How do I stop payment on hold?

How do I remove a hold from my bank account

Removing a hold on a bank account

When figuring out how to remove a hold on a bank account, you can often contact your bank and find out what caused the hold. If it was a pre-authorization hold placed by a merchant on a debit card transaction, you might be able to contact them directly and have them remove it.

Can a bank release a hold early

You can ask your bank to provide an explanation for the hold or sometimes even to release the hold. In most cases, you won't be able to do anything about the hold though, and because all banks have them, you can't switch banks to avoid them either.

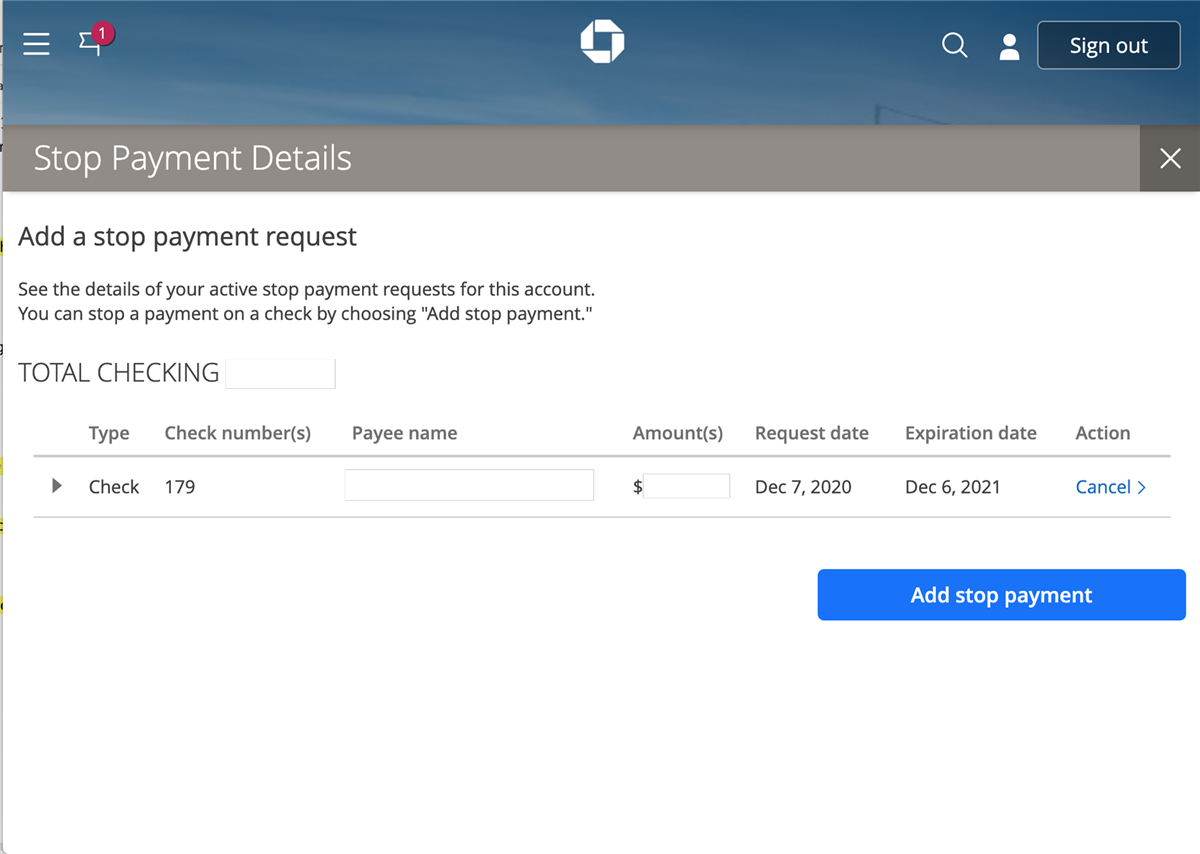

Can I tell my bank to block a transaction

First, notify the vendor. Next, tell your bank about your request at least three business days before the money is scheduled to be transferred. Your notice to the bank may be oral, but the institution may require you to provide a written follow-up within 14 days to ensure that no additional payments are made.

