How do I withdraw money from my TD line of credit?

Can I withdraw money from my credit line

Fees for a credit card cash advance

Unlike withdrawing money from a bank account, a cash advance pulls money from your line of credit through your credit card. In addition to repaying the money you withdraw, you'll need to pay additional fees and interest as well. The fees for a cash advance can be substantial.

How do I turn my credit line into cash

Do a cash advance: You can make an ATM withdrawal with your credit card to turn some of your available credit into cash. You just need to get a PIN from the card's issuer. You can withdraw up to the “cash advance limit” listed on your statement.

How do I get a cash advance on my TD Bank credit card

To get a TD Bank cash advance, use a TD Bank credit card and a corresponding PIN at a participating ATM and withdraw the cash, up to the card's available cash advance limit. If you do not have a PIN, contact TD Bank customer service at (888) 561-8861 to request one.

Cached

How do I withdraw money from my credit balance

How to use a credit card at an ATM to withdraw moneyInsert your credit card into an ATM.Enter your credit card PIN.Select the “cash withdrawal” or “cash advance” option.Select the “credit” option, if necessary (you may be asked to choose between checking, debit or credit)Enter the amount of cash you'd like to withdraw.

Cached

Can I transfer money from my line of credit to my bank account

You'll need a form of identification with your current address, and your banker will review your credit history. Borrow funds when you need them: You can transfer funds from your line of credit account to a checking account on your phone, online, in person at a branch, or with checks.

Can I transfer money from my line of credit to another bank account

You can use Interac e-Transfer® in online or mobile banking to send money from your line of credit to another bank account.

What does credit line available as cash mean

Your cash credit line available is the amount of money on your credit card that is currently available for you to use for bank cash advance transactions. Keep in mind that any bank cash advance transactions you have made but have not yet been processed should be subtracted from your cash credit line available.

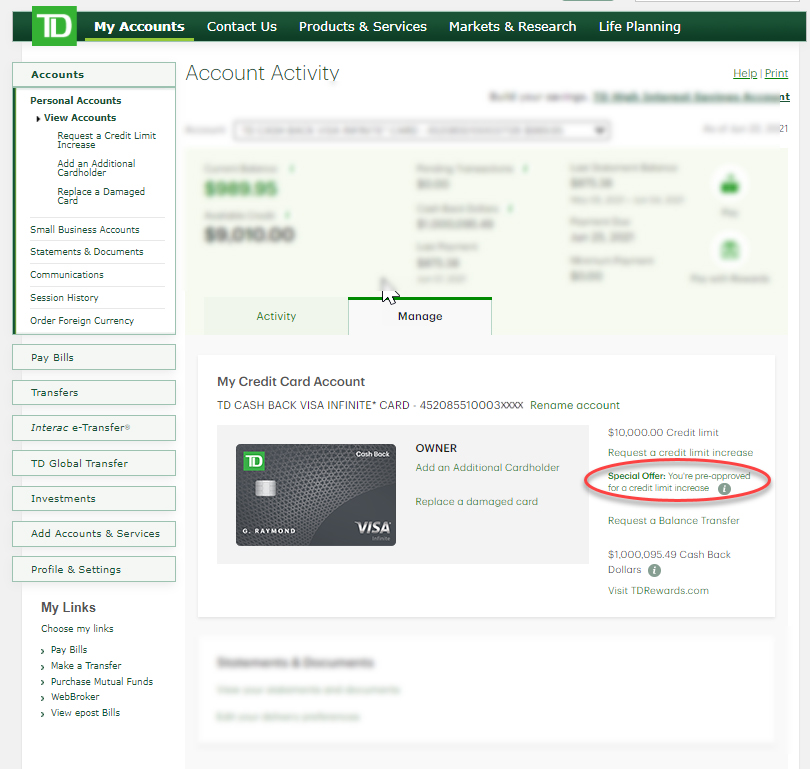

Can I withdraw cash from my TD credit card

A TD Credit Card can be used to make purchases, cash advances or, if you have other accounts with TD – it can be used to access those accounts with TD.

Can I transfer cash advance from my credit card to my bank account

Bring your credit card and a photo ID to the bank teller, and tell them the amount you would like to withdraw. There will be a fee associated with this transaction, usually between 3% and 5% of the amount being withdrawn.

How much cash can I withdraw from credit

What is the maximum cash advance limit you can withdraw from a credit card Cash advances are typically capped at a percentage of your card's credit limit. For example, if your credit limit is $15,000 and the card caps your cash advance limit at 30%, your maximum cash advance will be $4,500.

Does withdrawing money affect credit score

Withdrawing cash (also known as a cash advance) from a credit card can have a negative impact on your credit score. Lenders may look at this unfavourably as it can be an indication of poor money management especially if there are multiple cash advances in a short period of time.

Can I transfer money from line of credit to checking account TD

Please visit your local TD Bank store to transfer money between your line of credit and your checking account. Please call our Bank by Phone automated service or live Customer Service to transfer funds from your checking account to your home equity line of credit.

Can I access my line of credit with my debit card

A personal line of credit carries a lower interest rate than most credit cards, plus it can be accessed straight from your debit card.

Can you transfer line of credit to debit card

Yes, as long as you have available funds in your line of credit, you can transfer funds to any of your available accounts.

Can I spend my available credit

You can spend your available credit up to your credit maximum. However, staying below 30% of your total available credit line will be best for your credit score. Spending more than you can afford to repay can result in a debt spiral that quickly compounds with interest payments.

What does $300 credit line mean

A credit limit on a credit card is the maximum dollar amount a cardholder can access for purchases, balance transfers, cash advances, fees and interest charges combined.

What is the max withdrawal from TD Bank ATM

| Daily ATM Withdrawal Limits at Top Banks | |

|---|---|

| TD Bank | $1,250-$1,500 |

| Union Bank | $500 |

| U.S. Bank | Dependent on customer relationship |

| Wells Fargo Bank | Dependent on customer relationship |

How much does TD charge for cash advance

Margins: For Purchases and Balance Transfers, 11.74%, 16.74% or 21.74% will be added to the Index; for Cash Advances, 21.99% will be added to the Index.

How much cash advance can I get from my credit card

Cash advances are typically capped at a percentage of your card's credit limit. For example, if your credit limit is $15,000 and the card caps your cash advance limit at 30%, your maximum cash advance will be $4,500.

Can you transfer money from credit to debit TD

To complete a cash advance on the TD app:

Select the TD Credit Card you want to transfer money from. Select Transfer from the top menu. Select the Account you want the money transferred to under the To Account menu. Enter the amount you want to transfer in the Amount field.