How does Dave credit card work?

How does the Dave card work

Dave is a personal finance app that is known for its ExtraCash™ feature, which offers a short-term loan of up to $500. There are no required fees, but users may leave an optional tip. It also provides a banking service that does not charge overdraft fees and has no minimum balance requirement.

Cached

How do I get a $500 advance on Dave

Open an ExtraCash™ account. Download the Dave app, link your bank to see if you're eligible for an ExtraCash™ advance, and then open an ExtraCash™ account.Advance up to $500.Transfer it to any account.Confirm your settlement.Settle your balance.Get ready for more money.

How much does Dave approve you for

Dave app advance amounts, fees and repayment terms

| Advance amounts | Up to $500. |

|---|---|

| Fees | Subscription fee: $1. Optional fast-funding fee: $1.99-$13.99. Optional tip: Up to 25% of the amount borrowed. |

| Repayment | Withdrawn from your bank account on the date Dave determines to be your next payday. |

Cached

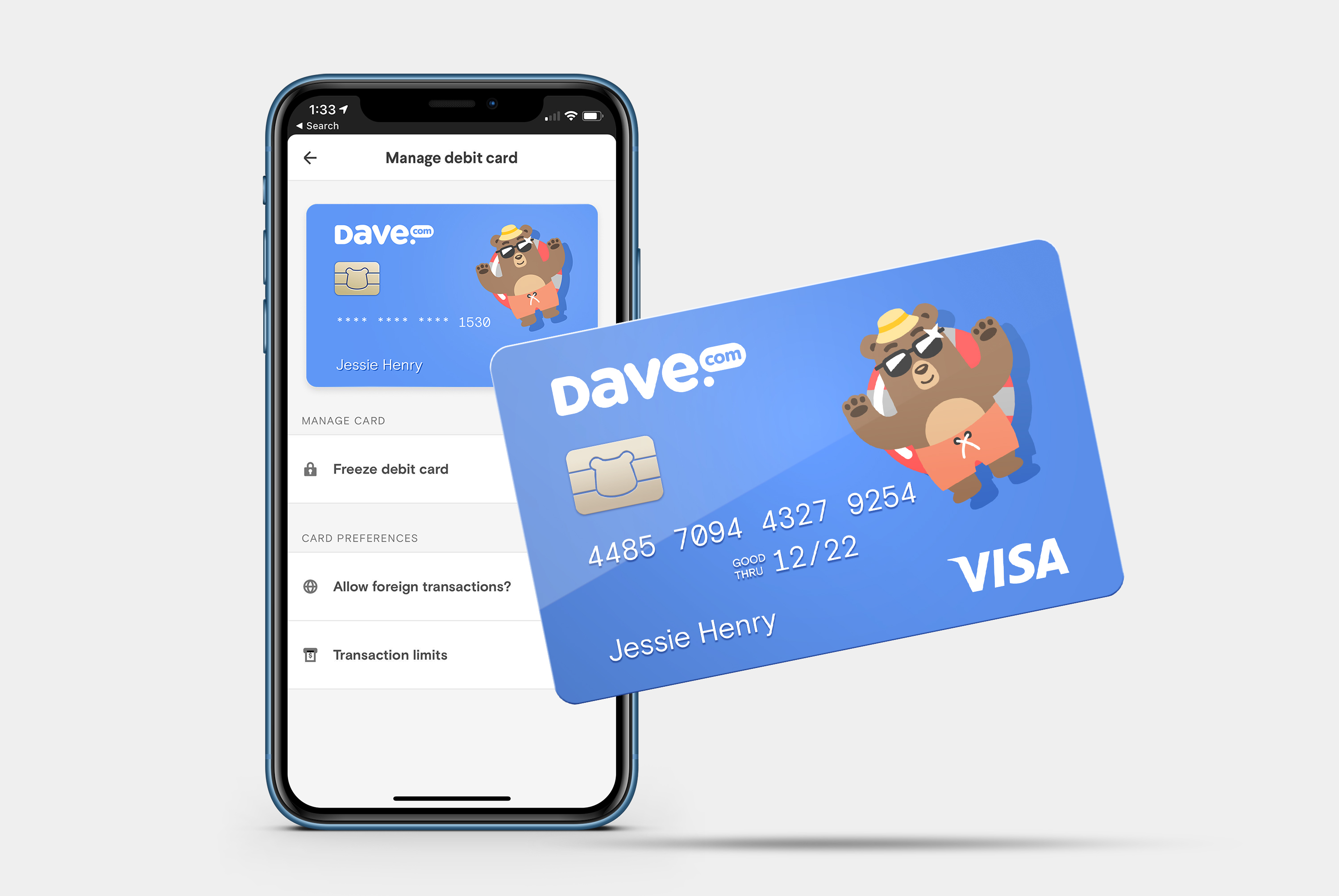

Is Dave card a credit card

When you sign up for Dave Banking, you'll receive a Visa debit card and get a cash management account. The account has no overdraft fees whatsoever, plus no required minimum deposit to open the account.

