How do you get around a bank garnishment?

What type of bank account Cannot be garnished

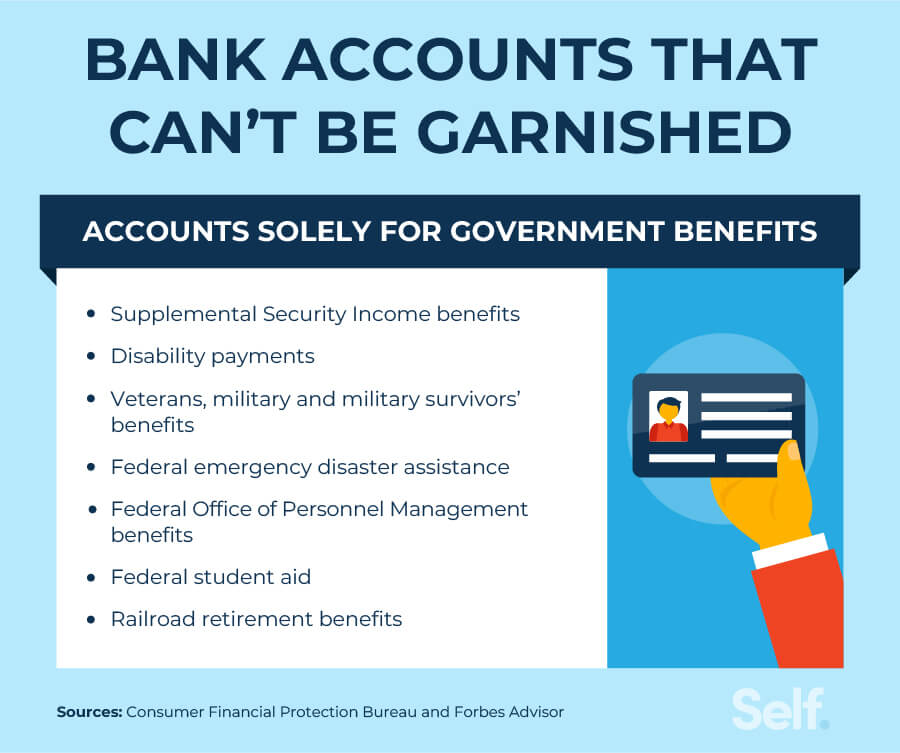

Bank accounts solely for government benefits

Federal law ensures that creditors cannot touch certain federal benefits, such as Social Security funds and veterans' benefits. If you're receiving these benefits, they would not be subject to garnishment.

Cached

Is there a way around garnishment

You can stop a garnishment by: Paying off the debt in full. Filing an objection to the garnishment with the court if you have legal basis, such debt was a result of fraud or identity theft. Filing for court protection and debt resolution through Chapter 13 or Chapter 7 bankruptcy.

Can a creditor take all the money in your bank account

If a debt collector has a court judgment, then it may be able to garnish your bank account or wages. Certain debts owed to the government may also result in garnishment, even without a judgment.

Cached

What states prohibit bank garnishments

What States Prohibit Bank Garnishment Bank garnishment is legal in all 50 states. However, four states prohibit wage garnishment for consumer debts. According to Debt.org, those states are Texas, South Carolina, Pennsylvania, and North Carolina.

Cached

How do I protect my bank account from garnishment

Pay your debts if you can afford it. Make a plan to reduce your debt.If you cannot afford to pay your debt, see if you can set up a payment plan with your creditor.Challenge the garnishment.Do no put money into an account at a bank or credit union.See if you can settle your debt.Consider bankruptcy.

What is the 11 word phrase to stop debt collectors

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase “please cease and desist all calls and contact with me immediately” to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

What is the most they can garnish from your paycheck

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.

Can you negotiate after wage garnishment

Another way to stop a wage garnishment is by negotiating with your creditor. Many creditors are reluctant to settle debts once they have a garnishment. However, an attorney can help you negotiate the best settlement by offering a lump sum amount or payment terms.

How do I stop creditors from garnishing my bank account

Pay your debts if you can afford it. Make a plan to reduce your debt.If you cannot afford to pay your debt, see if you can set up a payment plan with your creditor.Challenge the garnishment.Do no put money into an account at a bank or credit union.See if you can settle your debt.Consider bankruptcy.

How do I protect my bank account from a Judgement

A judgment debtor can best protect a bank account by using a bank in a state that prohibits bank account garnishment. In that case, the debtor's money cannot be tied up by a garnishment writ while the debtor litigates exemptions.

What happens if you owe the bank money and don’t pay

Money you owe to your bank is a non-priority debt, which means that you might not lose your home for not paying the debts, but you can still be taken to court and ordered to pay what you owe – often with extra costs on top.

How long can a Judgement freeze your bank account

There is no set time limit. Some judgment creditors try to seize funds right away, and others never actually take funds at all.

How to stop creditors from taking money from your bank account

How to stop automatic electronic debitsCall and write the company. Tell the company that you are taking away your permission for the company to take automatic payments out of your bank or credit union account.Call and write your bank or credit union.Stop payment.Monitor your accounts.

What is the 777 rule with debt collectors

One of the most rigorous rules in their favor is the 7-in-7 rule. This rule states that a creditor must not contact the person who owes them money more than seven times within a 7-day period. Also, they must not contact the individual within seven days after engaging in a phone conversation about a particular debt.

What is a drop dead letter

You have the right to send what's referred to as a “drop dead letter. '' It's a cease-and-desist motion that will prevent the collector from contacting you again about the debt. Be aware that you still owe the money, and you can be sued for the debt.

Can I quit my job to avoid wage garnishment

There are several options for stopping a wage garnishment. One, you can quit your job. Your creditor won't get your money, but neither will you. Two, you can pay the debt in full.

Does wage garnishment affect credit

If wage garnishment is a financial burden

A garnishment judgment will stay on your credit reports for up to seven years, affecting your credit score.

How do I write a letter to stop wage garnishment

Your letter should include a heading with your name and contact information, as well as the name and contact information of your creditor. The body of your letter should be divided into paragraphs and should clearly state your request to stop the wage garnishment.

How long does it take for a creditor to freeze your bank account

There is no set time limit. Some judgment creditors try to seize funds right away, and others never actually take funds at all. Most judgment creditors will wait at least a few weeks before attempting to levy your bank account.

How long does a levy stay on your bank account

What Are My Options To Avoid A Bank Levy During the time after a creditor puts a levy on your bank account, funds in your account up to the amount of the judgment are frozen, and the bank will hold the money for 15 days.