How do you record sales?

How would a sale on account be recorded

A sale on the account is recorded in the company's books by debiting asset account (receivables) and crediting revenue account. Selling on account means that revenue has been earned but not yet received, meaning it's a future cash expectation.

How do you record sales in a company

A few of the most important documents to save include:Payroll documentation.Sales receipts.Tax returns.Deposit slips.1099 forms.Receipts.Bills.Canceled checks.

Cached

Which journal is used to record sales

The sales journal is used to record all of the company sales on credit. Most often these sales are made up of inventory sales or other merchandise sales. Notice that only credit sales of inventory and merchandise items are recorded in the sales journal. Cash sales of inventory are recorded in the cash receipts journal.

What is journal entry for sales

What are sales journal entries Sales journal entries, sometimes referred to as revenue journal entries, are records of a cash or credit sale to a client. These entries also reflect any changes to accounts, including sales tax payable accounts, costs of goods sold and inventory.

What is the double entry for sales

Double entry is a system of Debit and Credit entries to describe the dual effect of a transaction. Every double entry must balance, with equal values on the Debit and Credit sides. A useful mnemonic to help you remember your double entry basics is DEAD CLIC.

How do you record sales and revenue

To record revenue from the sale from goods or services, you would credit the revenue account. A credit to revenue increases the account, while a debit would decrease the account.

What is an example of a sales journal entry

Example of the Sales Journal Entry

For example, a company completes a sale on credit for $1,000, with an associated 5% sales tax. The goods sold have a cost of $650. The sales journal entry is: [debit] Accounts receivable for $1,050.

Do you credit or debit sales

Sales are treated as credit because cash or a credit account is simultaneously debited.

How do you record sales on a general journal

How Do You Record a Journal Entry for SalesDebit the cash account for the total amount that the customer paid you, which includes sales price plus tax.Debit the cost of goods sold account for the total amount of money it cost you to produce the item.

What is the accrual entry for sales

The entry of accrued revenue entry happens for all the revenue at once. Deferred Revenue is when the revenue is spread over time. Accrued revenue entry leads to cash receipts. Deferred revenue is the recognition of receipts and payments after the actual cash transaction.

When should I record a sale

In principle, the seller should record the sales transaction when the ownership of the goods is transferred to the buyer. Practically speaking, however, accountants typically record the transaction at the time the sales invoice is prepared and the goods are shipped.

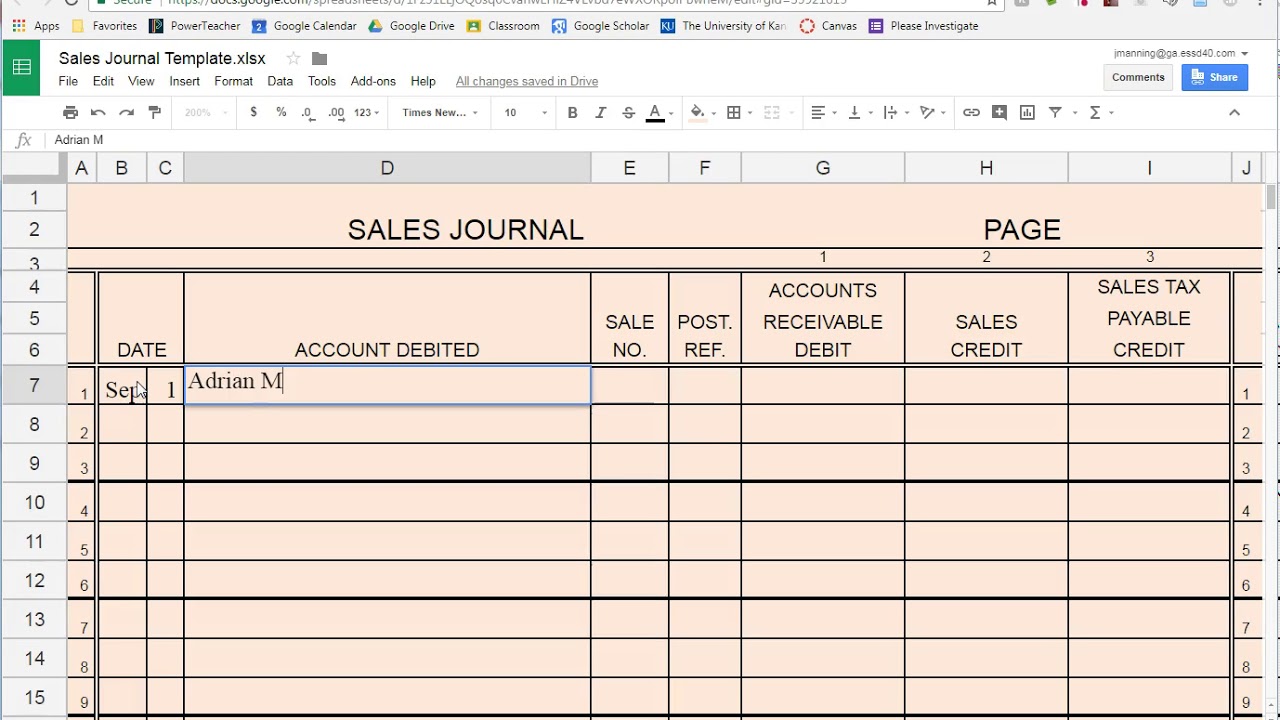

What is the format of the sales journal

Format of Sales Journal comprises six columns:- Date, Account debited, Invoice No., Accounts Receivable- Dr. Sales- Cr. And the cost of goods sold- Dr. Inventory- Cr.

What is the sales ledger entry

A sales ledger is a ledger entry that records any sale in the book of records, even if the payment is received or not yet received. They record sales and sales returns, which is a negative entry since the product that was sold is returned.

What is accrual vs cash sales

The difference between cash basis and accrual basis accounting comes down to timing. When do you record revenue or expenses If you do it when you pay or receive money, it's cash basis accounting. If you do it when you get a bill or raise an invoice, it's accrual basis accounting.

Is it better to over accrue or under accrue

Thus, an under accrual of an expense will result in more profit in the period in which the entry is recorded, while an under accrual of revenue will result in less profit in the period in which the entry is recorded.

What two entries are required to record a sale

Recording Sales on Account

The first entry records the actual sale with a debit entry to an asset account and a credit entry to a revenue account. The second entry requires a debit to the cost of goods sold account and a credit entry to the inventory account.

What is an example of sales in accounting

In accounting, the term sales refers to the revenues earned when a company sells its goods, products, merchandise, etc. When a company sells a noncurrent asset that had been used in its business (old delivery truck, display counters, company car, etc.), the amount received is not recorded as a sale.

What should a sales journal include

A sales journal must include the transactions of sales purchased and/or sold on credit. The entries should include the date of transaction, customer information, customer id#, invoice #, sales price, cost of sales, goods and services tax, debit, credit, and post reference #.

How do you write a journal entry for sales transactions

To create a sales journal entry, you must debit and credit the appropriate accounts. Your end debit balance should equal your end credit balance. As a refresher, debits and credits affect accounts in different ways. Assets and expenses are increased by debits and decreased by credits.

Should I do cash or accrual

Accrual accounting gives a better indication of business performance because it shows when income and expenses occurred. If you want to see if a particular month was profitable, accrual will tell you. Some businesses like to also use cash basis accounting for certain tax purposes, and to keep tabs on their cash flow.