How do I send documents to TransUnion?

How do I upload documents to TransUnion dispute

Currently, we don't support document uploads for online public record disputes, or for updates to personal information like your Social Security number, date of birth, name or address. If you need to add or update personal information on your report, you will need to dispute by mail.

Cached

Can I send an email to TransUnion

Consumer Solutions Partnership Program

Learn more by emailing us today at [email protected] to connect with our dedicated sales team.

How do I send documents to the credit bureau

Send your letter by certified mail with “return receipt requested,” so you can document that the credit bureaus got it. Keep your original documents. Include copies of the documents that support your request and save copies for your files.

What documentation should I send in to validate my ID or address TransUnion

Any two of the following documents are acceptable proof of your current mailing address: Drivers license. State ID card. Bank or credit union statement.

Where do I send my mail to TransUnion

Where do I send my dispute to TransUnion You can send disputes by mail to TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA 19016-2000.

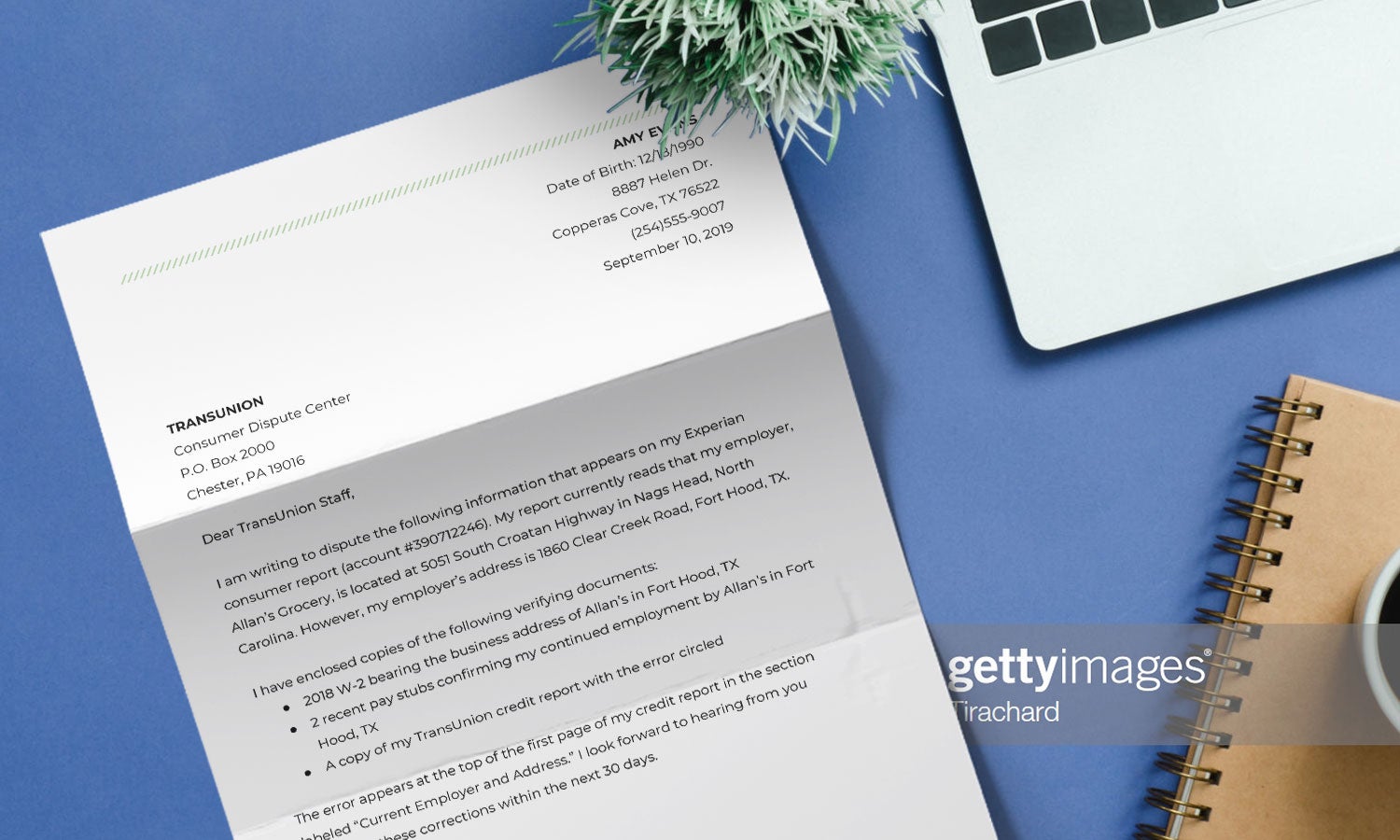

What documents do I need to send a dispute letter

Information to include in your dispute letterFull name.Date of birth.Current address.Driver's license number.Social Security number (optional).The account number of the tradeline you're disputing (e.g., account number found on your utility bill, student loan bill or mortgage statement).

Where do I send my TransUnion letter

If you need to contact the credit bureau by mail, TransUnion's mailing address is: TransUnion Consumer Solutions / P.O. Box 2000 / Chester, PA 19016. TransUnion customer service can help you set up a credit freeze, file a dispute, add a fraud alert, manage your account, and more.

Does sending letters to credit bureaus work

A credit dispute letter doesn't automatically fix this issue or repair your credit. And there are no guarantees the credit reporting agency will remove an item—especially if you don't have strong documentation that it's an error. But writing a credit dispute letter costs little more than a bit of time.

What is the mailing address for TransUnion credit bureau

The address for TransUnion is P.O. Box 1000, Chester, PA 19022. Under federal law, consumers are entitled to receive a copy of their credit report from all three agencies every 12 months, and can obtain a free copy by calling 877-322-8228.

How do I submit an address verification

There are several ways to provide location evidence, including a proof of residency letter (Affidavit of Residence). However, the most common way to help prove location is by giving documents that indicate the address, the dates of service and the person's name on the account.

