How does credit score work in UK?

How does UK do credit scores

The UK credit score system centres around three main credit reference agencies (CRAs): Experian, Equifax and TransUnion. Each one collects information from creditors and factors these into an algorithm that calculates your credit score. Each CRA uses a unique rating scale and may receive different data points.

Is UK credit score the same as US credit score

Many countries, including Canada and the U.K., have credit scoring systems that are similar to the American system. Yet, there is no communication between the systems. So your credit score in the U.S. will not affect your credit score in the U.K.

Cached

Does UK have a credit score system

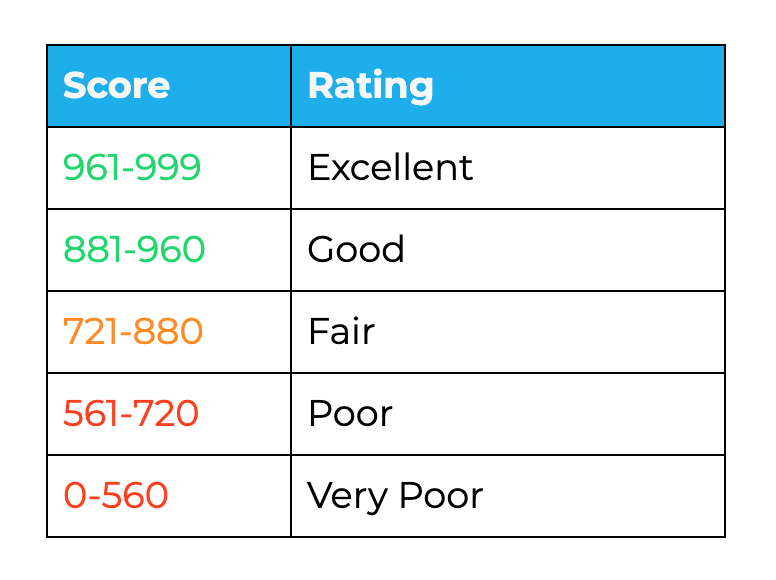

In the UK there are three main credit rating agencies, they are TransUnion, Experian and Equifax. Their credit score range is between 0 and 999. Regardless of the company, the higher the number, the more trustworthy you are deemed financially.

What is a good credit score in UK

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good.

Why don t I have a credit score UK

You are under 18:Your credit score isn't usually available until you are 18 years old. You have never used credit:If you have never used credit or don't have any bills, such as energy, water or a mobile phone contract in your name, you won't be able to build a credit score.

What is a poor credit score UK

In the UK, having bad credit can impact how many lenders are willing to give you a credit card, mortgage or bank loan. A bad credit score with Equifax is under 379. A 'Poor' credit score with Equifax is 280-379, and a 'Very Poor' credit score is under 279.

Can I transfer UK credit score to USA

In the past, different credit reporting systems and laws made it difficult to share credit information across borders, even when the credit reporting agencies operate in both countries. Today, it's possible to use your U.K. credit history in the U.S.

How do I build credit from USA to UK

Here are some tips for getting started:Get established with a UK address. Proof of residence is an important criteria for building UK credit.Be gainfully employed.Open a bank account in the UK.Apply for credit cards with high interest rates.Put any and all bills in your name.Open one (or a couple) store cards.

Does anyone have a 999 credit score

There's no universal number that indicates a good score because each credit agency uses a different scoring system. Experian, for example, uses a range from 0 to 999. A score of between 881 and 960 is good, between 961 and 999 your score is excellent.

How do I establish credit in the UK as a US citizen

How do I build my credit score in the UKMake sure you're on the electoral roll.Open a bank account.Go for small lines of credit.Manage your household bills well.Make your rent count too.

How do I establish credit in the UK

There are some simple steps you can take to start building a credit history.Open and manage a bank account.Set up some Direct Debits.Don't miss payments.Whether you're on the electoral register.Financial ties with other people.Checking your credit report.

Why is my credit score 0 UK

You've not used any credit in a long time

If it's been longer than that, and you don't have any other credit accounts on your report, you might not see a credit score. It's a good idea to start building your score again – you could take out a credit builder card .

Is a credit score of 400 good UK

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 400 FICO® Score is significantly below the average credit score. Many lenders choose not to do business with borrowers whose scores fall in the Very Poor range, on grounds they have unfavorable credit.

Is US credit history valid in UK

The short answer is no. For a number of reasons, and despite the fact that Experian and Equifax have bureaus in both the US and UK, your credit score is as irrelevant overseas as is your GPA after college.

Can I use my US credit card in UK

Using a credit card

You won't have any problems using a travel credit card in the UK. Most major credit cards are accepted, but you'll find it hard to use your Diners Club, American Express or Discover cards at small businesses.

Is there a 0 credit score

But your credit score won't start at zero, because there's no such thing as a zero credit score. The lowest score you can have is a 300, but if you make responsible financial decisions from the beginning, your starting credit score is more likely to be between 500 and 700.

Is a credit score of 528 bad

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 528 FICO® Score is significantly below the average credit score. Many lenders choose not to do business with borrowers whose scores fall in the Very Poor range, on grounds they have unfavorable credit.

Can UK debt follow me to USA

There's no law saying you can't move to another country if you have debt—even if it's in collections. But if you've taken on debt in the U.S., you're contractually obligated to pay it, regardless of where you choose to live. Living abroad can make it more difficult for creditors to find you and collect on your debt.

Can I transfer my credit score from UK to US

When you have a good credit history in the UK, it's quite easy to overlook this important number in any international relocation. However, your credit score is not a portable asset. Moving to the USA for the first time means essentially building your credit history from scratch.

What is a good credit score UK out of 700

between 604-627

Scores between 566-603 are considered Fair. Scores between 604-627 are considered Good. Scores 628 and above are considered Excellent.