How do you record selling common stock?

What is the journal entry for selling stock

When a company such as Big City Dwellers issues 5,000 shares of its $1 par value common stock at par for cash, that means the company will receive $5,000 (5,000 shares × $1 per share). The sale of the stock is recorded by increasing (debiting) cash and increasing (crediting) common stock by $5,000.

CachedSimilar

How do you record common stock in accounting

Upon issuance, common stock is recorded at par value with any amount received above that figure reported in an account such as capital in excess of par value. If issued for an asset or service instead of cash, the recording is based on the fair value of the shares given up.

Cached

What happens when common stock is sold

Companies sell common stock to raise money, which they then use for various initiatives, like general corporate purposes, growth or new products. Investors who buy common stock own a small piece of the company and share in its profits. They usually have the right to vote on what happens at the company.

Is selling common stock a debit or credit

Common stock is not a debit but a credit entry because it is an equity balance. Recall that, credit entries increase equity, revenue, or liability accounts and reduce asset or expense accounts.

What are the two journal entries to record selling inventory

The first entry records the actual sale with a debit entry to an asset account and a credit entry to a revenue account. The second entry requires a debit to the cost of goods sold account and a credit entry to the inventory account.

How do I record a stock sale in QuickBooks

You can record your sales of inventory. Products by selecting the create menu. And then choosing either invoice. Or sales receipt if you're telling a customer how much money they owe. And giving them

Is common stock a revenue or expense

As an investor, common stock is considered an asset. You own the property; the property has value and can be liquidated for cash. As a business owner, stock is something you use to get an influx of capital. The capital is used as savings, to buy machinery or property, or to pay operating expenses.

Is common stock recorded as revenue

Common Stock does not go on the Income Statement. Common Stock goes on the Balance Sheet under 'Equity'.

How does selling common stock affect the balance sheet

The company receives the proceeds from the sale of common stock as an asset, and the common stock is recorded as an asset on the company's balance sheet. For the investors who purchase the common stock, it represents an investment in the company and is therefore an asset for the investor.

Is common stock an expense or revenue

As an investor, common stock is considered an asset. You own the property; the property has value and can be liquidated for cash. As a business owner, stock is something you use to get an influx of capital. The capital is used as savings, to buy machinery or property, or to pay operating expenses.

Is selling stocks debt or equity

equity

Debt involves borrowing money directly, whereas equity means selling a stake in your company in the hopes of securing financial backing.

How do you record sale of goods in a journal entry

How Do You Record a Journal Entry for SalesDebit the cash account for the total amount that the customer paid you, which includes sales price plus tax.Debit the cost of goods sold account for the total amount of money it cost you to produce the item.

What is the double entry for sales

Double entry is a system of Debit and Credit entries to describe the dual effect of a transaction. Every double entry must balance, with equal values on the Debit and Credit sides. A useful mnemonic to help you remember your double entry basics is DEAD CLIC.

How do you record what you sell

When you credit one account, you debit another. This means every transaction has a plus and minus added to respective accounts. When it comes to a sales entry, you first enter the sale as a receivable or as cash, which is a debit. You also enter a debit for the cost of goods sold.

How do you track stock sales

Top Methods to Track Your StocksUse Online Tracking Services: Robo Advisors and Brokerages.Track Your Investment with Personal Finance Apps.DIY With Spreadsheets.Use Desktop Apps for Investment Tracking.Start Using a Trading Journal.

Is common stock an asset or a liability

asset

Common stock is a type of tradeable asset, or security, that equates to ownership in a company.

What type of accounting is common stock

What is the Common Stock Account The common stock account is a general ledger account in which is recorded the par value of all common stock issued by a corporation. When these shares are sold for an amount in excess of their par value, the excess amount is recorded separately in an additional paid-in capital account.

Do you record common stock in the journal entry

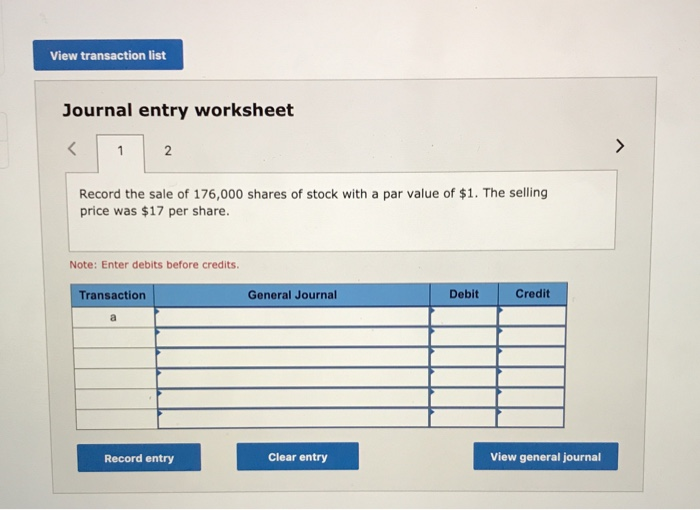

Common shares with par value are journalized by debiting cash (asset) for the amount received for the shares and crediting common shares (equity) up to the par value, with the balance of the entry credited to additional paid-in capital (equity).

What is common stock on an income statement

Common stock represents the number of company shares and is found on the balance sheet, and common stockholders are the company's owners who have voting rights and earn dividends. The common stock formula is Outstanding Shares = Number of Issued Shares – Treasury Stocks.

How do you treat common stock on a balance sheet

Common stock is reported in the stockholder's equity section of a company's balance sheet.