Why is TransUnion unable to verify my identity online

If your identity cannot be verified, this indicates that TransUnion is unable to confirm that you are who you say you are. This can happen when you do not have any credit history, or when the information you provided about yourself does not match TransUnion's records.

Can you send a letter to the credit bureau

There are a few ways to dispute an issue on your credit report, including mailing a letter to the credit bureaus. Your credit dispute letter should detail the error (or errors) you found on your credit report. Your letter should also include copies of important documents to help the bureaus conduct an investigation.

Where do I send a dispute letter to TransUnion

How to dispute your TransUnion report by mail. You can send disputes by mail to TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA 19016-2000. TransUnion recommends including the following in your dispute letter: Your Social Security number and date of birth.

Where do I send letters to the credit bureau

Here are the mailing addresses for each credit bureau:Equifax. P.O. Box 7404256. Atlanta, GA 30374-0256.Experian. Dispute Department. P.O. Box 9701. Allen, TX 75013.TransUnion. Consumer Solutions. P.O. Box 2000. Chester, PA 19022-2000.

Where do I send a letter to the credit bureau

Here are the mailing addresses for each credit bureau:Equifax. P.O. Box 7404256. Atlanta, GA 30374-0256.Experian. Dispute Department. P.O. Box 9701. Allen, TX 75013.TransUnion. Consumer Solutions. P.O. Box 2000. Chester, PA 19022-2000.

What is the 609 loophole

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.

How do I write a letter to remove debt from my credit report

I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it. Because I am disputing this debt, you should not report it to the credit reporting agencies.

What documents can be used to verify address

Address VerificationAny bill or financial statement showing your name and residence address. Utility bill (electricity, gas, garbage, water, or sewer) Cable TV or internet bill. Telephone bill. Bank statement.Lease or rental agreement showing your name and residence address.Registration for a PO Box or private mailbox.

What is address verification process

How the Address Verification Service (AVS) Works. During the checkout process, a customer enters their address, which is then compared to the address on file with the issuing bank. Once the addresses are compared, the issuing bank returns an AVS code to the merchant.

How come my identity Cannot be verified

You may have recently moved. You may have answered security questions incorrectly. Your credit report may be locked or frozen. Your credit profile may contain erroneous information.