How do you calculate interest on a credit card cash advance?

How is cash advance interest charged

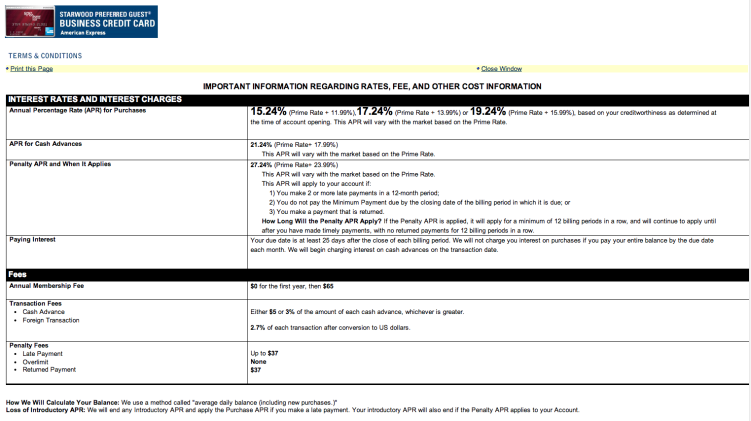

The most common structure is 5% of the advance amount or $10, whichever is more. But some card issuers may charge less or more than that. In addition to the cash advance fee, card issuers also typically charge a higher APR compared to the rate charged on regular purchases.

Is interest charged immediately on cash advances

The amount of money you transfer or withdraw as a cash advance will appear on your credit card statement and interest will begin accruing right away. Cash advances typically come with a higher APR than regular purchases and you may also incur a cash advance fee.

How do I avoid interest on a cash advance

Pay off your cash advance as fast as you can

Since your advance begins accruing interest the same day you get your cash, start repaying the amount you borrow as soon as possible. If you take out a $200 cash advance, aim to pay that amount in full—or as much as possible—on top of your minimum payment.

Cached

How to calculate credit card interest formula

For example, if you currently owe $500 on your credit card throughout the month and your current APR is 17.99%, you can calculate your monthly interest rate by dividing the 17.99% by 12, which is approximately 1.49%. Then multiply $500 x 0.0149 for an amount of $7.45 each month.

Cached

Why do I keep getting charged cash advance interest

Cash advance interest charges accrue when you transfer or withdraw money from your credit card. The interest rate on cash advances is the same as your normal purchase rate.

Do cash advances hurt your credit score

Cash advances can impact credit scores like any other loan. While they don't inherently hurt your credit score, they can lead to future credit issues. For example, using too much of your available credit or paying your cash advance back late can ding your credit score.

Does a cash advance hurt your credit

A cash advance won't directly impact your credit scores, but it will use more of your available credit. This affects your credit utilization ratio. And depending on how much you borrow, that could lower your credit scores.

What is a reason you should not use a credit card cash advance

Interest Rates Are Higher for Cash Advances

Cash advances are a credit card convenience service a lot of people are willing to pay more for. Using cash advances can potentially reflect desperation or and greater financial risk for the credit card company.

Why is it generally not a good idea to put a cash advance on your credit card

Overusing cash advances can make it harder to receive credit limit increases, reasonable interest rates and could even cause creditors to close accounts without notice. If you must take out a cash advance, withdraw only as much as you need and make every effort to pay it back quickly.

How do I calculate my interest rate

How do you calculate interest per year The equation for calculating interest rates is as follows: Interest = P x R x N. Where P equals the principal amount (the beginning balance), and R stands for the interest rate (usually per year, expressed as a decimal).

How to calculate credit card interest minimum payment

Percentage + interest + fees

Suppose your balance (before interest and fees) is $10,000 and you've accrued $160 in interest and $38 in late fees. If your issuer calculates your minimum as 1% of the balance plus interest and fees, you'd have a minimum payment of $298.

Why cash advances are bad

As noted earlier, a cash advance usually has a high-interest rate. If this affects your ability to pay the monthly charges promptly, that also could affect your credit score. And if the cash advance puts you over the card's credit limit, your credit score can be dinged.

What is bad about cash advances

Cash advances can impact credit scores like any other loan. While they don't inherently hurt your credit score, they can lead to future credit issues. For example, using too much of your available credit or paying your cash advance back late can ding your credit score.

What is the downside of cash advance

Higher interest rate: Many cards charge a higher APR for cash advances than for regular purchases. No grace period: Your credit card usually gives you a grace period of at least 20 days to pay off your purchase before you're charged interest. Cash advances, though, start to accrue interest from day one.

Why is it a bad idea to get a cash advance on your credit card

The biggest downside to getting a cash advance is that you'll likely end up paying more in interest and fees than you would if you instead used your credit card (or another payment method) to make the purchase.

What is the biggest problem with using your credit card for a cash advance

Credit card companies often charge higher rates for cash advances than for purchases for two reasons: Cash advances are a credit card convenience service a lot of people are willing to pay more for. Using cash advances can potentially reflect desperation or and greater financial risk for the credit card company.

Do cash advances hurt credit score

A cash advance won't directly impact your credit scores, but it will use more of your available credit. This affects your credit utilization ratio. And depending on how much you borrow, that could lower your credit scores.

What are some negatives of taking a cash advance using your credit card

Credit card cash advances: the consHigh APR.Additional fees.It could affect your credit score.No safety net if your money is stolen.Carry a balance on your card.Reallocate funds.Consider a personal loan.

What is 6% interest on a $30000 loan

For example, the interest on a $30,000, 36-month loan at 6% is $2,856.

How do you calculate interest per month

It's easy. Simply divide your APY by 12 (for each month of the year) to find the percent interest your account earns per month. For example: A 12% APY would give you a 1% monthly interest rate (12 divided by 12 is 1).