How do I trace a child tax credit payment?

Is there a way to track advance child tax credit payments

2023 Tax Filing Information

Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account.

Cached

What is the IRS number to trace child tax credit

Use Where's My Refund, call us at 800-829-1954 and use the automated system, or speak with an agent by calling 800-829-1040 (see telephone assistance for hours of operation). However, if you filed a married filing jointly return, you can't initiate a trace using the automated systems.

What to do if I didn’t receive my child tax credit

If You Didn't Receive Advance Payments

You can claim the full amount of the 2023 Child Tax Credit if you're eligible — even if you don't normally file a tax return. To claim the full Child Tax Credit, file a 2023 tax return.

How can I see 6419 online

What if I can't find my Letter 6419Click the “Sign in to Your Online Account” button.Click “ID.me Create New Account” on the next page.Follow the on-screen instructions to provide information to set up the secure ID.me account.

What number do I call to talk to someone at the IRS

800-829-1040

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040 (see telephone assistance for hours of operation).

How long does it take the IRS to process a check payment

Tax payments check is delivered within 2-5 business days. IRS may take up to 3 weeks to process your check after it has been delivered. To check your tax payment status, you can either create an account at IRS's website or call IRS e-file Payment Services at 1-888-353-4537.

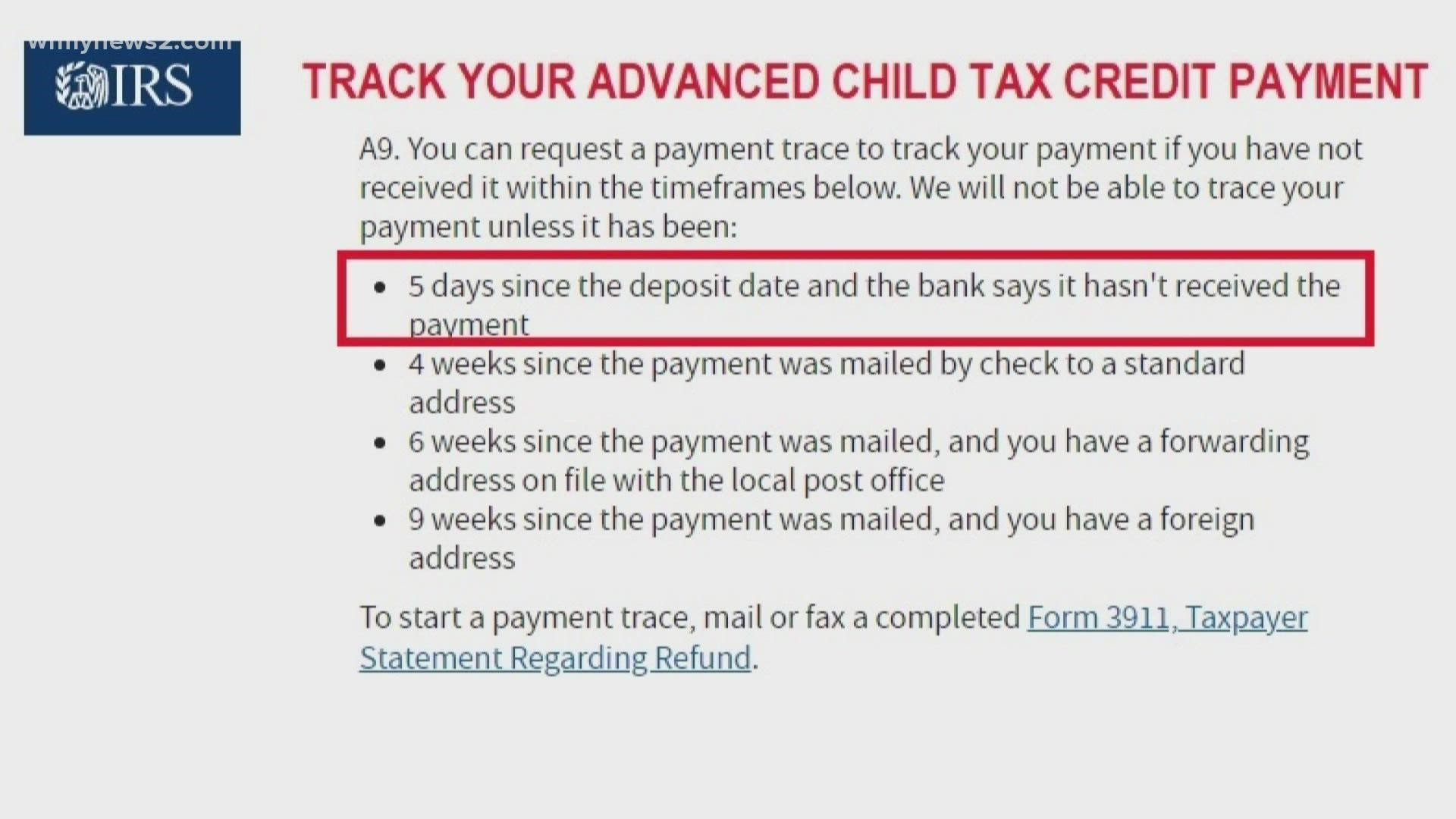

What is the payment trace form 3911

Form 3911 is completed by the taxpayer to provide the Service with information needed to trace the nonreceipt or loss of the already issued refund check.

Does each parent receive letter 6419

According to the IRS, letters sent to married couples only show half the amount of advance payments they received. Each spouse will receive a letter. You must add the amounts on both letters and enter the total when filing your joint return.

How do I talk to a real person at the IRS without waiting

How to speak directly to an IRS representativeCall the IRS at 1-800-829-1040 during their support hours.Select your language, pressing 1 for English or 2 for Spanish.Press 2 for questions about your personal income taxes.Press 1 for questions about a form already filed or a payment.Press 3 for all other questions.

What phone number is 800 829 0922

Visit www.irs.gov/paymentplan for more information on installment agreements and online payment agreements. You can also call us at 1- 800-829-0922 to discuss your options. For information on how to obtain your current account balance or payment history, go to www.irs.gov/balancedue.

