How do you calculate interest charges?

What is 6% interest on a $30000 loan

For example, the interest on a $30,000, 36-month loan at 6% is $2,856.

What is an example of interest charge

The daily rate is your annual interest rate (the APR) divided by 365. For example, if your card has an APR of 16%, the daily rate would be 0.044%. If you had an outstanding balance of $500 on Day One, you would incur $0.22 in interest that day, for a total of $500.22 on Day Two.

What is 5% interest on a $20000 loan

For example, if you take out a five-year loan for $20,000 and the interest rate on the loan is 5 percent, the simple interest formula would be $20,000 x .05 x 5 = $5,000 in interest.

What is 7% interest on a 500000 loan

Your total interest on a $500,000 mortgage

On a 30-year mortgage with a 7.00% fixed interest rate, you'll pay $697,544 in interest over the loan's life.

What is interest formula examples

Interest, in its most simple form, is calculated as a percent of the principal. For example, if you borrowed $100 from a friend and agree to repay it with 5% interest, then the amount of interest you would pay would just be 5% of 100: $100(0.05) = $5.

What is the percentage interest charged

The interest rate is the amount a lender charges a borrower and is a percentage of the principal—the amount loaned. The interest rate on a loan is typically noted on an annual basis known as the annual percentage rate (APR).

How much is $5000 with 5% interest

If you have $5,000 in a savings account that pays five percent interest, you will earn $250 in interest each year. This works out to be $20.83 per month. The interest earned depends on the interest rate and the amount of money in the account.

What is 5% interest on $20000

For example, if you take out a five-year loan for $20,000 and the interest rate on the loan is 5 percent, the simple interest formula would be $20,000 x .05 x 5 = $5,000 in interest.

How much is 3% interest on $5000

Compound Interest FAQ

| Year 1 | $5,000 x 3% = $150 |

|---|---|

| Year 2 | $5,000 x 3% = $150 |

| Year 3 | $5,000 x 3% = $150 |

| Total | $5,000 + $450 = $5,450 |

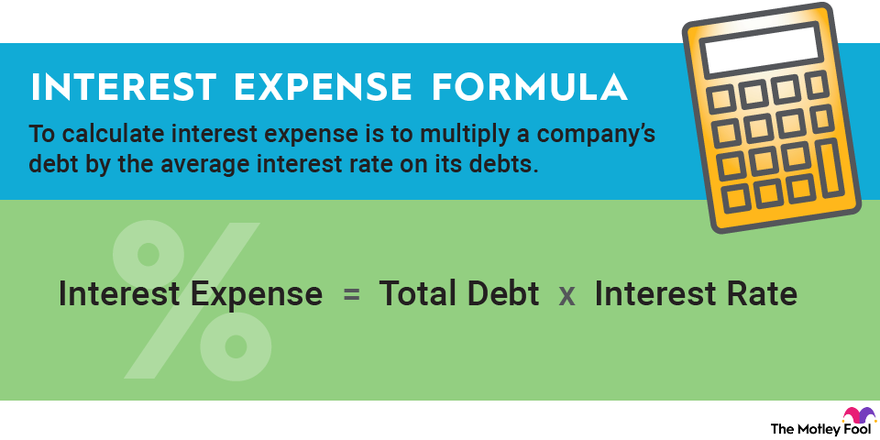

What is the easiest way to calculate interest

To calculate simple interest, multiply the principal amount by the interest rate and the time. The formula written out is "Simple Interest = Principal x Interest Rate x Time." This equation is the simplest way of calculating interest.

What are the three interest formulas

Interest FormulaSimple Interest = P × R × T.Compound Interest = P(1 + r/n)nt- P.CI = P(1 + r/n)nt- P.Example 1: What is the simple interest on the principal amount of $10,000 in 5 years, if the interest rate is 15% per annum

How do I calculate interest per month

It's easy. Simply divide your APY by 12 (for each month of the year) to find the percent interest your account earns per month. For example: A 12% APY would give you a 1% monthly interest rate (12 divided by 12 is 1).

What does 5% interest rate mean

Interest effects the overall price you pay after your loan is completely paid off. For example, if you borrow $100 with a 5% interest rate, you will pay $105 dollars back to the lender you borrowed from. The lender will make $5 in profit.

What is 5% interest on $100

For example, if there is $100 in the account, the monthly interest would be $0.42.

How much is 6% interest on $1000

Answer: $1,000 invested today at 6% interest would be worth $1,060 one year from now. Let us solve this step by step.

How do you manually calculate interest

Here's the simple interest formula: Interest = P x R x T. P = Principal amount (the beginning balance). R = Interest rate (usually per year, expressed as a decimal). T = Number of time periods (generally one-year time periods).

How do you calculate monthly interest payments

Divide your interest rate by the number of payments you'll make that year. If you have a 6 percent interest rate and you make monthly payments, you would divide 0.06 by 12 to get 0.005. Multiply that number by your remaining loan balance to find out how much you'll pay in interest that month.

What is the most basic method of calculating interest

Simple Interest Formula

To calculate simple interest, multiply the principal amount by the interest rate and the time. The formula written out is "Simple Interest = Principal x Interest Rate x Time." This equation is the simplest way of calculating interest.

What is the most common method of interest calculation

Traditionally, there are two common methods used for calculating interest: (i) the 365/365 method (or Stated Rate Method) which utilizes a 365-day year; and (ii) the 360/365 method (or Bank Method) which utilizes a 360-day year and charges interest for the actual number of days the loan is outstanding.

How do you calculate interest on 50000

The formula for calculating simple interest is:(P x r x t) ÷ 100.(P x r x t) ÷ (100 x 12)FV = P x (1 + (r x t))Example 1: If you invest Rs.50,000 in a fixed deposit account for a period of 1 year at an interest rate of 8%, then the simple interest earned will be: