How does a tax deduction work?

How do tax deductions work examples

For example, if you earn $50,000 in a year and make a $1,000 donation to charity during that year, you are eligible to claim a deduction for that donation, reducing your taxable income to $49,000. The Internal Revenue Service (IRS) often refers to a deduction as an allowable deduction.

What do tax deductions actually do

Tax deductions reduce your total taxable income—the amount you use to calculate your tax bill. On the other hand, tax credits are subtracted directly from the taxes you owe. Some tax credits are even refundable, meaning that if the credits reduce your tax bill to below zero, you'll get a refund for the difference.

Cached

Does a tax deduction give you money

Deductions can reduce the amount of your income before you calculate the tax you owe. Credits can reduce the amount of tax you owe or increase your tax refund. Certain credits may give you a refund even if you don't owe any tax.

Cached

Is a tax deduction a good or bad thing

Deductions can help you qualify for other tax breaks

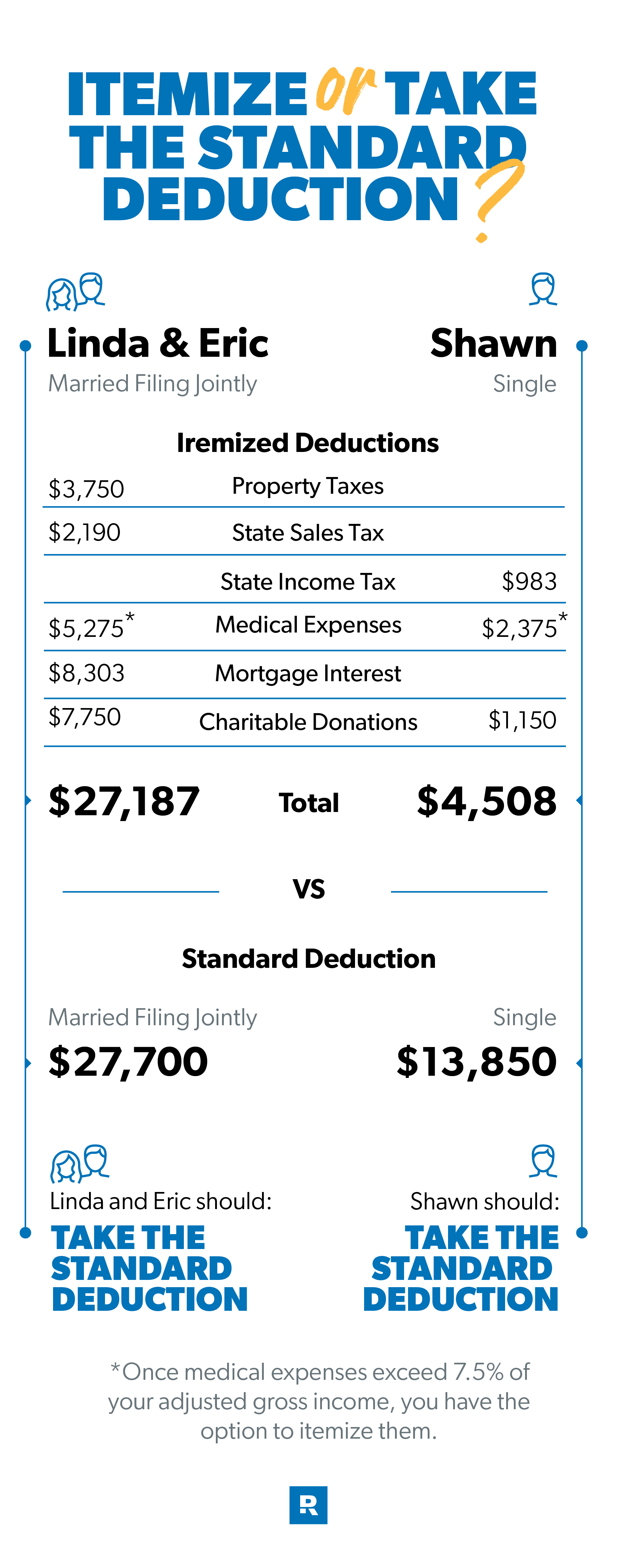

Taxpayers generally opt to itemize their deductions — such as those for charitable donations, mortgage interest, state and local taxes, and certain medical and dental expenses — if their total value exceeds the standard deduction amount.

What does 100% tax deductible mean

When something is tax deductible — meaning that it's able to be legally subtracted from taxable income — it serves as a taxpayer advantage. When you apply tax deductions, you'll lower the amount of your taxable income, which, in turn, lessens the amount of tax you'll have to pay the Internal Revenue Service that year.

How much do tax write offs save you

To calculate how much you're saving from a write-off, just take the amount of the expense and multiply it by your tax rate. Here's an example. Say your tax rate is 25%, and you just bought $100's worth of work supplies, which are fully tax deductible.

Do you get more money back for deductions

Deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction saves you $220.

What are tax deductions for dummies

What are tax deductions A tax deduction lowers your taxable income and thus reduces your tax liability. You subtract the amount of the tax deduction from your income, making your taxable income lower. The lower your taxable income, the lower your tax bill.

How to get a $10,000 tax refund

CAEITCBe 18 or older or have a qualifying child.Have earned income of at least $1.00 and not more than $30,000.Have a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and any qualifying children.Living in California for more than half of the tax year.

How much is a 5000 tax deduction worth

Example: Tax credit vs. tax deduction

| $5,000 tax deduction | $5,000 tax credit | |

|---|---|---|

| Minus tax deduction | ($5,000) | |

| Taxable income | $75,000 | $80,000 |

| Tax rate (married filing jointly) | 12% | 12% |

| Calculated tax | $9,000 | $9,600 |

Who benefits most from tax deductions

Lower Income Households Receive More Benefits as a Share of Total Income. Overall, higher-income households enjoy greater benefits, in dollar terms, from the major income and payroll tax expenditures.

How much do tax deductions save you

For most non-business deductions, the savings are based upon your tax bracket. For example, if you are in the 12% tax bracket, a $1,000 deduction would save you $120 in taxes. On the other hand, if you are in the 32% tax bracket, the $1,000 deduction will save you $320 in taxes.

Do write-offs lower your tax bracket

When you take write-offs, you can reduce your taxable income based on your tax bracket. So, the higher your tax bracket, the more you could potentially save. For example, a $100 tax deduction is worth $10 to a taxpayer in the 10% bracket, while a $100 deduction is worth $37 to someone in the 37% bracket.

How do I get the biggest tax refund

6 Ways to Get a Bigger Tax RefundTry itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

How do people get large tax refunds

By contributing more toward your tax bill with each paycheck, you'll increase the amount you pay in during the year—and thereby increase your chances of getting a bigger refund.

How much taxes should be taken out of $1000

These percentages are deducted from an employee's gross pay for each paycheck. For example, an employee with a gross pay of $1,000 would owe $62 in Social Security tax and $14.50 in Medicare tax.

How do deductions lower a person’s taxes

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction saves you $220.

How much do you get back from tax write offs

(The amount depends on your filing status. In 2023, it's $12,550 for single filers, $25,100 if you're married filing jointly, and $18,800 if you're a head of household.)

How much do tax write-offs save you

To calculate how much you're saving from a write-off, just take the amount of the expense and multiply it by your tax rate. Here's an example. Say your tax rate is 25%, and you just bought $100's worth of work supplies, which are fully tax deductible.

How to get $5,000 tax refund

The IRS says if you welcomed a new family member in 2023, you could be eligible for an extra $5,000 in your refund. This is for people who had a baby, adopted a child, or became a legal guardian. But you must meet these criteria:You didn't receive the advanced Child Tax Credit payments for that child in 2023.