How does Coinbase credit card work?

Is the Coinbase card a credit card

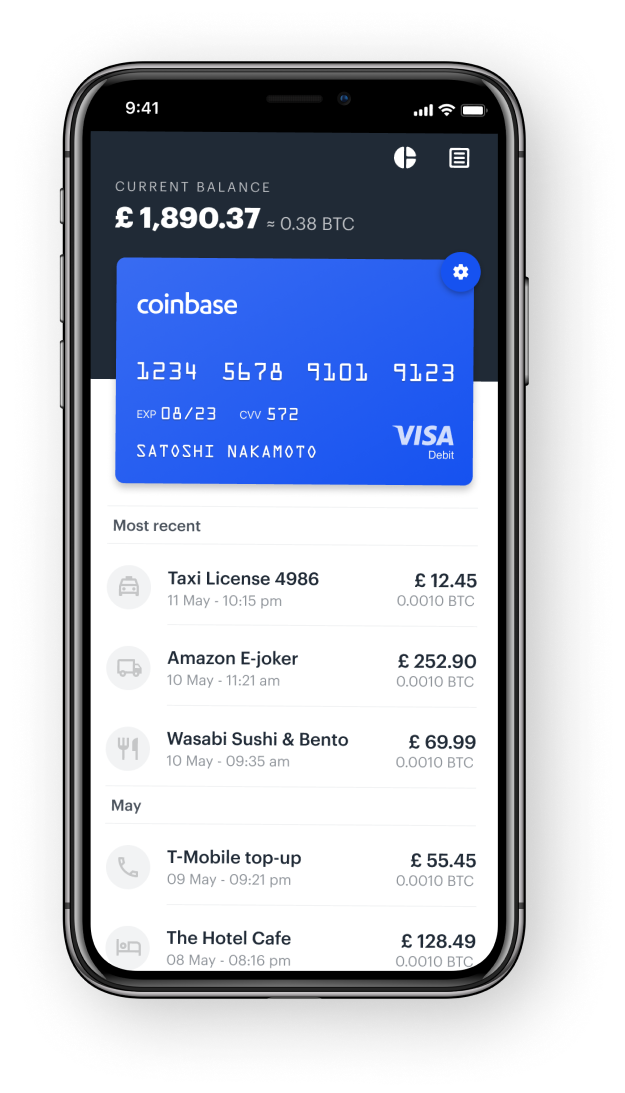

The Coinbase Card* is a debit card issued by Metabank and runs on the Coinbase platform. It allows you to spend any cryptocurrencies or U.S. dollars you own anywhere Visa cards are accepted. To spend your cryptocurrency, Coinbase will automatically convert all your cryptocurrency to U.S. dollars when making a purchase.

Cached

Is Coinbase card worth it

If you're an active Coinbase user and hold cash or USDC in your account, the Coinbase card is worth using. The rotating rewards help you diversify your portfolio. And earning 4% back on certain cryptos is one of the highest rates out there. However, avoid spending crypto to earn crypto at all costs.

Cached

What is Coinbase credit card use for

Coinbase Card allows you to spend crypto¹ (including USDC) or US dollars anywhere Visa cards are accepted. You can use your card to spend cash or any of the cryptocurrencies that you own. (For US users only) – You'll have the ability to earn rewards when spending with your Coinbase Card.

What is the credit card limit on Coinbase

The Coinbase debit card limit is $2500 per day.

This means that you can use your card to purchase up to $2500 worth of goods and services in a single day. If you need to make a larger purchase, you will need to either use another form of payment or split your purchase into multiple transactions.

Is Coinbase credit card safe

Almost no fees: Coinbase card has no annual fee, sign up fee or card issuance fee. Robust security: With the Coinbase debit card, you can rest assured that your digital assets are safe. The two-step verification, instant card freeze and other security features will protect your card and digital assets.

Can I use my Coinbase card anywhere

The Coinbase Card is a Visa debit card that can be used everywhere Visa is accepted. It works offline, online, and internationally. You can use the card for everyday purchases at your favourite merchants or at ATMs to make cash withdrawals from your Coinbase account.

Does Coinbase card have a monthly fee

Are there any fees associated with Coinbase Card There are no transaction fees for spending with the Coinbase Card. You can spend your default cash currency, USDC, or any supported crypto on Coinbase using your Coinbase Card and there will be no transaction fees.

Can you use Coinbase card anywhere

The Coinbase Card is a Visa debit card that can be used everywhere Visa is accepted. It works offline, online, and internationally. You can use the card for everyday purchases at your favourite merchants or at ATMs to make cash withdrawals from your Coinbase account.

Does Coinbase report to IRS

Currently, Coinbase may issue 1099 forms to both you (the account owner) and the IRS if you meet certain qualifying factors. These forms detail your taxable income from cryptocurrency transactions.

How do I get my $7500 card purchase limit on Coinbase

To apply for a limit increase on the Coinbase mobile app:

Tap. > Profile & Settings. Tap Limits and features. Tap Increase limits > Apply now.

What is the $1000 limit on Coinbase

For example, if you add Apple Pay to your account and your card's transaction limit is $1,000, you can purchase up to $1,000 worth of crypto in a 24-hour period in addition to the limit on your Coinbase account.

Does Coinbase affect credit score

Does Coinbase report to credit bureaus No. Coinbase does not report any loan-related information or activity to credit reporting agencies at this time.

Can I use my Coinbase card like a debit card

The Coinbase Card is a Visa debit card that can be used everywhere Visa is accepted. It works offline, online, and internationally. You can use the card for everyday purchases at your favourite merchants or at ATMs to make cash withdrawals from your Coinbase account.

Does Coinbase charge extra for credit card

Coinbase also charges a spread-based fee of 0.50%, while other fees depend more on which method of payment you're using — ACH transfers are free, whereas using a bank account or USD Wallet adds a 1.49% fee, using a credit or debit card adds a 3.99% fee and wire transfers rack up an extra fees of $10 incoming and $25 …

Why is Coinbase charging $30

You are seeing a charge on your statement because someone connected your bank account on our website and used it to purchase bitcoin (a digital currency). If you don't recognize this charge, it's possible that someone has connected your bank account without your permission.

Can you withdraw money from Coinbase card

Coinbase Card is accepted anywhere Visa® debit cards are accepted, at over 40M+ merchants worldwide. If you choose to spend crypto, Coinbase will automatically convert all cryptocurrency to US Dollars for use in purchases and ATM withdrawals.

Can the IRS seize your Coinbase account

Yes. A variety of large crypto exchanges have already confirmed they report to the IRS. Back in 2016, the IRS won a John Doe summons against Coinbase. A John Doe summons compels a given exchange to share user data with the IRS so it can be used to identify and audit taxpayers, as well as prosecute those evading taxes.

Do I have to pay taxes on crypto if I don’t cash out

If you buy crypto, there's nothing to report until you sell. If you earned crypto through staking, a hard fork, an airdrop or via any method other than buying it, you'll likely need to report it, even if you haven't sold it.

What is the highest limit on Coinbase

Purchase and deposit limits will be different depending on your region and payment method type. For US customers, if you're looking to deposit more than the maximum $25,000 a day ACH limit, one option is to complete a wire transfer from your bank account to your Coinbase account.

Can I cash out 100000 from Coinbase

To cash out your funds, you first need to sell your cryptocurrency for cash, then you can either transfer the funds to your bank or buy more crypto. There's no limit on the amount of crypto you can sell for cash.