How do you get money added back to your Social Security check from Medicare?

How do you qualify to get $144 back on your Medicare

To qualify for the giveback, you must:Be enrolled in Medicare Parts A and B.Pay your own premiums (if a state or local program is covering your premiums, you're not eligible).Live in a service area of a plan that offers a Part B giveback.

Cached

What zip codes get money back from Medicare

All ZIP Codes in the United States and its territories are eligible for the Give Back Benefit because they are all eligible for Medicare Advantage plans.

Cached

Do they take money out of your Social Security check for Medicare

premium deducted automatically from their Social Security benefit payment (or Railroad Retirement Board benefit payment). If you don't get benefits from Social Security (or the Railroad Retirement Board), you'll get a premium bill from Medicare.

Cached

How do I get $144 added back to my Social Security

To qualify for a Medicare giveback benefit, you must be enrolled in Medicare Part A and B. You must be responsible for paying the Part B Premiums; you should not rely on state government or other local assistance for your Part B premiums.

How do I get my Part B premium back

If you're looking to reenroll in Medicare Part B, follow these steps:Go to the Social Security Administration website.Complete the application.Mail all required documents to the Social Security office. Include all required official or certified documents to allow for a seamless process.

Who is eligible for Medicare Part B reimbursement

How do I know if I am eligible for Part B reimbursement You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

Who qualifies for money back on Social Security

If you are at least age 65, you may be eligible for cash benefits on your own record. If you are full retirement age or older, you can work and receive your monthly Social Security benefits, no matter how much you earn.

How do I get the $16728 Social Security bonus

To acquire the full amount, you need to maximize your working life and begin collecting your check until age 70. Another way to maximize your check is by asking for a raise every two or three years. Moving companies throughout your career is another way to prove your worth, and generate more money.

How much will they take out of my Social Security check for Medicare in 2023

Most people pay the standard Part B monthly premium amount ($164.90 in 2023). Social Security will tell you the exact amount you'll pay for Part B in 2023. You pay the standard premium amount if you: Enroll in Part B for the first time in 2023.

How do you get extra money added to your Social Security check

Additional work will increase your retirement benefits. Each year you work will replace a zero or low earnings year in your Social Security benefit calculation, which could help to increase your benefit amount. Social Security bases your retirement benefits on your lifetime earnings.

