How do you record owner’s capital?

How do you record capital in accounting

Below are the steps you can follow to record your business's capital assets:Total the cost. When recording the value of a capital asset, you need to consider more than just the cost paid for it.Determine its category.Record the invoice.Making the payment.Calculate depreciation.Selling the asset.

How do you record capital in journal entry

The capital can be introduced via bank transfer by the promoters, or it can be introduced in cash. You will have to debit and credit appropriate accounting heads. The Cash / Bank Account needs to be Debited and Capital Account needs to be Credited.

What is owner’s capital in accounting

The fund invested by the owner in the business or the net amount claimable by the owner from the business is known as the Capital or Owner's Equity or Net Worth.

Where do you record owner’s equity

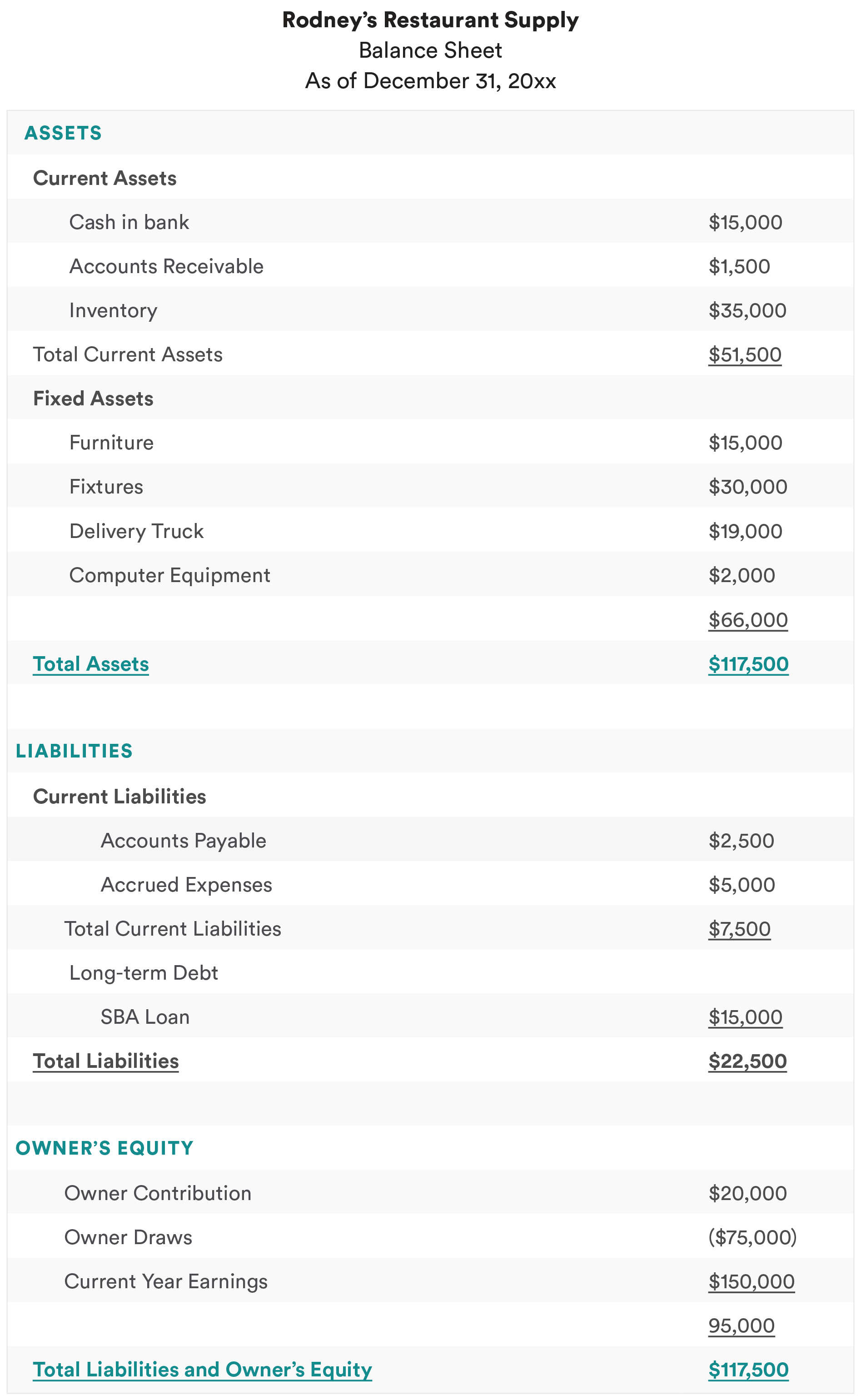

The owner's equity is recorded on the balance sheet at the end of the accounting period of the business. It is obtained by deducting the total liabilities from the total assets. The assets are shown on the left side, while the liabilities and owner's equity are shown on the right side of the balance sheet.

Cached

How is capital recorded in balance sheet

Capital account in accounting

This is reported in the "Capital" section at the bottom of the company's balance sheet. For sole proprietors, this part is called owner's equity, and for companies, it is called shareholder's equity.

Is capital an asset or an expense

A capital expenditure is recorded as an asset, rather than charging it immediately to expense. It is classified as a fixed asset, which is then charged to expense over the useful life of the asset, using depreciation.

What is capital journal entry

Interest on Capital Journal Entry is similar to entry relating to an interest expenditure incurred for the entity's loans/borrowings. So, this Interest on Capital is also an expense to the business.

How are capital assets recorded

Capital assets are reported at their historical cost net of accumulated depreciation in financial statements using the economic resources measurement focus and the accrual basis of accounting.

Is owner’s capital debited or credited

credit balances

The owner's capital account (and the stockholders' retained earnings account) will normally have credit balances and the credit balances are increased with a credit entry.

Is owner’s capital an asset or equity

Definition: Owner's Capital, also called owner's equity, is the equity account that shows the owners' stake in the business. In other words, this account shows the how much of the company assets are owned by the owners instead of creditors. Typically, the owner's capital account is only used for sole proprietorships.