CachedSimilar

How long can a transaction be on hold

A pending transaction is a recent card transaction that has not yet been fully processed by the merchant. If the merchant doesn't take the funds from your account, in most cases it will drop back into the account after 7 days.

How long does it take for a hold to be removed from a debit card

Typically the hold stays on your account until the funds are transferred to the merchant from your financial institution, often 3-4 days. If you look at your account online it may show as a pending transaction.

How long does a bank put a hold on your account

Deposit holds typically range from 2-7 business days, depending on the reason for the hold. For deposits made on weekends, funds are considered deposited on Monday (the first business day), so the hold will go into effect the next business day (Tuesday).

Can you ask the bank to remove a hold

You can ask your bank to remove a check hold, but that doesn't guarantee the bank will comply. If the bank has reason to believe that the check may be fraudulent or that the check writer lacks sufficient funds to cover it, the hold may remain in place for the full window that's allowed by law.

Can funds on hold be reversed

Issuing an authorization reversal means the transaction is effectively canceled. After receiving this message, the bank will promptly remove the hold and release the funds so that the buyer may use them for something else.

Can you ask your bank to block a pending transaction

You can tell the card issuer by phone, email or letter. Your card issuer has no right to insist that you ask the company taking the payment first. They have to stop the payments if you ask them to. If you ask to stop a payment, the card issuer should investigate each case on its own merit.

Can a bank cancel a pending transaction

Unfortunately, it's not very easy to do—your card issuer has no ability to cancel or otherwise alter the transaction until it's been finalized. Skip contacting your card issuer and go straight to the merchant instead.

Can I cancel a transaction if its on hold

Once a transaction appears as pending on your account, you're unable to stop or cancel the transaction until it's complete. The merchant then sends us their transaction file for settlement, and we send the merchant your transaction payment.

Will a debit hold go away

Typically the hold stays on your account until the funds are transferred to the merchant from your financial institution, often 3-4 days. If you look at your account online it may show as a pending transaction.

Can I cancel a card hold

Your card issuer is not able to alter a transaction until it's finished, making cancelling a pending one a bit tricky. Your best bet is to contact the merchant who placed the charge, so they can contact your card issuer and request the transaction be reversed.

What happens when a bank puts a hold on your account

A hold is a temporary delay in making funds available. The bank makes it so that you cannot withdraw the money or use it for payments, even though those funds appear in your account.

Why do banks put you on hold

When a bank places an account on hold, it usually does so to protect itself from potential loss, but it also may have the interest of the customer in mind. For instance, a bank may put a hold on an account if they detect unusual activity that may be due to suspected fraud or identity theft.

How long can a bank put a hold on funds

Banks cannot place holds on checks indefinitely. Federal Reserve rules require banks to hold checks for a “reasonable period of time” which means two business days for checks issued by the same bank and no more than seven business days for checks that are drawn from a different bank.

Can I ask my bank to release pending funds

Some banks or credit unions may make funds available more quickly than the law requires, and some may expedite funds availability for a fee. If you need the money from a particular check, you can ask the teller when the funds will become available.

Will freezing my bank account stop pending transactions

No. Any pending transactions that have already received authorization will be processed and paid.

Can I call my bank to cancel a transaction

If you are unable to work with a merchant to cancel a pending charge, you may be able to contact your credit card issuer or bank once the amount posts and dispute the charge. Situations where it's best to contact your credit card or bank include: There's a transaction you don't recognize.

Why can’t pending transactions be cancelled

A pending transaction can only be cancelled if the merchant provides us with a pre-authorisation release confirming they have no intention to debit the restricted funds. As the merchant has authorisation over the funds, we cannot release the funds without their authority.