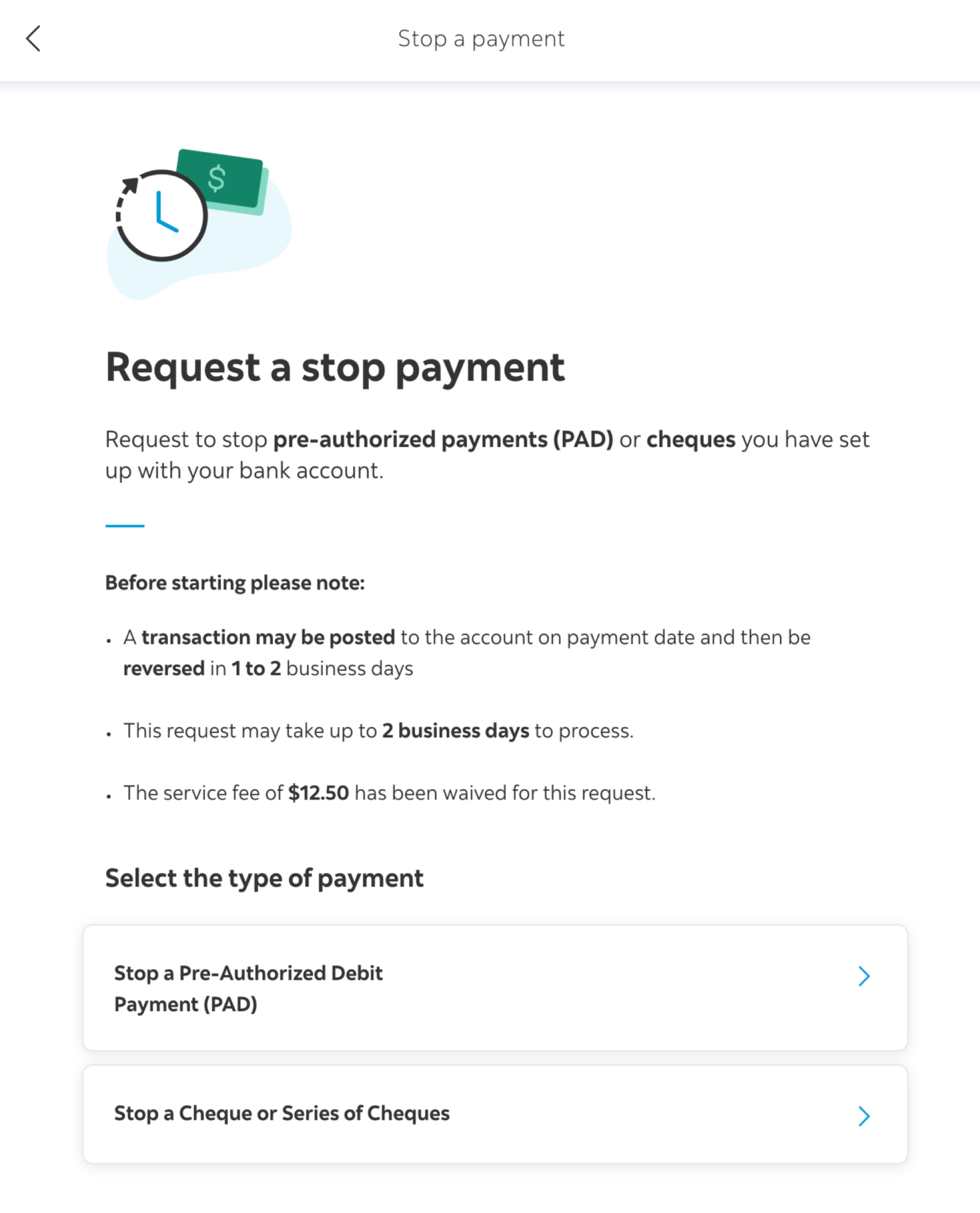

How do I stop pre authorized payments?

How do I stop automatic payments from my bank account

You can contact your bank and place a stop payment order on the recurring transaction. Generally, a stop payment order is only good for six months. To stop payment, you will need to notify your bank at least three business days before the next payment is scheduled to be made. Notice may be made orally or in writing.