What is owner’s capital on a balance sheet

An owners capital account is the equity account listed in the balance sheet of a business. It represents the net ownership interests of investors in a business. This account contains the investment of the owners in the business and the net income earned by it, which is reduced by any draws paid out to the owners.

What is owner equity vs capital

Equity represents the total amount of money a business owner or shareholder would receive if they liquidated all their assets and paid off the company's debt. Capital refers only to a company's financial assets that are available to spend.

Is capital an asset or equity

Capital is a subcategory of equity, which includes other assets such as treasury shares and property.

Where is capital recorded

It is reported at the bottom of the company's balance sheet, in the equity section. In a sole proprietorship, this section would be referred to as owner's equity and in a corporation, shareholder's equity.

Is capital a liability or expense

Even though capital is invested in the form of cash and assets, it is still considered to be a liability. This is because the business is always in the obligation to repay the owner of the capital. So, from the perspective of accounting, capital is always a liability to the business.

Where does capital go on a balance sheet

Capital assets can be found on either the current or long-term portion of the balance sheet. These assets may include cash, cash equivalents, and marketable securities as well as manufacturing equipment, production facilities, and storage facilities.

Is capital an expense or income

Capital income

This is income received from the sale of non-current assets of the business, such as the proceeds received from selling a motor vehicle.

Is capital credited or debited

The balance in a capital account is usually a credit balance, though the amount of losses and draws can sometimes shift the balance into debit territory. It is usually only possible for the account to have a debit balance if an entity has received debt funding to offset the loss of capital.

What is the double entry for capital

The double-entry rule is thus: if a transaction increases a capital, liability or income account, then the value of this increase must be recorded on the credit or right side of these accounts.

Why is owner’s capital recorded as liability

Even though capital is invested in the form of cash and assets, it is still considered to be a liability. This is because the business is always in the obligation to repay the owner of the capital. So, from the perspective of accounting, capital is always a liability to the business.