How do I verify if I received the 3rd stimulus check?

How much was the 3rd stimulus check

$1,400

Third round of stimulus checks: March 2023

The third payment provided eligible individual taxpayers for a check of up to $1,400, while couples filing jointly could receive a maximum of $2,800.

What if I don’t know if I got the 3rd stimulus

If you haven't received all of the money you are eligible for, you will need to claim the Recovery Rebate Credit on your 2023 tax return. The third stimulus checks were technically advance payments of that credit.

How much is the EIP3 amount

$1,400

$600 from EIP2. $1,400 for EIP3 (dependents of any age)

How to do a payment trace for third stimulus check

How to Request a Payment TraceCall the IRS at 800-919-9835; or.Mail or fax a completed Form 3911 to the IRS.

Did everyone get a third stimulus check

Some people may have gotten the impression that everyone is entitled to a third stimulus check. Unfortunately, that's just not the case. There are a few reasons why you could be left without a third stimulus check. It could be because of your income, age, immigration status, or some other disqualifying factor.

How much is the 1st 2nd and 3rd stimulus check

The U.S. government has sent out three rounds of stimulus checks — for up to $1,200, $600 and $1,400 — over the past year in response to the coronavirus pandemic.

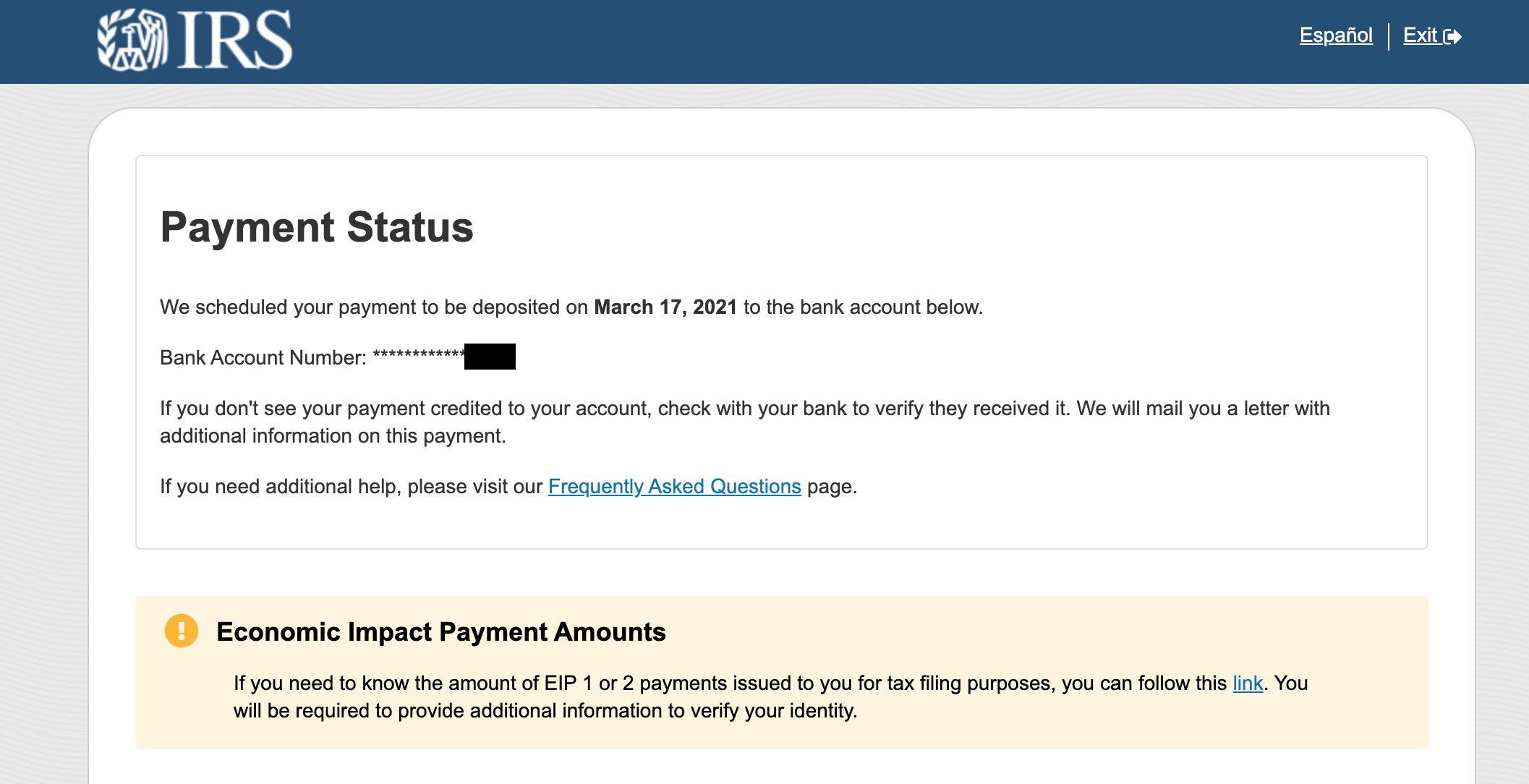

Can I look up if I received a stimulus check

Eligible individuals can visit IRS.gov and use the Get My Payment tool to find out the status of their Economic Impact Payment. This tool will show if a payment has been issued and whether the payment was direct deposited or sent by mail.

Do I have to claim my third stimulus

Or next year None of the three stimulus checks (or Recovery Rebate Credits) are considered income, and therefore aren't taxable. They won't reduce your refund or increase what you owe when you file your taxes this year, or next. They also won't affect your eligibility for any federal government assistance or benefits.

When was EIP3 paid out

Those who receive veterans benefits started to receive EIP3 on April 14th.

When were EIP 3 payments issued

The IRS began issuing these payments on March 12, 2023 and continued through the end of the year.

When was the EIP3 payment issued

Those who receive veterans benefits started to receive EIP3 on April 14th.

