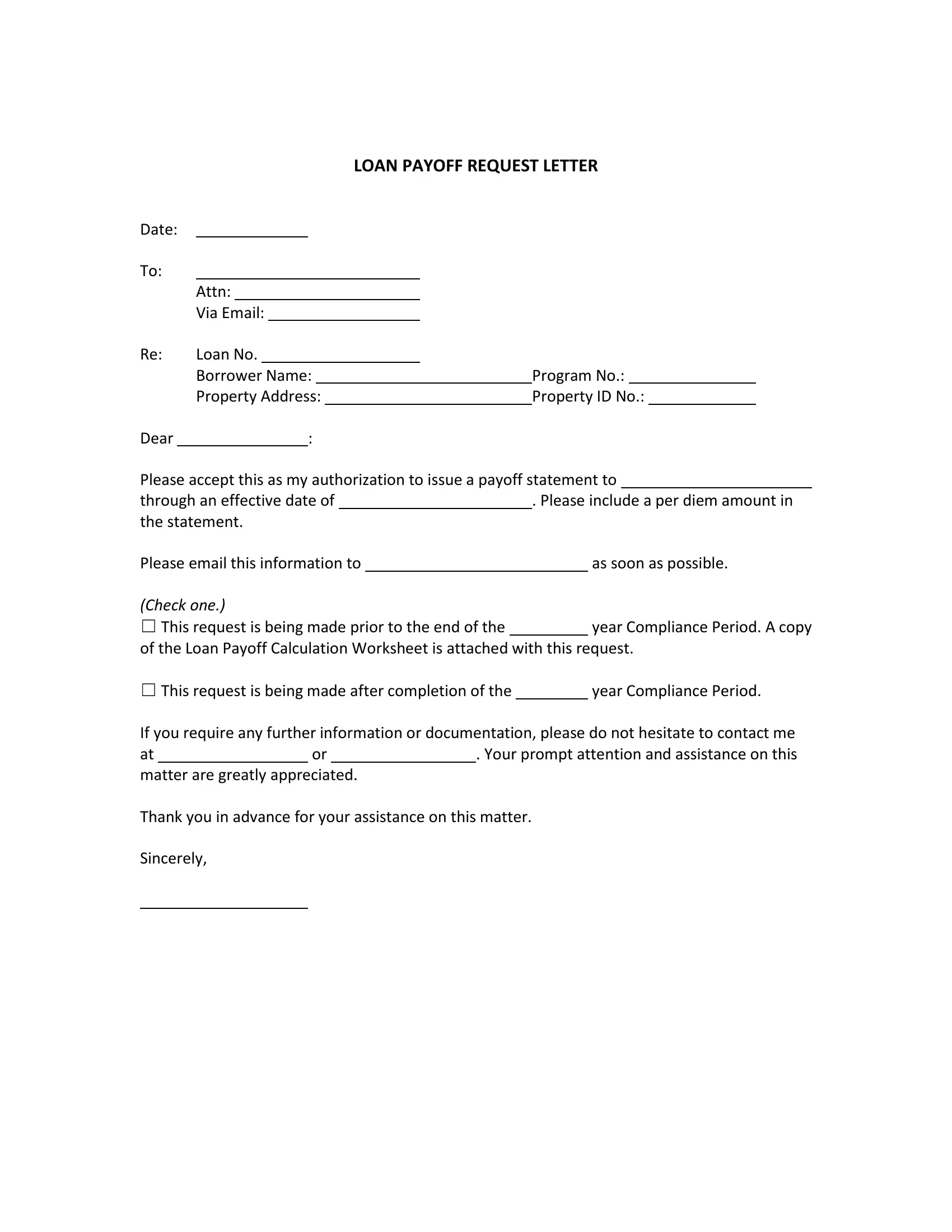

What is a payoff request form

You request a payoff statement from your lender when you want to know exactly how much it costs to pay off your house. You need this information before you sell your home, refinance the mortgage or you otherwise decide to get rid of the debt.

How long does it take to get a loan payoff letter

within seven business days

How long does it take to get a mortgage payoff statement Generally speaking, you should receive your mortgage payoff statement within seven business days of your request.

What is required in a payoff letter

The letter should include a clear statement of the payoff amount (i.e., the specific dollar amount representing all principal, interest, fees and other charges due and owing from the borrower to the existing lender) as of a specific payoff date.

Can I make an offer to pay off a debt

Full and final settlement means that you ask your creditors to let you pay a lump sum instead of the full balance you owe on the debt. In return for having a lump-sum payment, the creditor agrees to write off the rest of the debt.

Is a loan payoff more or less than balance

Is my payoff amount the same as my current balance Your payoff amount is how much you will actually have to pay to satisfy the terms of your mortgage loan and completely pay off your debt. Your payoff amount is different from your current balance.

Can lender refuse payoff

Whether you are reinstating or paying off a loan, you should make sure to pay the full amount that is due. Otherwise, the lender could reject your payment and move forward with the foreclosure sale anyway.

Is it bad to pay off a loan early

If you have personal loan debt and are in a financial position to pay it off early, doing so could save you money on interest and boost your credit score. That said, you should only pay off a loan early if you can do so without tilting your budget, and if your lender doesn't charge a prepayment penalty.