How do you qualify for tuition deduction?

Who qualifies for tuition and fees deduction

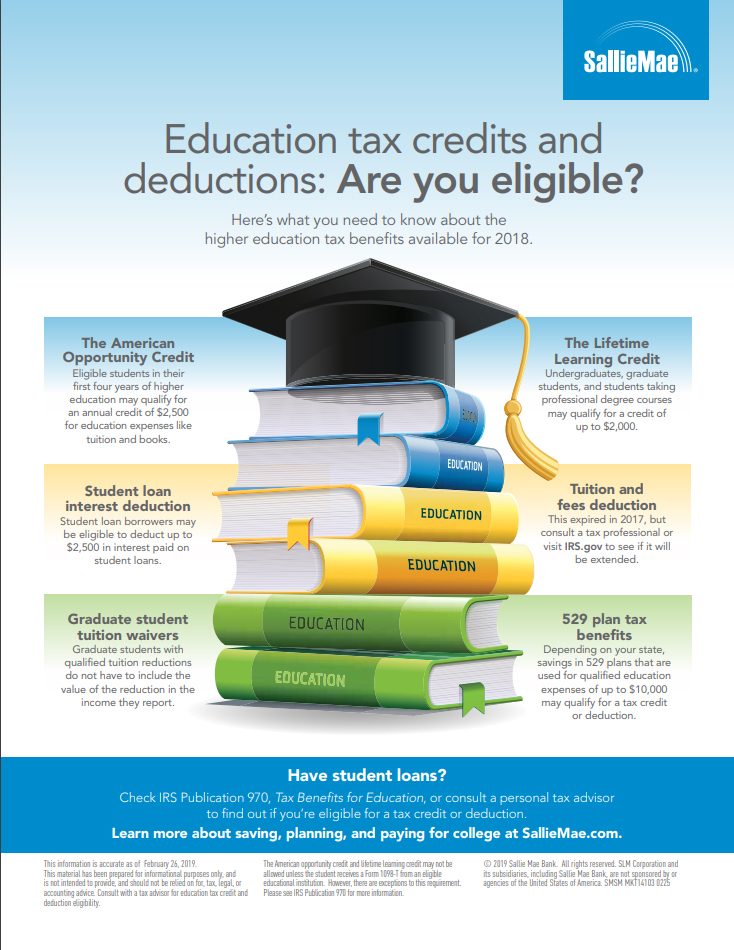

Deductible expenses – As the name implies, you can deduct tuition and fees from your taxes. Specifically, you can deduct tuition and fees required for enrollment or attendance at an eligible postsecondary educational institution. However, you can't deduct personal, living, or family expenses, such as room and board.

What is the income limit to deduct college tuition

But the amount you're allowed to claim depends on your modified adjusted gross income (MAGI). In order to get the full $2,500 credit, your MAGI cannot be higher than $91,850 (or over $137,800 for joint filers) in 2023. The LLC, on the other hand, is a nonrefundable tax credit.

CachedSimilar

How does tuition tax deduction work

Some college tuition and fees are deductible on your 2023 tax return. The American Opportunity and the Lifetime Learning tax credits provide deductions, but you can only use one at a time. Neither can be used for room and board, insurance, medical expenses, transportation, or living expenses.

Cached

Can I claim my child’s college tuition on taxes

It is possible to get a tax credit when you pay college tuition. You can claim a tax credit for your college tuition, or your dependent child's college tuition, either through the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC).

Can I deduct tuition if my parents paid it

You can use education payments made by your parents or third parties to claim tuition tax credits if both of these are true: You're a student. You qualify to claim an education credit.

How do I claim a college student as a dependent

However, to claim a college student as a dependent on your taxes, the Internal Revenue Service has determined that the qualifying child or qualifying relative must: Be younger than the taxpayer (or spouse if MFJ) and: Be under age 19, Under age 24 and a full-time student for at least five months of the year.

Can I choose not to claim my college student as a dependent

If it's more than $11,000, your student will need to file their own tax return. If your student is employed, you should not claim their earned income on your return. If your student files their own tax return, you can still claim them as a dependent, but you shouldn't claim their income on your return.

What counts as income for college students

What Counts as Income Students can list actual income from a job if they have one, including part-time or seasonal work and side hustles. In addition to income from a job, regular allowances or bank deposits received from parents or family can count toward income.

How many times can you claim tuition on taxes

There is no limit on the number of years you can claim the credit. It is worth up to $2,000 per tax return.

How much can a college student make and still be claimed on parents taxes

Do they make less than $4,400 in 2023 Your relative can't have a gross income of more than $4,400 in 2023 and be claimed by you as a dependent.

Should parents claim college student on taxes

Is my college student a tax dependent Generally, a parent can claim your college student children as dependents on their tax returns.

When should I stop claiming my college student as a dependent

Normally, the IRS only allows parents to claim a child as financially dependent until he or she reaches age 19. The age limit increases to 24 if you attend college full-time at least five months out of the year.

Can parents get a tax write off for paying for their kids college if they are not a dependent

Whoever claims the student as a dependent is the only one who can claim expenses for the credits and deductions. You are not able to claim any education credits for a non-dependent child.

Is it better for a college student to claim themselves or be dependent

Considerations When Filing as a Dependent or Independent Student. If your parents meet eligibility criteria to claim you as financially dependent for tax purposes, it is usually more beneficial for them to do so rather than you claiming a deduction for yourself.

Does a parent have to claim a college student as a dependent

A part-time college student can only be claimed as a dependent if they are under 19 years old. However, the age limit for dependents is extended if your dependent is considered a full-time student. If your dependent is a full-time student, they can be claimed up to 24 years old.

What are the IRS rules for claiming a college student as a dependent

To claim your child as your dependent, your child must meet either the qualifying child test or the qualifying relative test: To meet the qualifying child test, your child must be younger than you and either younger than 19 years old or be a "student" younger than 24 years old as of the end of the calendar year.

What is the highest income to qualify for financial aid

Did You Know There is no income cut-off to qualify for federal student aid. Many factors—such as the size of your family and your year in school—are taken into account.

How much can a student make before it affects financial aid

There is no set income limit for eligibility to qualify for financial aid through. You'll need to fill out the FAFSA every year to see what you qualify for at your college. It's important to make sure you fill out the FAFSA as quickly as possible once it opens on October 1st for the following school year.

How much does the IRS allow for tuition reimbursement

$5,250

If the company you currently work for has provided funds for educational assistance such as tuition reimbursement or employer student loan repayment, you may exclude an amount from your taxable income. This amount goes up to $5,250.

Should I claim my 22 year old college student as a dependent

To meet the qualifying child test, your child must be younger than you and either younger than 19 years old or be a "student" younger than 24 years old as of the end of the calendar year. There's no age limit if your child is "permanently and totally disabled" or meets the qualifying relative test.