How do I write a late payment forgiveness letter?

How do I get late payments removed from my credit report

To get an incorrect late payment removed from your credit report, you need to file a dispute with the credit bureau that issued the report containing the error. Setting up automatic payments and regularly monitoring your credit can help you avoid late payments and spot any that were inaccurately reported.

Cached

Do goodwill letters work for late payments

A Goodwill letter might affect your credit score less if you missed a payment long ago. Instead, a Goodwill letter might be more effective in removing a payment you missed last month and impacting your credit score. Credit reporting companies also consider how many days your payment was late.

CachedSimilar

How do I write a credit forgiveness letter

I respectfully request that you forgive my alleged debt, as my condition precludes any employment, and my current and future income does not support any debt repayment. Please respond to my request in writing to the address below at your earliest convenience. Thank you in advance for your understanding of my situation.

How do you write a letter to explain late payments

To Whom It May Concern: I am writing this letter to explain my late payments on my (mortgage/credit card) to (mortgage/credit card company) in (insert month/year). I am very distressed that this has ever happened to me, but I was <laid off>, <seriously injured>, <going through a death in family> .

How much does removing late payments increase credit score

If you're able to remove late payments from your credit report through a credit reporting dispute or negotiation, you could improve your credit score by as much as about 20 to 130 points.

What is a 609 letter to remove late payments

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices.

How do I get a goodwill letter to remove late payments

I truly believe that it doesn't reflect my creditworthiness and commitment to repaying my debts. It would help me immensely if you could give me a second chance and make a goodwill adjustment to remove the late [payment/payments] on [date/dates]. Thank you for your consideration, and I hope you'll approve my request.

How successful are goodwill letters

Writing a goodwill letter doesn't guarantee a negative mark will be removed from your credit reports. But it's a simple exercise that doesn't take much time and doesn't have any major downsides. What's more — having a goodwill letter can raise your score by as much as 110 points.

How do I write a self forgiveness letter

“I need to forgive myself for….” “I am sorry I did….” Write out your emotional truth about the experience, allowing yourself to feel your regret and guilt. But avoid self-hatred, self-shaming, or self-condemnation statements.

What is an example of a loan forgiveness letter

Dear [RECIPIENT'S NAME], Our firm has contacted you in the past about your debt in the amount of $[AMOUNT] for [DESCRIPTION]. Due to extenuating circumstances combined with the amount of the debt you owe, we have taken it upon ourselves to completely relieve you of this debt. YOUR DEBT HAS BEEN FORGIVEN IN-FULL.

How do you politely apologize for late payments

Sample Sentences for Step 2We apologize for this late payment.We apologize for this late payment.I hope my late payment has not caused any inconvenience and apologize if it has.We apologize for this unfortunate set of circumstances.We apologize for these circumstances.We apologize for this inconvenience.

How do you respond to common late payment excuses

The response to such an excuse should focus on understanding the specific reason for disputing the invoice after it falls due. Dear client, Thank you for letting me know why my invoice has not been paid. Firstly, I would like to express my concern at your displeasure after the invoice has fallen due.

Can you have a 700 credit score with late payments

It may also characterize a longer credit history with a few mistakes along the way, such as occasional late or missed payments, or a tendency toward relatively high credit usage rates. Late payments (past due 30 days) appear in the credit reports of 33% of people with FICO® Scores of 700.

How long does it take to repair credit after late payments

How long it takes to raise your score

| Event | Average credit score recovery time |

|---|---|

| Missed/defaulted payment | 18 months |

| Late mortgage payment (30 to 90 days) | 9 months |

| Closing credit card account | 3 months |

| Maxed credit card account | 3 months |

What is a 623 dispute letter

A business uses a 623 credit dispute letter when all other attempts to remove dispute information have failed. It refers to Section 623 of the Fair Credit Reporting Act and contacts the data furnisher to prove that a debt belongs to the company.

Do 609 letters really work

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit report—it's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.

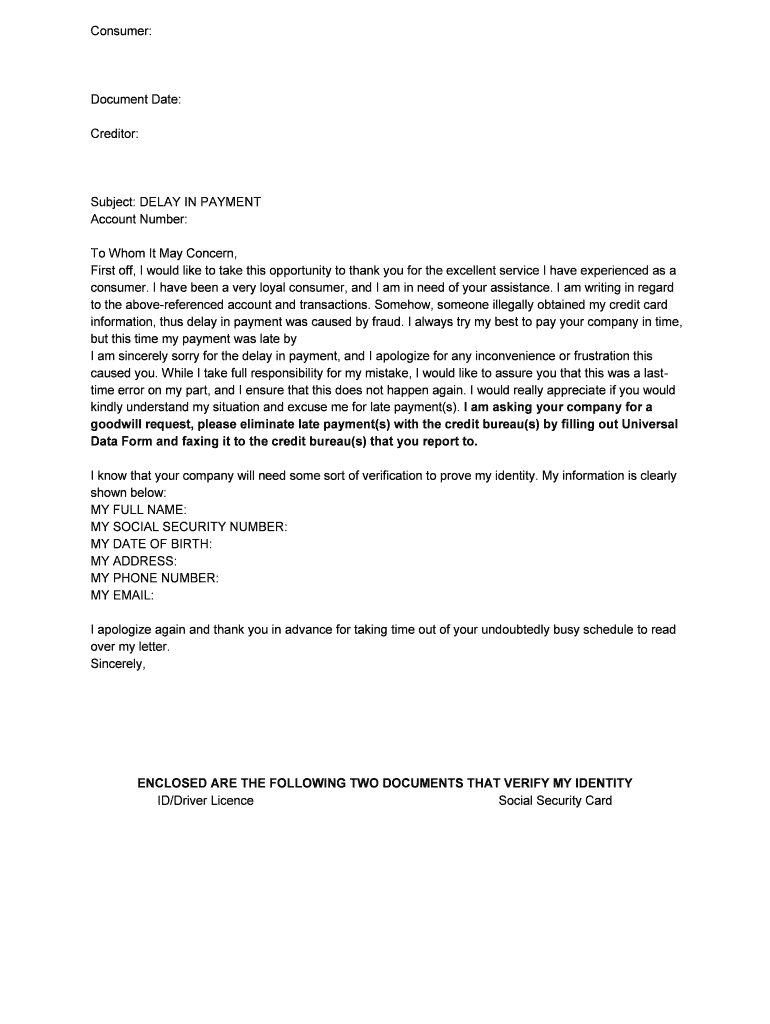

How to write and mail a goodwill letter asking for forgiveness

The following are important details to include in the goodwill letter:The date.Your name.Your address.Your creditor's name.Your creditor's address.Your account number.The negative mark you'd like removed.Which credit bureaus the mark needs to be removed from.

Who do you write a goodwill deletion letter to

In a goodwill letter, you are writing directly to the original creditor or collection agency and asking for forgiveness. You are not directly reaching out to any of the three credit bureaus – Equifax, Experian, or TransUnion – and it is not to be used for disputing errors.

How long does a creditor have to respond to a goodwill letter

A goodwill letter is an unofficial letter sent to a creditor. As such, there's no timeline requirement or even an obligation on the creditor to respond to the letter.

How do you write an effective goodwill letter

The following are important details to include in the goodwill letter:The date.Your name.Your address.Your creditor's name.Your creditor's address.Your account number.The negative mark you'd like removed.Which credit bureaus the mark needs to be removed from.