How do I write a check to Citibank?

How do you write an official check

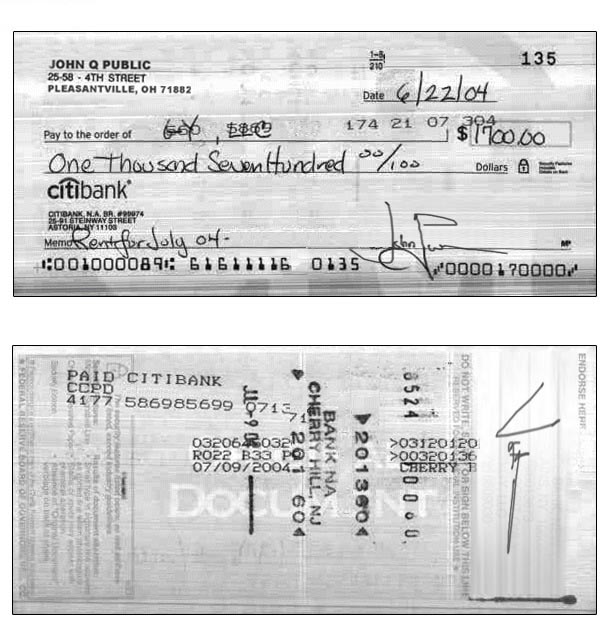

How to Write a CheckStep 1: Date the check. Write the date on the line at the top right-hand corner.Step 2: Who is this check forStep 3: Write the payment amount in numbers.Step 4: Write the payment amount in words.Step 5: Write a memo.Step 6: Sign the check.

Cached

How do you write a payee check

How to Write an Account Payee ChequeOn the left corner, draw two diagonal lines and write “Account Payee” in between the diagonal lines.Write the date, amount, name of the recipient and your signature.

How do you write a check with an account number

To make your check secure and provide instructions to your bank, write “For Deposit Only to Account Number XXXXXXXXX.” Then sign your name below that, staying within the endorsement area. For an added level of security, wait until right before you are ready to deposit the check to add your signature.

Cached

How do I deposit a check to my Citibank account

Next choose the account you're depositing to enter the amount. And then tap the camera icon to snap a photo of your signed. Check you can choose to align the check within the grid to capture the image

What is the difference between check and official check

It's more practical and safer to write a check, but the payee may want more protections than what's provided by a normal personal check. With a certified check, the recipient knows that the bank has verified the check, signature, and availability of funds. It's a source of guaranteed funds.

How does a check need to be written

Key Takeaways

You should write the payment amount in both words and numbers, and you should carefully fill out other fields such as the data line, signature, and memo line. Recording details in a check register can record more information than your bank statement will show, such as who you paid and why.

Where does the name of the payee go on a check

The payee's name goes on the first line in the center of the check. This is indicated by the phrase "Pay to the Order Of." The amount of the check in a dollar figure is filled out in the box next to the payee's name. The amount written out in words goes on the line underneath the payee's name.

What is the payee line of a check

Payee Line

In this section, you specify who will receive funds from your checking account. Write the name of the person or organization that you wish to pay, also known as the payee. Only the payee is allowed to deposit the check, cash it, or endorse it to someone else.

How do you write a payee check with account number

You need to draw two parallel crossed lines at the top left side of the instrument. You will then need to write 'A/C Payee Only'. You can also write “Account payee” on the cheque leaf. If you don't write “Account payee”, then it will be processed as a crossed cheque instead.

Do I need to write my account number on the back of a check

Bring identification or a bank card to the location where the check can be cashed. Write the account number on the check's back if you plan to deposit it directly into an account.

Does Citibank accept check deposit

Mobile Banking: What you get with Mobile Check Deposit

Mobile Check Deposit allows you to deposit your checks without a trip to the bank. Use the Citi Mobile banking app to deposit your next check with your mobile phone.

How do you deposit a check into your own account

2 There are several ways to make the deposit:By taking a picture of the check with your mobile device and your bank's app.By depositing the check at an ATM.By taking the check to your bank in person (or mailing it in)

How long does an official check take to clear

Usually, it takes about two business days for a check to clear. That can vary from check to check, though. It's important to review your financial institution's deposit agreement, which will specify how long they typically hold checks for.

What’s the difference between a certified check and a bank check

The main difference is that a cashier's check is written against the bank's account, while a certified check is written against the payer's personal account.

Do you have to write out numbers on a check

Do I have to write out the numbers on a check While it's not technically required that you fill out the numeral and written portions of the amounts on your check, the written amount serves as a verification for the bank and helps ensure that your deposit is accurate.

What not to do when writing a check

Don't:Do Not Write Blank Checks. Ensure you have filled in the amount and the name of the business or individual before you sign and write a check.Do Not Address Check to Cash. Do not print your check payee out to “CASH”.Do Not Forget to Verify Your Check.Do Not Lose Your Checks.

Do you write the bank name on a check

Your Bank's Contact Information

Your bank's name appears on every check you write. However, this section doesn't contain important info, such as the routing number. A phone number and address may be included, or you might just see the bank's logo.

What should be written on the for line of a check

Memo (or “For”) line: If you like, include a note. This step is optional and will not affect how banks process your check. The memo line is a good place to add a reminder about why you wrote the check.

How do you write a check to someone’s bank account

Write “Pay to the Order of” and the third party's name below your signature. It's important to write the name of the person that you are signing the check over to in the endorsement area under your signature. This signals to the bank that you are endorsing the transfer of ownership for the check.

Do you need to write bank account number on check

The account number listed on a check is used to identify the unique bank account that the money is coming from. Without the right account number, paychecks can get delayed or fees may be charged for missing bills due to checks not going through.