How do refundable credits work?

How do refundable tax credits work

Refundable tax credits are called “refundable” because if you qualify for a refundable credit and the amount of the credit is larger than the tax you owe, you will receive a refund for the difference. For example, if you owe $800 in taxes and qualify for a $1,000 refundable credit, you would receive a $200 refund.

Cached

What does refundable credits mean on tax transcript

Refundable Credit: Occurs when the amount of a credit is greater than the tax owed. Taxpayers not only can have their tax reduced to zero; they can also receive a "refund" of excess credit.

What is the difference between refundable and refundable credits

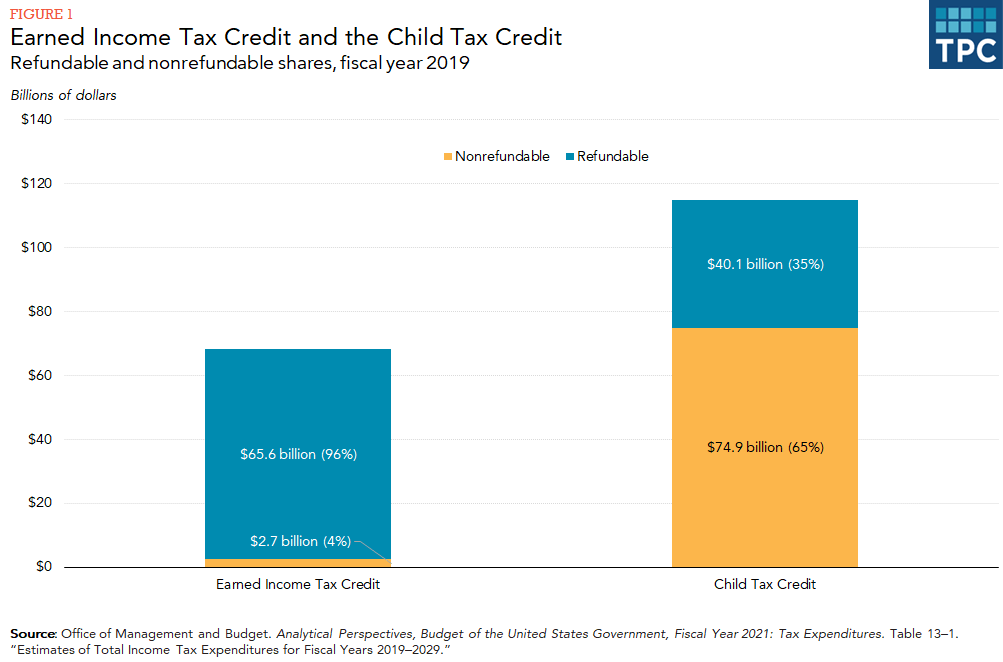

REFUNDABLE VERSUS NONREFUNDABLE TAX CREDITS

The maximum value of a nonrefundable tax credit is capped at a taxpayer's tax liability. In contrast, taxpayers receive the full value of their refundable tax credits. The amount of a refundable tax credit that exceeds tax liability is refunded to taxpayers.

Cached

What are examples of refundable credits

What Are Some Examples of a Refundable Tax Credit In U.S. federal policy, the two main refundable tax credits are the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC).

Cached

Do tax credits come out of your refund

Some tax credits are refundable. If a taxpayer's tax bill is less than the amount of a refundable credit, they can get the difference back in their refund. Some taxpayers who aren't required to file may still want to do so to claim refundable tax credits. Not all tax credits are refundable, however.

Do tax credits add to your refund

Credits and Deductions for Individuals

Credits can reduce the amount of tax you owe or increase your tax refund. Certain credits may give you a refund even if you don't owe any tax.

Why is a refundable tax credit more valuable

A refundable tax credit reduces the federal tax you owe and could result in a refund if it is more than you owe. Let's say you are eligible for the Child Tax Credit for $1,000 but only owe $200 in taxes. The additional amount ($800) is treated as a refund.

What is the difference between refundable and refundable child tax credits

What is the difference between a refundable and nonrefundable tax credit (A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero. A refundable tax credit allows taxpayers to lower their tax liability to zero and still receive a refund.)

Which is better refundable or nonrefundable

Nonrefundable Tax Credits. Both refundable and nonrefundable tax credits lower your tax bill dollar for dollar. Nonrefundable credits only apply to your tax liability, while refundable tax credits can wipe out your tax bill and provide a refund for the remaining credit.

Can you carry over refundable tax credits

What are the R&D credit carryforward rules for California While the federal government places a 20-year expiration date on unused R&D tax credits, the state of California allows employers to carry forward R&D tax credits until they are exhausted.

What is not an example of a refundable credit

A refundable tax credit results in a tax refund if the amount owed is below zero. Examples of nonrefundable credits in the U.S. tax code include the foreign tax credit (FTC) and the saver's credit.

How to get a $10,000 tax refund

CAEITCBe 18 or older or have a qualifying child.Have earned income of at least $1.00 and not more than $30,000.Have a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and any qualifying children.Living in California for more than half of the tax year.

What is the $5000 tax credit

Disabled Access Credit: This employer incentive helps small businesses cover the cost of making their businesses accessible to persons with disabilities. The maximum amount of the credit is $5,000.

What is the $2000 tax credit

The Child Tax Credit is worth a maximum of $2,000 per qualifying child. Up to $1,500 is refundable. To be eligible for the CTC, you must have earned more than $2,500.

Do refundable tax credits reduce taxable income

A tax credit is a dollar-for-dollar amount taxpayers claim on their tax return to reduce the income tax they owe. Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund.

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

Do you have to pay back the refundable Child Tax Credit

There is no remaining amount of Child Tax Credit that you can properly claim on your 2023 tax return; and. There is no amount of advance Child Tax Credit that you need to repay to the IRS.

How does the refundable Child Tax Credit work

What does it mean to me if my Child Tax Credit is fully refundable (added January 31, 2023) A11. It means that you do not need any income or need to owe any tax in 2023 to receive the full amount of the Child Tax Credit for which you are eligible.

Does non-refundable mean you can’t cancel

When an airline says that a ticket is nonrefundable, it doesn't mean that you can't cancel a ticket. Depending on the ticket type, often, 'nonrefundable' simply means: The airline will not give you all of your money back if you cancel (true for most basic economy tickets).

Are nonrefundable credits used before refundable credits

Taxpayers entitled to both types of credits should apply their nonrefundable credits first. Only then should they figure in refundable credits that could yield a refund.