Can you cancel a pre-authorized transaction

You will need to notify your bank at least three business days before the scheduled date of the transfer and inform it that you wish to stop payment. You can provide the notice orally, but the bank may require you to confirm the request in writing.

Cached

How do I block a company from charging my credit card

Start by putting in your request with the vendor. But if the vendor continues to charge your credit card, contact your card issuer. You'll have 60 days to dispute the charge, starting when the card issuer sends you the statement with the charges.

CachedSimilar

Can I block someone from taking money from my bank account

Call and write your bank or credit union. Tell your bank that you have “revoked authorization” for the company to take automatic payments from your account. Click here for a sample letter . Some banks and credit unions may offer you an online form.

CachedSimilar

Does freezing your card stop pending transactions

If I have a pending transaction when I freeze my card, will the transaction be paid Yes. Transactions which have already been authorised will clear. It is only from the point that the lock is put in place that a initiated transaction will be declined.

How do I stop an automatic payment on an app

Just see click on the apps. And then here at the manage subscription. Page you'll find the uh. There are two options the post payments. And also cancel subscription.

How long can a pre authorization take to cancel itself

With debit cards, authorization holds (also known as card authorization, pre-authorization, or pre-auth) can fall off the account anywhere from 1–10 days after the transaction date depending on your bank's policy.

How do I revoke a payment authorization

Call and write the company. Tell the company that you are taking away your permission for the company to take automatic payments out of your bank account. This is called “revoking authorization.” If you decide to call, be sure to send the letter after you call and keep a copy for your records.

Can I block a company from debiting my account

Give your bank a "stop payment order"

Even if you have not revoked your authorization with the company, you can stop an automatic payment from being charged to your account by giving your bank a "stop payment order" . This instructs your bank to stop allowing the company to take payments from your account.

Can I block a merchant from my card

Debit Card Control is a FREE service which allows you to take control of your debit card transactions. Turn your card on or off, block certain types of transactions, block certain merchants, and even set spending limits.

Can I block an automatic payment

You have a right to stop automatic payments from your account, even if you previously allowed them. To cancel these payments, you'll need to talk to your bank as well as the company or service provider that's receiving the payment.

How to stop a someone from stealing money from your bank account

Contact your bank or card provider to alert them. Reporting is an important first step to getting your money back, and you could be liable for all money lost before you report it. If you've been targeted, even if you don't fall victim, you can report it to Action Fraud.

How do I stop pending transactions

Canceling a pending transaction usually requires contacting the merchant who made the charge. Once a pending transaction has posted, contact your bank or card issuer to dispute it.

How long does a pre authorization take to cancel itself

With debit cards, authorization holds (also known as card authorization, pre-authorization, or pre-auth) can fall off the account anywhere from 1–10 days after the transaction date depending on your bank's policy.

Can I cancel a subscription through my credit card

The best way to stop recurring payments on a credit card (like utilities, subscription services, or rent) is to contact the service provider directly. You may be able to do that online, by phone, in person, or by mail, depending on the service.

How do you reverse a pre authorization

An authorization hold can be cancelled by the merchant if his acquirer supports a process known as authorization reversal. Upon receipt of a reversal request, the acquirer will send a reversal message to the cardholder's issuing bank.

How do you revoke an authorization

Call and write the company. Tell the company that you are taking away your permission for the company to take automatic payments out of your bank account. This is called “revoking authorization.” If you decide to call, be sure to send the letter after you call and keep a copy for your records.

Can I block a company from my credit card

Contact Card Issuer

If the vendor in question continues to take money from your account despite your request that it stop, you'll need to get in touch with your card issuer and ask that they block the company from charging your credit card.

Can you block a company from charging your debit card

Even if you have not revoked your authorization with the company, you can stop an automatic payment from being charged to your account by giving your bank a "stop payment order" . This instructs your bank to stop allowing the company to take payments from your account.

Can I tell my bank to block a transaction

To stop payment, you need to notify your bank at least three business days before the transaction is scheduled to be made and your bank may charge a fee. The notice to stop the transaction may be made orally or in writing. A bank can require written confirmation of an oral stop payment request.