Cached

Does Dave card build credit

Dave might be your top choice if you're looking for ways to build credit. You may be able to use monthly payments on rent and utility to improve your credit score.

Can you withdraw money from Dave card

And then the two if we click on here. It's going to show you the different options you have available if you don't have an external account. For. This example.

Why won t Dave give me a cash advance

Your income history and spending patterns. Your bank account must have a minimum 60-day history and a positive balance. To qualify for a larger cash advance limit, your account needs to show at least $1,000 in monthly deposits.

Why am I not eligible for Dave cash advance

Qualification — To qualify for a cash advance, you'll need to have a bank account with direct deposit set up, and at least two past direct deposits completed in that account. Dave will analyze your spending and earning habits to determine how large an advance you can afford. This amount can change from day to day.

How do I borrow $200 from Cash App

How to Use Cash App BorrowOpen Cash App.Go to the “Banking” section of the home screen.Click “Borrow” if it's available to you.Tap “Unlock” to see how much you can borrow.Select your desired amount and repayment option.Agree to the terms and accept the loan offer.

Is Dave credit card legit

Is Dave legit Dave is a legitimate option if you're interested in mobile banking. It partners with Evolve Bank & Trust, an FDIC-insured institution. For a fee of $1 per month, you have access to a spending account, a debit Mastercard, free cash advances and credit-building and budgeting tools.

What happens if I can’t pay Dave back

What happens if you don't pay the Dave app back Dave doesn't charge any late fees or overdraft fees, so you won't have to pay any additional charges. That said, if you're unable to pay back a cash advance, your access to the app will eventually be suspended.

What happens if I don’t pay Dave back

What happens if you don't pay the Dave app back Dave doesn't charge any late fees or overdraft fees, so you won't have to pay any additional charges. That said, if you're unable to pay back a cash advance, your access to the app will eventually be suspended.

Can I use my Dave card anywhere

Out of network fees apply. The Dave debit Mastercard® is accepted everywhere a Mastercard debit card is accepted. Foreign transaction fees apply. Rewards are not offered by Evolve Bank & Trust, but instead are offered and managed by Dave, Inc., in partnership with Figg.

How do I borrow $200 from cash App

How to Use Cash App BorrowOpen Cash App.Go to the “Banking” section of the home screen.Click “Borrow” if it's available to you.Tap “Unlock” to see how much you can borrow.Select your desired amount and repayment option.Agree to the terms and accept the loan offer.

How do you qualify for a Dave cash advance

Qualification — To qualify for a cash advance, you'll need to have a bank account with direct deposit set up, and at least two past direct deposits completed in that account. Dave will analyze your spending and earning habits to determine how large an advance you can afford. This amount can change from day to day.

How do you qualify for Dave advance

Dave Cash Advance: You may request a cash advance of up to $250 with no interest and no credit check required. Dave will look at your bank account history to determine the amount you're eligible for. You'll likely get a higher amount on the cash advance if you receive a total deposit of $1,000 or more each month.

How to borrow $1,000 from Cash App

StepsOpen the app and sign in.Click on your account balance.Click on 'Borrow'Tap on 'Unlock'Choose your repayment option.Agree and accept.

How to borrow $500 dollars from Cash App

Open your app and look for the word "Borrow." If it's there, navigate through the prompts to request the amount you need and accept the loan amount. If you don't see the Borrow function in the app, it means you can't borrow money from Cash App.

How long do you have to pay off Dave

Your Dave Extra Cash advance will automatically be repaid when you receive your next paycheck, so you'll need to pay it back all at once and usually in less than 14 days. Don't worry if you're a little slow in replying your advance – Dave doesn't charge any late fees!

How do you have to pay Dave back

You can pay us back manually by going to the "Account" tab and reviewing the "Advances" section and selecting the current advance. If you choose to do a partial payback under Pay Other Amount,the rest of your advance will be automatically pulled from your account on your original payback date.