How do you qualify for Apple installments?

Why am i not eligible for Apple Card monthly installments

ACMI is not available for purchases made online at the following special stores: Apple Employee Purchase Plan, participating corporate Employee Purchase Programs, Apple at Work for small businesses, Government, and Veterans and Military Purchase Programs, or on refurbished devices.

Cached

What credit score do you need to finance with Apple

Apple Financing uses Experian and other credit bureaus to evaluate your Apple Pay Later application. If your credit score is low — for example, if your FICO9 score is less than 6206 or Lift Premium score is lower than 5807 — Apple Financing might not approve your application.

How do I qualify for Apple payments

Requirements to get Apple CardBe 18 years or older, depending on where you live.Be a U.S. citizen or a lawful U.S. resident with a U.S. residential address that isn't a P.O.Use two-factor authentication with your Apple ID.Sign in to iCloud with your Apple ID.

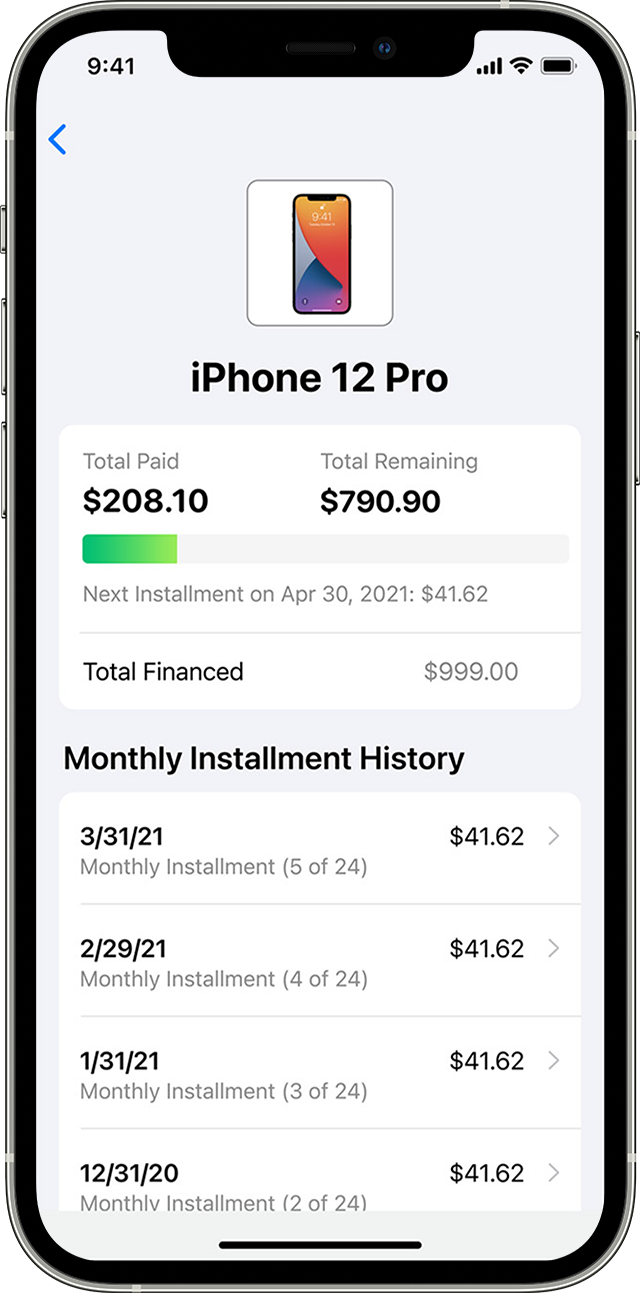

How do Apple installment plans work

Your monthly installment is automatically added to the minimum payment due on your Apple Card — including any associated AppleCare+ coverage. If you share your card with a Co‑Owner, 4 you're both responsible for the monthly installment payment.

Cached

Does everyone get approved for an Apple credit card

Apple Card uses FICO Score 9. FICO Score 9 ranges from 300 to 850, with scores above 660 considered favorable for credit approval.

Does the Apple credit card have to be paid in full every month

If you don't pay your monthly balance in full by your due date, interest begins to accrue. Interest is charged on the unpaid portion of your monthly balance and begins to accrue on new purchases until you pay the monthly balance in full.

Can I get an Apple Card with a 580 credit score

Apple Card uses FICO Score 9. FICO Score 9 ranges from 300 to 850, with scores above 660 considered favorable for credit approval.

What is the minimum income for Apple Card

There is no minimum income limit you need to have.

Is everyone eligible for Apple Pay later

Be 18 years of age or older. Be a U.S. citizen or a lawful resident with a valid, physical U.S. address that's not a P.O. Box. Set up Apple Pay with an eligible debit card on your device. You can only make Apple Pay Later down payments using a debit card.

Can I do monthly installments without Apple Card

Installment plans range from six months to two years. Apple Pay Later isn't restricted to Apple products, nor does it require the use of the Apple Card.

Does Apple let you pay in installments

Now when you shop at Apple using Apple Card, you can pay monthly at 0% APR for your new iPhone, iPad, Mac, Apple Watch, and eligible accessories when you choose to check out with Apple Card Monthly Installments.

Is it hard to be approved for Apple Card

Yes, it is hard to get the Apple Card because it requires at least good credit for approval. Unless your credit score is 700 or higher and you have a lot of income, it will be difficult for you to get approved for the Apple Card.

What is the minimum income for the Apple Card

There is no minimum income limit you need to have. The amount is used in part to determine your available credit limit if you are approved. Check your last year's tax return.

What is the minimum monthly payment for Apple Card

The Apple Card minimum payment is either $25 or 1% of the statement balance, plus fees, past-due amounts, and interest – whichever is higher. If your balance is less than $25, the entire amount is your minimum payment. Note that if you recently missed a payment, the issuer may add a late fee to your minimum payment.

What FICO score does Apple Card look at

Understanding your FICO score.

Apple Card uses FICO Score 9. FICO Score 9 ranges from 300 to 850, with scores above 660 considered favorable for credit approval.

Is it hard to get approved for Apple Card

Yes, it is hard to get the Apple Card because it requires at least good credit for approval. Unless your credit score is 700 or higher and you have a lot of income, it will be difficult for you to get approved for the Apple Card.

Why i didn t get approved for Apple Card

Customers must have a good credit score to be approved for the Apple Card. According to Apple, applicants with scores above 600 are likely to be accepted, while those with scores lower than 600 might not be approved.

What is the limit for Apple Pay later

$50 to $1,000

Users can apply for Apple Pay Later loans of $50 to $1,000, which can be used for online and in-app purchases made on iPhone and iPad with merchants that accept Apple Pay.

Who are eligible for buy now pay later

Eligibility criteria for Buy Now Pay Later

You must be aged above 18 years. The maximum age of eligibility in some cases can be up to 55 years. You must be a salaried individual. You must have a bank account and all the KYC documents in place.

Is it better to pay iPhone in full or monthly

Paying off early does not really save you anything, since the loan is at 0% interest. You don't have to trade the phone at 12 months, you can keep it and pay the entire 24. Either way, you are paying the same for the phone if you purchased it all at once, or make the 24 month payments.