How do I use my look back credit?

How does the look back credit work

The three-year lookback period is as follows: Taxpayers who file claims for credit or refund within three years from the date the original return was filed will have their credits or refunds limited to the amounts paid within the three-year period before the filing of the claim plus the period of any extension of time …

Cached

Who can use the lookback credit

The Earned Income Tax Credit (EITC) lookback rule lets taxpayers with lower earned incomes use either their 2023 or 2023 income to calculate the EITC – whichever one leads to a better refund for the taxpayer. This includes those that received unemployment benefits or took lower-paying jobs in 2023.

Cached

What is the lookback rule for tax returns in 2023

In plain language, the taxpayer is entitled to receive a refund for the amounts paid through withholding because the claim for refund was filed within three years of the original return and by the last possible date of the lookback period under Notice 2023-21 (i.e., July 15, 2023, plus three years).

What is the look back credit on Turbotax

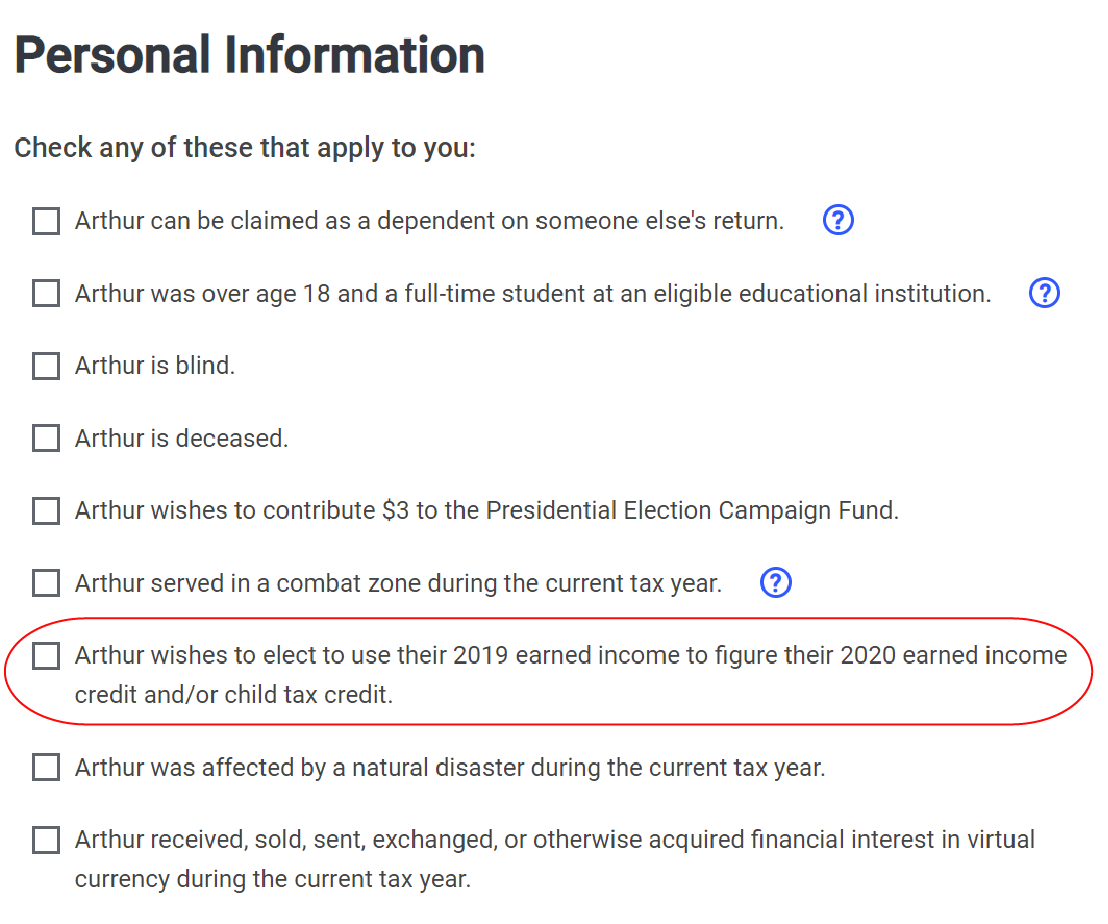

The American Rescue Plan of 2023 has a “lookback” provision that allows you to use your 2023 earned income instead of your 2023 earned income to calculate the Earned Income Credit (EIC) or Additional Child Tax Credit (ACTC) on your 2023 tax return if doing so makes the credit larger.