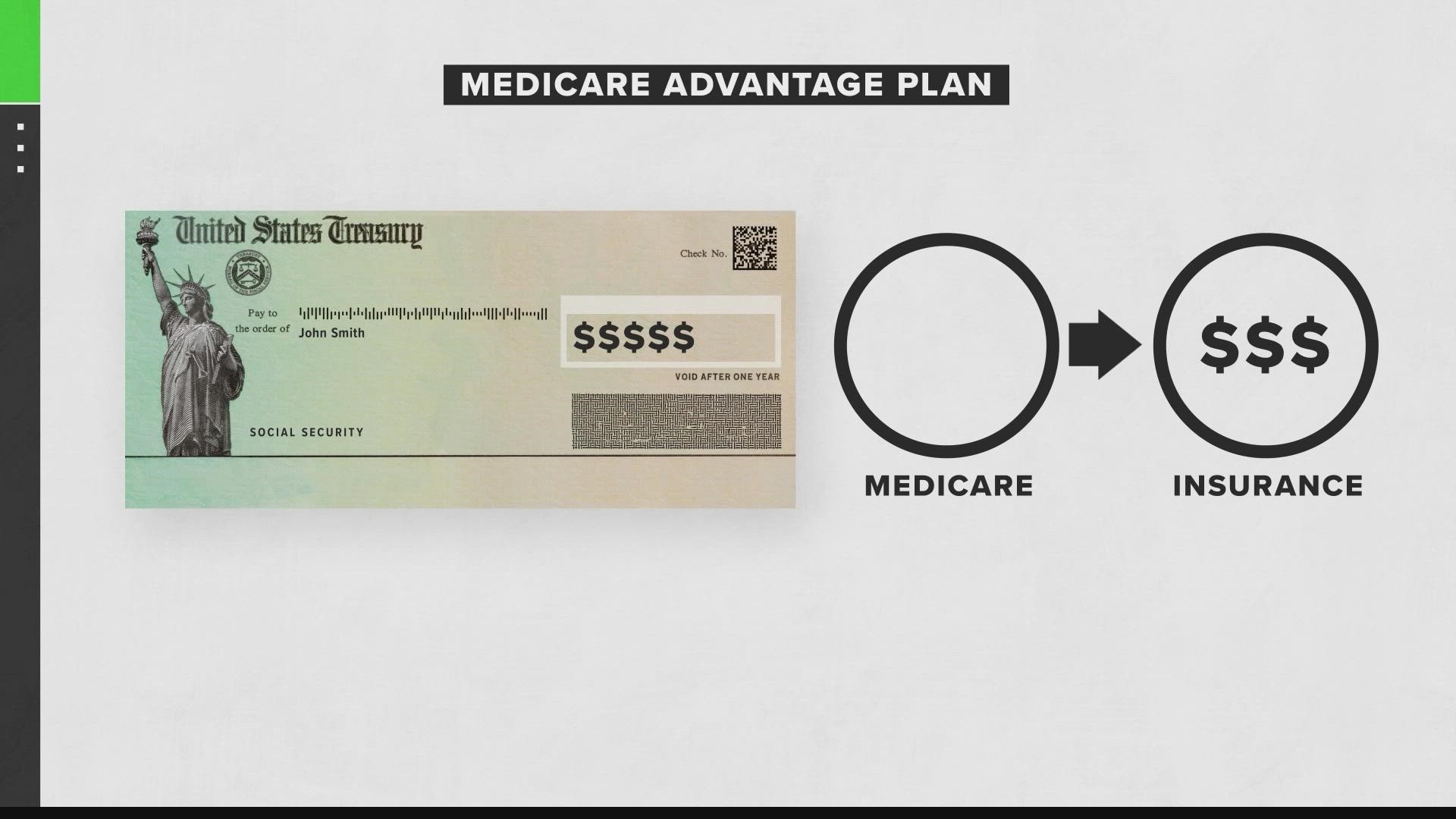

What is a $125 Medicare Part B premium give back

The Medicare Part B Give Back Benefit is another name for a Part B premium reduction. The premium reduction allows insurance companies to cover part of your Part B premium, thereby reducing how much you pay for Medicare each month.

Who qualifies for refund of Medicare premiums

Frequently Asked Questions. 1. How do I know if I am eligible for Part B reimbursement You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

How do I get the $16000 Social Security bonus

How to Get a Social Security BonusOption 1: Increase Your Earnings. Social Security benefits are based on your earnings.Option 2: Wait Until Age 70 to Claim Social Security Benefits.Option 3: Be Strategic With Spousal Benefits.Option 4: Make the Most of COLA Increases.

What is the 2023 Social Security increase for 2023

Social Security benefits and Supplemental Security Income (SSI) payments will increase by 8.7% in 2023. This is the annual cost-of-living adjustment (COLA) required by law. The increase will begin with benefits that Social Security beneficiaries receive in January 2023.

Who qualifies for money added to Social Security

The Supplemental Security Income (SSI) program provides monthly payments to adults and children with a disability or blindness who have income and resources below specific financial limits. SSI payments are also made to people age 65 and older without disabilities who meet the financial qualifications.

How do I get reimbursed for Part B premium

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.

Do you get a Medicare tax refund

You might overpay Social Security and Medicare taxes for a number of reasons. Some workers are exempt from paying these taxes. The government will give the money back to you if this happens, either as a refund or you can claim it as a tax credit in some cases.

How do you qualify for Social Security bonus

Wait as Long as You Can

Claiming “early,” at age 62, will result in the permanent reduction of your Social Security checks by up to 30%. Waiting until age 70, however, has the opposite effect. For every year that you delay claiming past full retirement age, your monthly benefits will get an 8% “bonus.”

Will there be an increase in Medicare in 2023

For 2023, the Part A deductible will be $1,600 per stay, an increase of $44 from 2023. For those people who have not worked long enough to qualify for premium-free Part A, the monthly premium will also rise. The full Part A premium will be $506 a month in 2023, a $7 increase.

Can you really get money added to your Social Security check

You may be able to get additional income through the Supplemental Security Income program, which helps seniors and the disabled who have limited income and financial resources.