How does Discover transfer balance work?

How to do a balance transfer with Discover

Log in to your Discover account and select “Card Services” and then “Balance Transfers” from the menu options. From there, you can see balance transfer offers you may have available on your account. Select the offer and complete your request by providing details about the balance you want to transfer.

How long does a balance transfer take with Discover

Discover, for example, tells cardholders that balance transfers on a new credit account will usually take between seven and 10 days. However, if you're transferring a balance to an existing account, it only takes seven days to process.

How much does Discover charge for a balance transfer

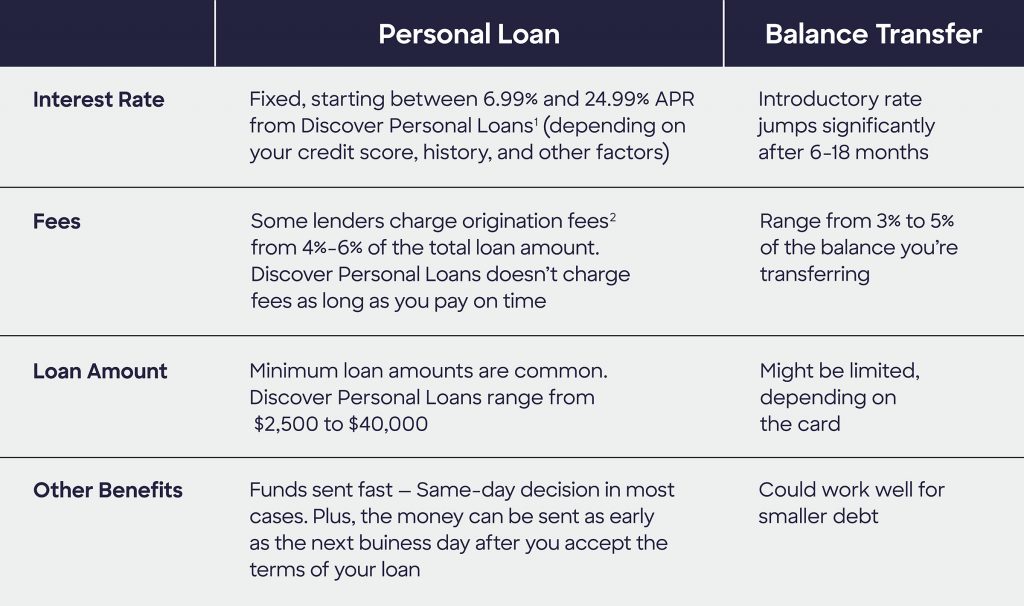

There's no minimum spending or maximum rewards. You could turn $150 cash back into $300." Balance transfer fee: 3% intro balance transfer fee, up to 5% fee on future balance transfers (see terms). Foreign transaction fees: None.

Cached

What does balance transfer mean on Discover

A balance transfer is when you move the outstanding balance of one credit card with a high-interest rate to another credit card that gives you a lower interest rate. Balance transfers can help you save money on interest and potentially pay off your debt faster.

Cached

Does transferring balances hurt your credit score

Balance transfers won't hurt your credit score directly, but applying for a new card could affect your credit in both good and bad ways. As the cornerstone of a debt-reduction plan, a balance transfer can be a very smart move in the long-term.

Is it a good idea to do a balance transfer

A balance transfer credit card is an excellent way to refinance existing credit card debt, especially since credit card interest rates can go as high as 30%. By transferring your balance to a card with a 0% intro APR, you can quickly dodge mounting interest costs and give yourself repayment flexibility.

Are balance transfers worth it

A balance transfer credit card is an excellent way to refinance existing credit card debt, especially since credit card interest rates can go as high as 30%. By transferring your balance to a card with a 0% intro APR, you can quickly dodge mounting interest costs and give yourself repayment flexibility.

What is the downside of a balance transfer

A balance transfer generally isn't worth the cost or hassle if you can pay off your balance in three months or less. That's because balance transfers typically take at least one billing cycle to go through, and most credit cards charge balance transfer fees of 3% to 5% for moving debt.

Do balance transfers hurt credit score

In some cases, a balance transfer can positively impact your credit scores and help you pay less interest on your debts in the long run. However, repeatedly opening new credit cards and transferring balances to them can damage your credit scores in the long run.

Is it bad for your credit score to transfer balances

Balance transfers won't hurt your credit score directly, but applying for a new card could affect your credit in both good and bad ways. As the cornerstone of a debt-reduction plan, a balance transfer can be a very smart move in the long-term.

Is it a good idea to transfer a balance from one credit card to another

A balance transfer credit card is an excellent way to refinance existing credit card debt, especially since credit card interest rates can go as high as 30%. By transferring your balance to a card with a 0% intro APR, you can quickly dodge mounting interest costs and give yourself repayment flexibility.