How do you qualify for PayPal in 4?

How do I get approved for PayPal Pay in 4

To be eligible for PayPal Pay in 4, you must purchase an eligible item that costs between $30 and $1,500 from a participating online merchant that accepts PayPal. You also must be at least 18 years old and live in an eligible state.

Cached

Why was i denied PayPal Pay in 4

When applying to use PayPal Pay in 4, a soft credit check may be required to assess your credit worthiness, so your application to use PayPal Pay in 4 may be rejected. Your credit score will not be impacted by the soft credit check.

Cached

Do you need a credit score to use PayPal Pay in 4

PayPal will conduct a soft credit pull when you apply for a payment plan. This doesn't affect your credit score, and there is no minimum credit score requirement to use PayPal.

Cached

What is the credit limit for PayPal Pay in 4

PayPal will automatically convert the purchase amount into U.S. dollars during the checkout process. PayPal sets purchase limits for Pay in 4, and will typically only approve this payment method for transaction amounts between $30 and $1,500.

Cached

How can I borrow money from PayPal

Even if you can't get a cash advance, there are three ways to borrow money from PayPal:PayPal business loans.PayPal working capital.PayPal credit.

Why am I not eligible for Pay in 4

There are several reasons we may not have been able to complete your scheduled repayment, including if there were insufficient funds on your debit card, credit card, or bank account used to make your repayment or if your payment method hasn't been confirmed.

Why won t my PayPal Credit work

Your purchase attempt might need further verification.

For your account security, we always check to make sure the information provided during checkout matches your account details. If the information can't be verified, the purchase will be declined.

What credit score does PayPal require

To get approved for PayPal, credit borrowers generally need a credit score of 670 or higher. Applicants with a credit score of 700 or higher have the best odds of getting approval for lending from PayPal.

Does PayPal Credit require good credit

The PayPal Cashback Credit Card requires at least good credit (a credit score of 700+) to get approved.

What credit score do you need for PayPal Credit

To get approved for PayPal, credit borrowers generally need a credit score of 670 or higher. Applicants with a credit score of 700 or higher have the best odds of getting approval for lending from PayPal.

How do I know my PayPal Credit limit

To check the limit from your account, go to your Dashboard and click PayPal Credit. If you have any question about PayPal Credit, please contact Synchrony Bank at 844-373-4961, Mon-Fri 8am-11pm ET, and Sat-Sun 9am-9pm ET.

What credit score is needed for a PayPal loan

You will need a credit score of at least 580 to meet PayPal business loan requirements. Your business must bring in at least $33,000 annually, and you must have been in business for at least nine months. You will also need a PayPal Business account.

What do you need to qualify for PayPal Credit

Applicants with a credit score of at least 600 and up to 850 may be eligible for PayPal Credit. The minimum age to be eligible is 18 or the state minimum, whichever is higher. PayPal Credit does not have or does not disclose a minimum annual income eligibility requirement.