Can you use lookback rule twice

Myths and realities about the lookback rule

Myth: You can use the lookback provision to apply 2023 to your entire return. Reality: You can only use the lookback provision for your eligibility for the Earned Income Credit and the Additional Child Tax Credit.

What is the look-back rule for capital gains tax

When gains exist from the sale of Section 1231 assets, gains will result in ordinary income to the extent of 1231 losses claimed by the given taxpayer in the previous five years. Any remaining gains left over will result in capital gain treatment.

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

What is the IRS lookback option

The lookback period is the five-year period before the excess benefit transaction occurred. The lookback period is used to determine whether an organization is an applicable tax-exempt organization.

What is the look-back method for taxes

Filed on IRS Form 8697, “Interest Computation Under the Look-Back Method for Completed Long-Term Contracts,” the look-back is a hypothetical recalculation of a contractor's taxable income based on the actual performance of its completed jobs.

What is the look-back option for taxes

The lookback period is the five-year period before the excess benefit transaction occurred. The lookback period is used to determine whether an organization is an applicable tax-exempt organization.

What is a lookback adjustment

Filed on IRS Form 8697, “Interest Computation Under the Look-Back Method for Completed Long-Term Contracts,” the look-back is a hypothetical recalculation of a contractor's taxable income based on the actual performance of its completed jobs.

How long do I have to buy another house to avoid capital gains

within 180 days

How Long Do I Have to Buy Another House to Avoid Capital Gains You might be able to defer capital gains by buying another home. As long as you sell your first investment property and apply your profits to the purchase of a new investment property within 180 days, you can defer taxes.

How can seniors avoid capital gains

The IRS allows no specific tax exemptions for senior citizens, either when it comes to income or capital gains. The closest you can come is a back-end tax-advantaged retirement account like a Roth IRA which allows you to withdraw money without paying taxes.

How are people getting $10,000 back on taxes

Individuals who are eligible for the Earned Income Tax Credit (EITC) and the California Earned Income Tax Credit (CalEITC) may be able to receive a refund of more than $10,000. “If you are low-to-moderate income and worked, you may be eligible for the Federal and State of California Earned Income Tax Credits (EITC).

Can I borrow from my 2023 tax return

Refund Advance is a no-interest loan that is repaid with your tax refund. Apply between Jan. 3, 2023 and Feb. 28, 2023.

What are the benefits of lookback options

Also known as a hindsight option, a lookback option allows the holder the advantage of knowing history when determining when to exercise their option. This type of option reduces uncertainties associated with the timing of market entry and reduces the chances the option will expire worthless.

What is an example of a lookback option

Examples of Lookback Options

At a certain point in the options period, it reaches a high price of $120 and a low price of $80. For a fixed strike lookback option, the best price reached is $120 while the strike price is $100. Based on these, the holder's profit can be calculated as follows: $120 – $100 = $20.

How long is IRS lookback

How far back can the IRS go to audit my return Generally, the IRS can include returns filed within the last three years in an audit. If we identify a substantial error, we may add additional years. We usually don't go back more than the last six years.

What is the 1095 C look back method

Form 1095-C is the IRS form that documents an employee's access to health insurance at their place of employment. To complete Form 1095-C, an employer can use the look-back method in order to provide the required tracking of every employee's hours, for both variable-hour employees and full-time employees.

What is earned income lookback

taxpayers who earn less income in the disaster year than the prior year the option of using their prior-year. income to calculate their EITC benefits.3 This provision is referred to as the “EITC lookback rule.”