How do I track a payment to the IRS

You can easily keep track of your payment by signing up for email notifications about your tax payment, each time you use IRS Direct Pay.Email notification will contain the confirmation number you receive at the end of a payment transaction.The IRS continues to remind taxpayers to watch out for email schemes.

How long does it take for a check to be mailed by IRS

As a result, you should receive a refund check in the mail in 3–4 weeks for your 2000 Form 1040 overpayment. If you don't receive your refund check within 4 weeks, please call us at 1-999-999-9999.

How long does it take the IRS to trace a payment

within six weeks

If your refund was direct deposited, the financial institution will get a letter within six weeks from the Bureau of the Fiscal Service in the Treasury Department, to verify where the deposit went. If the check hasn't been cashed, you'll get a replacement refund check in about six weeks.

How to do IRS refund trace

Use Where's My Refund, call us at 800-829-1954 (toll-free) and use the automated system, or speak with a representative by calling 800-829-1040 (see telephone assistance for hours of operation).If you filed a married filing jointly return, you can't initiate a trace using the automated systems.

Can I look up my IRS letter 6419

The IRS sent Letter 6419 out from December 2023 through January 2023, so you should have received yours by now. But don't worry if you weren't sent a letter, didn't receive it or threw it out. You can also use the IRS' CTC Update Portal or create and check your IRS account for a record of your advance CTC payments.

Will both spouses receive letter 6419

Each spouse will receive a letter. You must add the amounts on both letters and enter the total when filing your joint return.

What is the fastest way to talk to someone at IRS

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040 (see telephone assistance for hours of operation).

What is the best time to call the IRS

A good rule of thumb: Call as early in the morning as possible. Phones are open from 7 a.m. to 7 p.m. (your local time) Monday to Friday, except: Residents of Hawaii and Alaska should follow Pacific time. Puerto Rico hours are 8 a.m. to 8 p.m. local time.

How do I call the IRS and speak to a live person

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040 (see telephone assistance for hours of operation).

What phone number is 1 800-829-8374

Tax practitioners with account or tax law questions may call 800-829-8374.