How do I find a lost stimulus check

How to Report a Missing Stimulus Check to the IRS. You may still have questions, especially if you haven't received a check, or you get the dreaded “payment status unavailable” notice. To report missing checks or ask other questions, call the IRS at 800-919-9835.

Who gets the third stimulus check for $1,400

The third round of stimulus payments is worth up to $1,400 per person. A married couple with two children, for example, can receive a maximum of $5,600. Families are allowed to receive up to $1,400 for each dependent of any age. Earlier rounds limited the payments to dependents under the age of 17.

Was the 3rd stimulus $1,400

Who was eligible for a third stimulus check. Under the terms, individuals could receive up to $1,400 through the third stimulus checks.

Who received 3rd stimulus check

For the third stimulus check, any household member that has an SSN qualifies for a payment. This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks.

When was the 3rd stimulus check sent out

| Americans started seeing the third round of stimulus payments in their bank accounts on March 12. As of May 26, the IRS says it has sent 167 million stimulus payments, worth about $391 billion.

How do I get a trace on my stimulus check

If you lost your refund check, you should initiate a refund trace: Use Where's My Refund, call us at 800-829-1954 and use the automated system, or speak with an agent by calling 800-829-1040 (see telephone assistance for hours of operation).

Do you have to claim the $1400 stimulus on your taxes

The IRS does not consider stimulus payments under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), the 2023 Coronavirus Response and Relief Supplemental Appropriations Act (CRRSAA, Section 314 of the Consolidated Appropriations Act, 2023), or the American Rescue Plan Act of 2023 (ARP) to be taxable …

How do I know if I get a stimulus check

Check if you qualify for the Golden State Stimulus IIFiled your 2023 taxes by October 15, 2023.Had a California Adjusted Gross Income (CA AGI) of $1 to $75,000 for the 2023 tax year.Had wages of $0 to $75,000 for the 2023 tax year.Been a California resident for more than half of the 2023 tax year.

Who received the 3rd stimulus check

For the third stimulus check, any household member that has an SSN qualifies for a payment. This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks.