How does Cash App work with credit cards?

Can you send money through Cash App with a credit card

Cash App supports debit and credit cards from Visa, MasterCard, American Express, and Discover. Most prepaid cards are also supported. ATM cards, Paypal, and business debit cards are not supported at this time.

Cached

How does Cash App work with credit cards

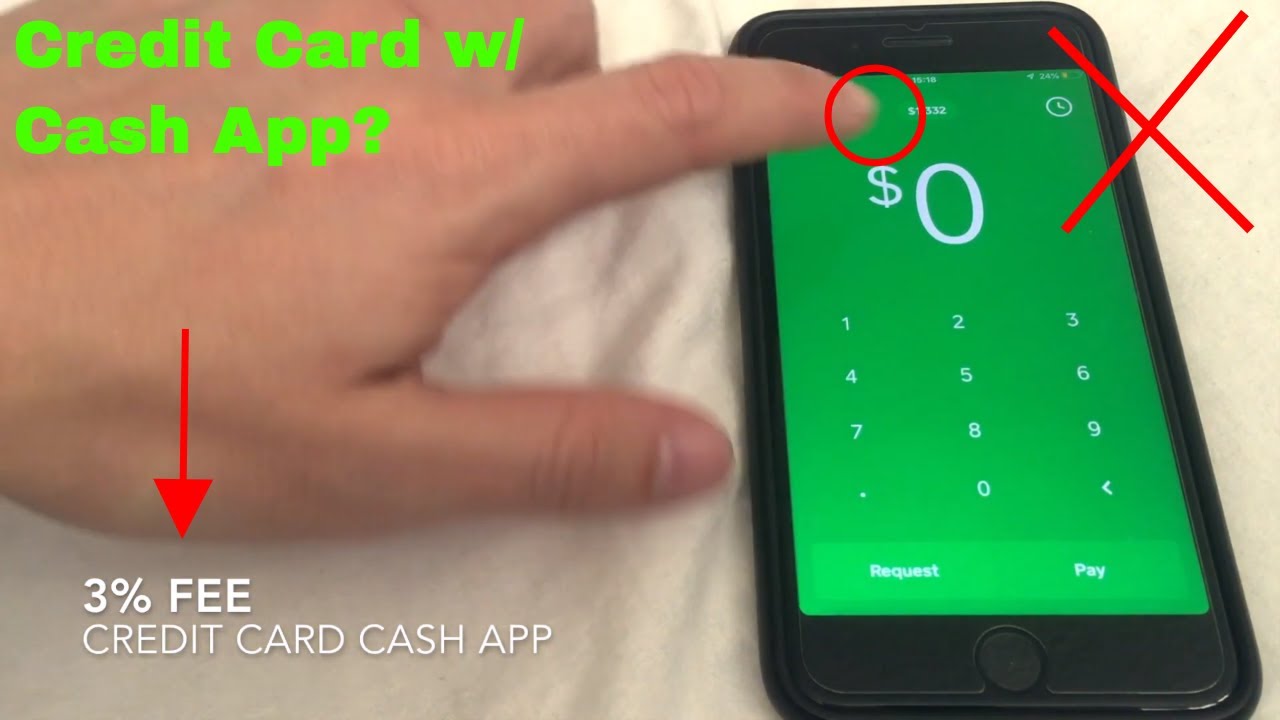

Credit card fees

Cash App will charge you a 3% fee every time you use your credit card to send money. If you send someone $200 with the Cash App through your linked credit card, then you'll pay $206. The app doesn't charge you any money to make payments with your debit card or bank account.

Cached

Does using a credit card on Cash App count as cash advance

Whenever you use your credit card on Cash App, though, be wary of cash advance fees that may be charged to your account.

Cached

Is it safer to use a credit card on Cash App

Cash App encrypts all data in transit and can claim PCI-DSS level 1 certification — the highest level of compliance with a set of standards designed to ensure companies store, transmit, and process credit card data to the highest standards. The app also offers fraud protection for unauthorized charges.