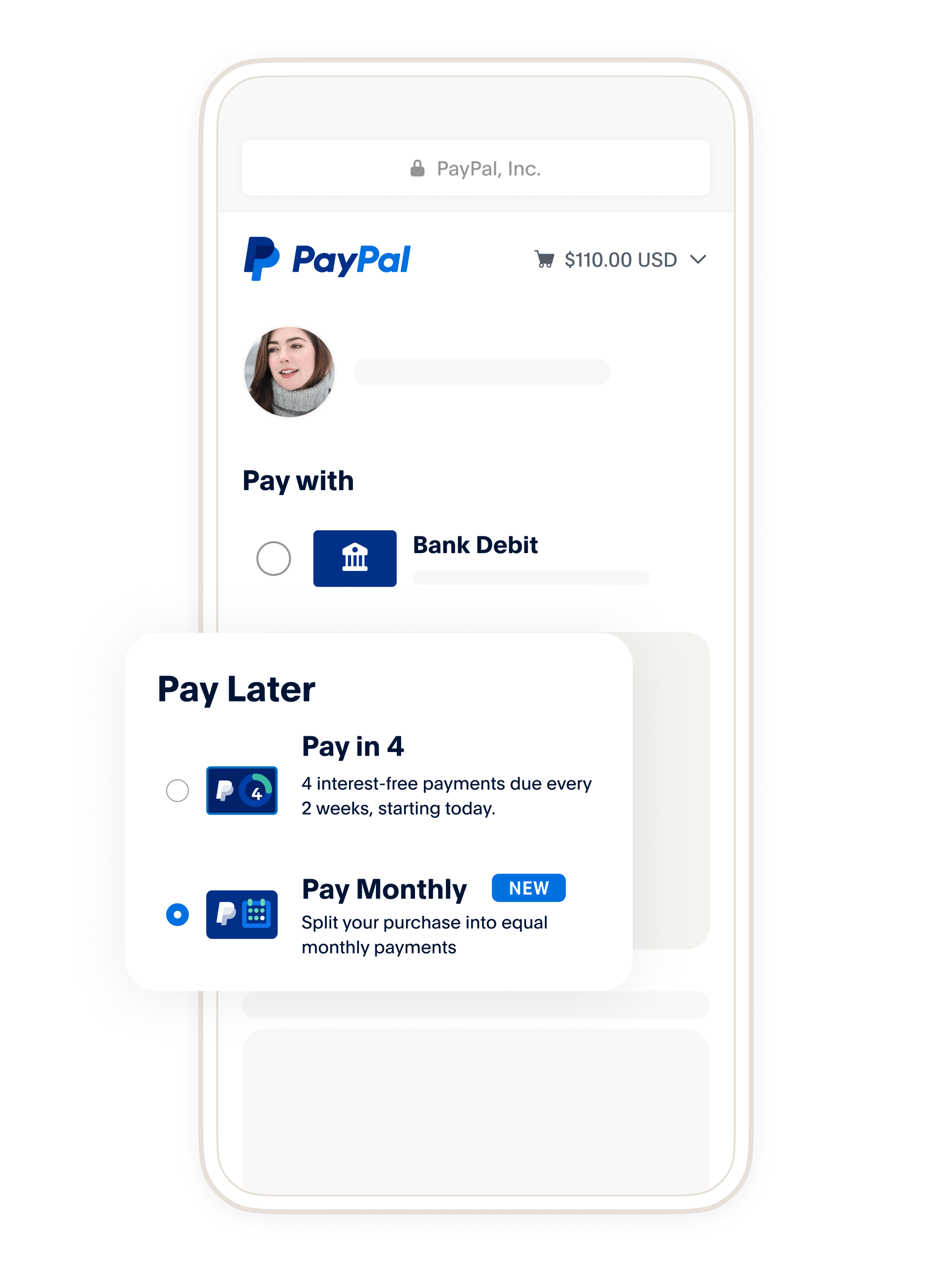

How do I enable PayPal pay later

Setup Pay Later messagingLog in to your Create account.Click on Shop > Payment Gateways > Edit this gateway next to PayPal.In the gateway settings, locate the Enable 'Pay Later': toggle and enable it.Next you can choose to Show 'Pay Later' on Basket if you would like the option to display on the basket.

Why do I keep getting denied for Afterpay

Things to consider:

Are there sufficient funds on your card (generally we look to see the first installment amount of the order value available to spend on the card you are using) length of time you have been using Afterpay (tighter in the first 6 weeks)

Why have I been rejected for PayPal Credit

PayPal typically declines a credit card when: Not enough credit or funds are available on the card. The card issuer wants to verify that the transaction is legitimate, and the card owner needs to approve the online transaction.

How can I get accepted for PayPal Credit

Applying for PayPal Credit is easy. Simply complete our short application form here and, if approved and once you accept the Credit Agreement, you'll have a credit limit linked to your PayPal account almost straight away.

Can I get PayPal Credit with a 600 credit score

You will need a credit score of at least 700 to get it.

Can I get PayPal Credit with bad credit

Lastly, it can be challenging to qualify for PayPal Credit if you have a limited or poor credit history. PayPal will check your credit report before approving your application for a credit line, so you may need a good credit score or credit history to be approved.

What credit score gets approved for PayPal Credit

(a credit score of 700+)

The PayPal Cashback Credit Card requires at least good credit (a credit score of 700+) to get approved.