How do you get around a garnishment?

Can I negotiate my garnishment

Another way to stop a wage garnishment is by negotiating with your creditor. Many creditors are reluctant to settle debts once they have a garnishment. However, an attorney can help you negotiate the best settlement by offering a lump sum amount or payment terms.

What is the most they can garnish from your paycheck

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.

Cached

How do I protect my money from garnishment

Pay your debts if you can afford it. Make a plan to reduce your debt.If you cannot afford to pay your debt, see if you can set up a payment plan with your creditor.Challenge the garnishment.Do no put money into an account at a bank or credit union.See if you can settle your debt.Consider bankruptcy.

Cached

What states have 100 wage garnishment protection

With few exceptions, all wages are fully protected from garnishment in North Carolina, Pennsylvania, South Carolina, and Texas. Judgment creditors may seek to evade these protections by serving the wage garnishment order on the consumer's employer's office in another state.

How do I write a letter to stop wage garnishment

Your letter should include a heading with your name and contact information, as well as the name and contact information of your creditor. The body of your letter should be divided into paragraphs and should clearly state your request to stop the wage garnishment.

How do you negotiate wage garnishment with a creditor

6 Options If Your Wages Are Being GarnishedTry To Work Something Out With The Creditor.File a Claim of Exemption.Challenge the Garnishment.Consolidate or Refinance Your Debt.Work with a Credit Counselor to Get on a Payment Plan.File Bankruptcy.

Can I quit my job to avoid wage garnishment

There are several options for stopping a wage garnishment. One, you can quit your job. Your creditor won't get your money, but neither will you. Two, you can pay the debt in full.

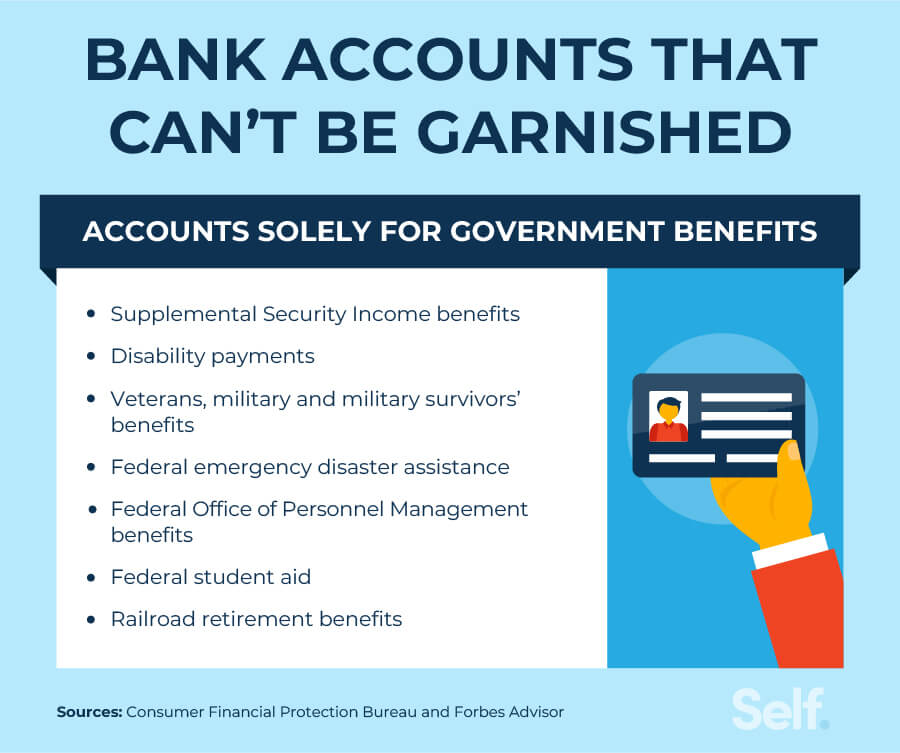

What type of bank account Cannot be garnished

Bank accounts solely for government benefits

Federal law ensures that creditors cannot touch certain federal benefits, such as Social Security funds and veterans' benefits. If you're receiving these benefits, they would not be subject to garnishment.

Can a creditor take all the money in your bank account

If a debt collector has a court judgment, then it may be able to garnish your bank account or wages. Certain debts owed to the government may also result in garnishment, even without a judgment.

What states are debtor-friendly

Kansas, Florida, Iowa, and Texas provide an unlimited dollar value homestead exemption. Florida and Texas, in fact, are well known as debtor-friendly states because of their homestead exemptions.

What is a letter of garnishment for wages

The letter will say that a court or government agency is requiring you to withhold part of an employee's salary or wages until the debt is paid off.

How do I stop a wage garnishment in Illinois

For the most part, there are only two ways to stop wage garnishments in Illinois. First, you can pay off the judgment. You may be able to pay the judgment in a lump sum, or you may have to wait for the garnishment to run its course. The second way to stop a garnishment is by filing bankruptcy.

Does wage garnishment affect credit score

If wage garnishment is a financial burden

A garnishment judgment will stay on your credit reports for up to seven years, affecting your credit score.

Can HR tell your boss about a wage garnishment

Yes. While different types of garnishments have different procedures and different rules, typically, your employer will be notified directly of your wage garnishment. This is because they have to comply with the process, allowing that portion of your wages to be deducted.

What is the 11 word phrase to stop debt collectors

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase “please cease and desist all calls and contact with me immediately” to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

How do I protect my bank account from a Judgement

A judgment debtor can best protect a bank account by using a bank in a state that prohibits bank account garnishment. In that case, the debtor's money cannot be tied up by a garnishment writ while the debtor litigates exemptions.

What type of bank accounts Cannot be garnished

Bank accounts solely for government benefits

Federal law ensures that creditors cannot touch certain federal benefits, such as Social Security funds and veterans' benefits. If you're receiving these benefits, they would not be subject to garnishment.

Which state is not in debt

By contrast, Alaska and Wyoming had the lowest levels of state government debt at just under $5 billion each. This can be attributed to their relatively diverse sources of income such as energy revenues, mineral royalties and taxes.

What states completely prohibit creditor garnishments of bank accounts

Bank garnishment is legal in all 50 states. However, four states prohibit wage garnishment for consumer debts. According to Debt.org, those states are Texas, South Carolina, Pennsylvania, and North Carolina.

How do I write a hardship letter for wage garnishment

Explain why the income withholding is a hardship. Document any income and all expenses. If there is a valid reason, such as your employee's spouse becoming unemployed that caused him to fall behind on payments, and that reason still applies, write it in the letter.