Why is Cash App declining my credit card

If Cash App notices potentially unauthorized activity on your account, we may decline Cash Card transactions for your protection. Depending on the transaction, we may send you a notification asking you to confirm whether you recognize the declined transaction within your app.

How do you pay someone with a credit card

3 ways to pay a friend with a credit cardCash App. Cash App is free to download and accepts credit and debit cards.Venmo. Venmo requires you to sign up for an account through Facebook or your email.PayPal. PayPal is one of the oldest services for electronically sending and requesting money.Apple Pay.Google Pay.Zelle.

Is using a credit card on Cash App instant

Once you link your credit card to Cash App, you will be able to make payments and withdraw funds, instantly.

Does borrowing money from Cash App go on your credit

Authorization to Obtain Credit Report and Credit Reporting

You understand that initially submitting personal information will not affect your credit score, however, submitting a loan application or accepting a loan may result in an inquiry on your credit report that may affect your credit score.

What are the disadvantages of Cash App

Payment Limits

Cash App initially limits the amount you can send and receive to $250 in a week and $1,000 per month, although you can increase this by going through an additional verification process. You can also not withdraw more than $1, 000 per week via an ATM or cash back using your debit card.

Why is Cash App charging a fee to receive money

Cash App is free to download and its core functions—making peer-to-peer payments and transferring funds to a bank account—are also free. Cash App makes money by charging businesses to use their application and by charging individual users transaction fees to access additional services.

How do I turn my credit card into cash

How to use a credit card at an ATM to withdraw moneyInsert your credit card into an ATM.Enter your credit card PIN.Select the “cash withdrawal” or “cash advance” option.Select the “credit” option, if necessary (you may be asked to choose between checking, debit or credit)Enter the amount of cash you'd like to withdraw.

Can I transfer money from credit card

Yes, you can transfer money from your credit card into your current account and then use the debit card linked to that account to spend it as you wish.

How do I borrow $200 from Cash App

How to Use Cash App BorrowOpen Cash App.Go to the “Banking” section of the home screen.Click “Borrow” if it's available to you.Tap “Unlock” to see how much you can borrow.Select your desired amount and repayment option.Agree to the terms and accept the loan offer.

What is the highest Cash App borrow limit

You can select loan amounts up to $200 when you borrow money from Cash App. However, this is the amount that you have to repay within four weeks. If you don't do so, a late fee is charged, which is 1.25%. This fee is charged to you once a one-week grace period is completed.

Is it safe to link your bank account to Cash App

Cash App uses cutting-edge encryption and fraud detection technology to make sure your data and money is secure. Any information you submit is encrypted and sent to our servers securely, regardless of whether you're using a public or private Wi-Fi connection or data service (3G, 4G, or EDGE).

Which is safer Cash App or venmo

Is Cash App safer than Venmo Not necessarily. Cash App and Venmo are money transfer apps, which are inherently risky since their services involve sending money to other people. But if you stick to sending money to friends and family, you likely won't run into any issues involving scams.

How do I avoid Cash App fees when receiving money

How do you avoid fees on Cash App To avoid fees on Cash App when sending or receiving money, don't use a credit card to send payments and don't use the instant deposit option when cashing out your balance.

How much is the instant fee for $500 on Cash App

While a standard transfer is free, an instant transfer would cost between $0.50 and $1.75. Likewise, an instant transfer of $500 would cost between $2.50 and $8.75. What about sending money Using a Cash App balance or linked bank account, a $100 payment wouldn't have an additional fee.

How do I convert my credit card to Cash App

Learn How to Add Credit Card on Cash App in 2023Open the CashApp App.Click on your Profile Icon on the Top Right.Click on the Linked Bank Section.Click on the Credit Card option.Enter your Credit Card Number.Enter your CC Expiration Date.Enter the Security Code.Enter your Zip Code.

How can I convert my credit card to cash without charges

MoneyGram and Western Union are two reliable online payment tool you can use to avoid charges. Although there are some factors you need to consider before using them. You need to consider the amount you want to transfer, which country your bank account exists, and it's bank regulations and the currency.